Two Sigma Advisers LP lifted its position in NXP Semiconductors (NASDAQ:NXPI - Free Report) by 3,165.2% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 150,200 shares of the semiconductor provider's stock after acquiring an additional 145,600 shares during the period. Two Sigma Advisers LP owned about 0.06% of NXP Semiconductors worth $36,050,000 as of its most recent SEC filing.

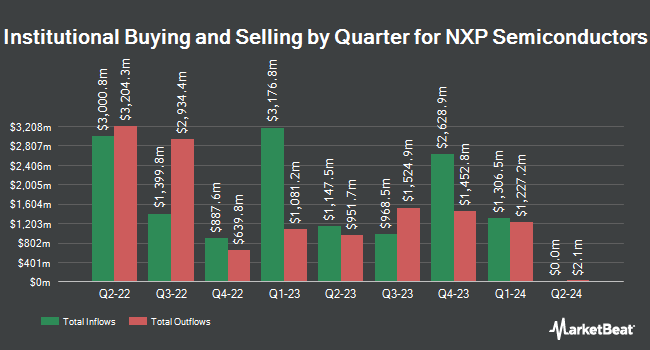

Several other institutional investors have also made changes to their positions in the company. Drive Wealth Management LLC increased its position in shares of NXP Semiconductors by 4.3% in the second quarter. Drive Wealth Management LLC now owns 953 shares of the semiconductor provider's stock worth $257,000 after acquiring an additional 39 shares in the last quarter. Patten Group Inc. grew its position in NXP Semiconductors by 1.2% during the second quarter. Patten Group Inc. now owns 3,454 shares of the semiconductor provider's stock valued at $929,000 after purchasing an additional 42 shares in the last quarter. West Paces Advisors Inc. grew its position in NXP Semiconductors by 3.1% during the second quarter. West Paces Advisors Inc. now owns 1,500 shares of the semiconductor provider's stock valued at $404,000 after purchasing an additional 45 shares in the last quarter. Octavia Wealth Advisors LLC grew its position in NXP Semiconductors by 5.4% during the second quarter. Octavia Wealth Advisors LLC now owns 880 shares of the semiconductor provider's stock valued at $238,000 after purchasing an additional 45 shares in the last quarter. Finally, Crumly & Associates Inc. grew its position in NXP Semiconductors by 2.0% during the third quarter. Crumly & Associates Inc. now owns 2,274 shares of the semiconductor provider's stock valued at $546,000 after purchasing an additional 45 shares in the last quarter. 90.54% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

NXPI has been the topic of a number of research analyst reports. Loop Capital initiated coverage on shares of NXP Semiconductors in a research report on Monday, November 11th. They set a "buy" rating and a $300.00 price objective on the stock. Truist Financial lowered their price objective on shares of NXP Semiconductors from $287.00 to $252.00 and set a "buy" rating on the stock in a research report on Wednesday, November 6th. Barclays lowered their price objective on shares of NXP Semiconductors from $330.00 to $280.00 and set an "overweight" rating on the stock in a research report on Tuesday, November 5th. Stifel Nicolaus lowered their price objective on shares of NXP Semiconductors from $275.00 to $260.00 and set a "hold" rating on the stock in a research report on Thursday, October 17th. Finally, Needham & Company LLC reduced their target price on shares of NXP Semiconductors from $300.00 to $250.00 and set a "buy" rating for the company in a research note on Wednesday, November 6th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and fourteen have assigned a buy rating to the company's stock. According to data from MarketBeat, NXP Semiconductors has an average rating of "Moderate Buy" and a consensus target price of $274.14.

Read Our Latest Report on NXPI

NXP Semiconductors Stock Performance

Shares of NXP Semiconductors stock traded up $1.67 on Friday, reaching $218.66. The stock had a trading volume of 2,302,284 shares, compared to its average volume of 2,244,484. The business's 50-day moving average price is $231.83 and its two-hundred day moving average price is $248.63. The company has a debt-to-equity ratio of 0.99, a quick ratio of 1.60 and a current ratio of 2.35. NXP Semiconductors has a fifty-two week low of $201.58 and a fifty-two week high of $296.08. The stock has a market cap of $55.57 billion, a P/E ratio of 20.86, a price-to-earnings-growth ratio of 4.51 and a beta of 1.46.

NXP Semiconductors (NASDAQ:NXPI - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The semiconductor provider reported $3.45 earnings per share for the quarter, topping analysts' consensus estimates of $3.43 by $0.02. The business had revenue of $3.25 billion during the quarter, compared to analysts' expectations of $3.25 billion. NXP Semiconductors had a net margin of 20.98% and a return on equity of 33.57%. NXP Semiconductors's revenue for the quarter was down 5.4% on a year-over-year basis. During the same period in the previous year, the company earned $3.31 earnings per share. On average, sell-side analysts forecast that NXP Semiconductors will post 11.33 EPS for the current year.

NXP Semiconductors Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 8th. Investors of record on Thursday, December 5th will be paid a dividend of $1.014 per share. This represents a $4.06 annualized dividend and a yield of 1.85%. The ex-dividend date is Thursday, December 5th. NXP Semiconductors's payout ratio is currently 38.65%.

Insider Activity at NXP Semiconductors

In related news, EVP Jennifer Wuamett sold 3,500 shares of the company's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $232.35, for a total transaction of $813,225.00. Following the completion of the transaction, the executive vice president now directly owns 30,269 shares in the company, valued at $7,033,002.15. This represents a 10.36 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 0.11% of the company's stock.

NXP Semiconductors Company Profile

(

Free Report)

NXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Further Reading

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.