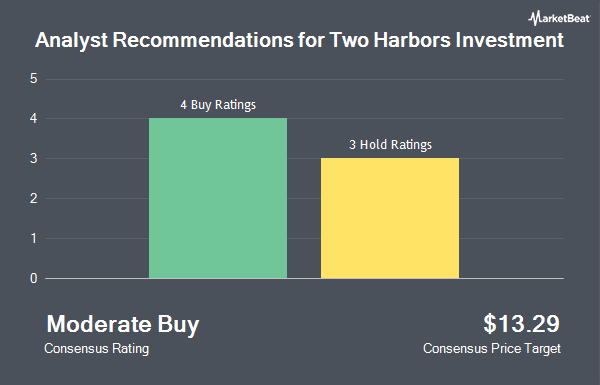

Two Harbors Investment Corp. (NYSE:TWO - Get Free Report) has been assigned an average rating of "Moderate Buy" from the seven analysts that are currently covering the stock, Marketbeat reports. Three research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $13.71.

Several research analysts recently commented on TWO shares. JMP Securities reduced their price objective on Two Harbors Investment from $15.00 to $14.50 and set a "market outperform" rating for the company in a research note on Thursday, October 17th. Royal Bank of Canada reduced their target price on shares of Two Harbors Investment from $14.00 to $12.00 and set a "sector perform" rating for the company in a research report on Friday, November 1st. StockNews.com upgraded shares of Two Harbors Investment to a "sell" rating in a research report on Thursday, December 12th. Compass Point cut their price objective on shares of Two Harbors Investment from $15.75 to $14.75 and set a "buy" rating for the company in a report on Monday, November 25th. Finally, JPMorgan Chase & Co. lowered their target price on Two Harbors Investment from $13.50 to $11.50 and set a "neutral" rating on the stock in a report on Wednesday, October 30th.

Check Out Our Latest Report on Two Harbors Investment

Two Harbors Investment Price Performance

Shares of NYSE TWO traded down $0.06 during trading on Friday, hitting $11.74. The company had a trading volume of 672,084 shares, compared to its average volume of 1,118,544. The firm has a market capitalization of $1.22 billion, a price-to-earnings ratio of -2.44 and a beta of 1.85. The stock has a fifty day simple moving average of $11.87 and a two-hundred day simple moving average of $12.90. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 0.80. Two Harbors Investment has a fifty-two week low of $11.28 and a fifty-two week high of $14.27.

Two Harbors Investment (NYSE:TWO - Get Free Report) last posted its quarterly earnings data on Monday, October 28th. The real estate investment trust reported $0.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.35 by ($0.22). Two Harbors Investment had a positive return on equity of 4.45% and a negative net margin of 87.84%. The firm had revenue of $112.64 million during the quarter. During the same quarter last year, the firm posted ($0.01) EPS. On average, research analysts expect that Two Harbors Investment will post 0.47 earnings per share for the current year.

Two Harbors Investment Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 29th. Stockholders of record on Friday, January 3rd will be issued a dividend of $0.45 per share. The ex-dividend date of this dividend is Friday, January 3rd. This represents a $1.80 dividend on an annualized basis and a dividend yield of 15.33%. Two Harbors Investment's dividend payout ratio is currently -37.34%.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in the business. JPMorgan Chase & Co. raised its holdings in Two Harbors Investment by 1.3% in the 3rd quarter. JPMorgan Chase & Co. now owns 258,142 shares of the real estate investment trust's stock valued at $3,583,000 after buying an additional 3,391 shares during the period. McIlrath & Eck LLC acquired a new stake in shares of Two Harbors Investment during the third quarter valued at about $64,000. Geode Capital Management LLC grew its stake in shares of Two Harbors Investment by 2.0% in the third quarter. Geode Capital Management LLC now owns 2,440,820 shares of the real estate investment trust's stock valued at $33,885,000 after buying an additional 48,264 shares in the last quarter. Barclays PLC raised its holdings in shares of Two Harbors Investment by 346.0% in the 3rd quarter. Barclays PLC now owns 172,557 shares of the real estate investment trust's stock valued at $2,395,000 after buying an additional 133,869 shares during the period. Finally, State Street Corp boosted its holdings in Two Harbors Investment by 2.7% during the 3rd quarter. State Street Corp now owns 3,877,111 shares of the real estate investment trust's stock valued at $53,814,000 after acquiring an additional 102,294 shares during the period. 64.19% of the stock is currently owned by institutional investors and hedge funds.

About Two Harbors Investment

(

Get Free ReportTwo Harbors Investment Corp. invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States. The company target assets include agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, hybrid mortgage loans, or derivatives; and other assets, such as financial and mortgage-related assets, including non-agency securities and non-hedging transactions.

Featured Stories

Before you consider Two Harbors Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Two Harbors Investment wasn't on the list.

While Two Harbors Investment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.