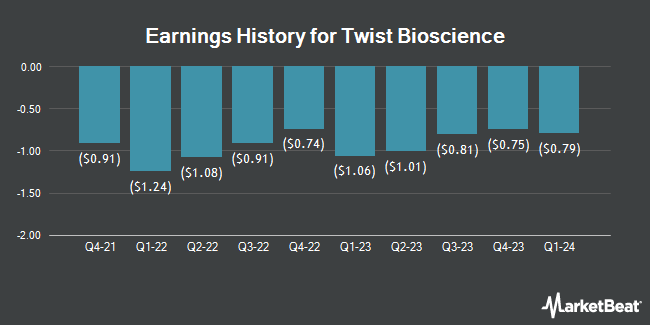

Twist Bioscience (NASDAQ:TWST - Get Free Report) will post its quarterly earnings results before the market opens on Monday, November 18th. Analysts expect Twist Bioscience to post earnings of ($0.73) per share for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

Twist Bioscience Stock Up 2.8 %

Shares of NASDAQ TWST traded up $1.25 during trading on Monday, reaching $46.65. 439,079 shares of the stock were exchanged, compared to its average volume of 938,781. The business's 50-day moving average price is $43.69 and its 200 day moving average price is $45.74. Twist Bioscience has a twelve month low of $15.99 and a twelve month high of $60.90. The company has a market capitalization of $2.73 billion, a price-to-earnings ratio of -11.88 and a beta of 1.78.

Insider Transactions at Twist Bioscience

In other news, CEO Emily M. Leproust sold 14,334 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $44.60, for a total transaction of $639,296.40. Following the completion of the transaction, the chief executive officer now owns 589,552 shares in the company, valued at approximately $26,294,019.20. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, CEO Emily M. Leproust sold 14,334 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $44.60, for a total value of $639,296.40. Following the completion of the sale, the chief executive officer now owns 589,552 shares of the company's stock, valued at $26,294,019.20. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Emily M. Leproust sold 1,730 shares of the company's stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $46.94, for a total transaction of $81,206.20. Following the completion of the sale, the chief executive officer now directly owns 495,523 shares of the company's stock, valued at $23,259,849.62. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 73,356 shares of company stock worth $3,205,239. Insiders own 3.92% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on TWST. Evercore ISI lifted their price target on shares of Twist Bioscience from $52.00 to $56.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 1st. Robert W. Baird boosted their target price on shares of Twist Bioscience from $40.00 to $46.00 and gave the company an "outperform" rating in a research note on Monday, August 5th. Leerink Partners boosted their target price on shares of Twist Bioscience from $45.00 to $48.00 and gave the company a "market perform" rating in a research note on Thursday, October 17th. Barclays lowered their target price on shares of Twist Bioscience from $60.00 to $55.00 and set an "overweight" rating for the company in a research note on Monday, August 5th. Finally, JPMorgan Chase & Co. boosted their target price on shares of Twist Bioscience from $28.00 to $35.00 and gave the company an "underweight" rating in a research note on Monday, August 5th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and seven have given a buy rating to the company. According to MarketBeat, Twist Bioscience has a consensus rating of "Moderate Buy" and an average price target of $51.22.

Check Out Our Latest Stock Report on TWST

About Twist Bioscience

(

Get Free Report)

Twist Bioscience Corporation engages in the manufacture and sale of synthetic DNA-based products. The company offers synthetic genes and gene fragments used in product development for therapeutics, diagnostics, chemicals/materials, food/agriculture, data storage, and various applications within academic research by biotech, pharma, industrial chemical, and agricultural companies, as well as academic labs; Oligo pools used in targeted NGS, CRISPR gene editing, mutagenesis experiments, DNA origami, DNA computing, data storage in DNA, and other applications; and immunoglobulin G proteins for customers focused on the pursuit of drug discovery and development.

Read More

Before you consider Twist Bioscience, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twist Bioscience wasn't on the list.

While Twist Bioscience currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.