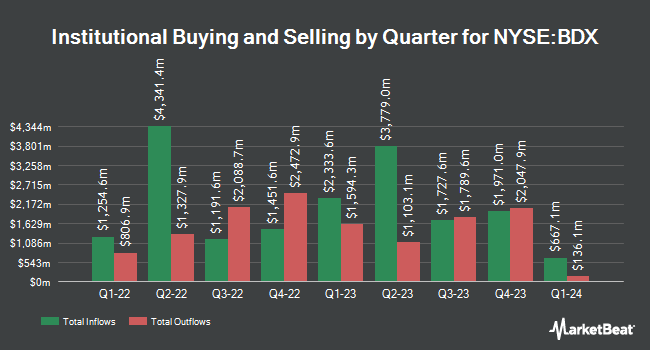

Two Sigma Advisers LP grew its stake in shares of Becton, Dickinson and Company (NYSE:BDX - Free Report) by 84.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 459,900 shares of the medical instruments supplier's stock after buying an additional 211,100 shares during the quarter. Two Sigma Advisers LP owned about 0.16% of Becton, Dickinson and Company worth $110,882,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors also recently made changes to their positions in the company. Charles Schwab Investment Management Inc. increased its position in shares of Becton, Dickinson and Company by 79.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,986,543 shares of the medical instruments supplier's stock valued at $720,089,000 after purchasing an additional 1,317,723 shares during the period. PineStone Asset Management Inc. grew its holdings in Becton, Dickinson and Company by 141.6% during the second quarter. PineStone Asset Management Inc. now owns 1,345,873 shares of the medical instruments supplier's stock worth $314,544,000 after acquiring an additional 788,735 shares during the period. First Eagle Investment Management LLC grew its holdings in Becton, Dickinson and Company by 32.5% during the second quarter. First Eagle Investment Management LLC now owns 2,803,255 shares of the medical instruments supplier's stock worth $655,149,000 after acquiring an additional 688,296 shares during the period. Massachusetts Financial Services Co. MA raised its position in Becton, Dickinson and Company by 9.4% in the third quarter. Massachusetts Financial Services Co. MA now owns 5,365,554 shares of the medical instruments supplier's stock worth $1,293,635,000 after acquiring an additional 460,440 shares in the last quarter. Finally, Vaughan Nelson Investment Management L.P. bought a new position in shares of Becton, Dickinson and Company during the 3rd quarter valued at about $108,243,000. 86.97% of the stock is owned by institutional investors and hedge funds.

Becton, Dickinson and Company Stock Down 0.9 %

NYSE BDX traded down $2.02 during trading on Friday, reaching $220.22. 1,655,191 shares of the company's stock were exchanged, compared to its average volume of 1,433,080. The company's fifty day simple moving average is $233.03 and its 200-day simple moving average is $233.73. Becton, Dickinson and Company has a fifty-two week low of $218.75 and a fifty-two week high of $249.89. The firm has a market capitalization of $63.67 billion, a PE ratio of 36.97, a P/E/G ratio of 1.65 and a beta of 0.41. The company has a current ratio of 1.17, a quick ratio of 0.74 and a debt-to-equity ratio of 0.69.

Becton, Dickinson and Company (NYSE:BDX - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The medical instruments supplier reported $3.81 EPS for the quarter, topping analysts' consensus estimates of $3.77 by $0.04. Becton, Dickinson and Company had a return on equity of 14.89% and a net margin of 8.55%. The firm had revenue of $5.44 billion for the quarter, compared to the consensus estimate of $5.38 billion. During the same quarter in the prior year, the company posted $3.42 earnings per share. The firm's revenue was up 6.9% on a year-over-year basis. Sell-side analysts predict that Becton, Dickinson and Company will post 14.43 EPS for the current year.

Becton, Dickinson and Company Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Monday, December 9th will be paid a $1.04 dividend. This represents a $4.16 dividend on an annualized basis and a dividend yield of 1.89%. This is an increase from Becton, Dickinson and Company's previous quarterly dividend of $0.95. The ex-dividend date of this dividend is Monday, December 9th. Becton, Dickinson and Company's dividend payout ratio (DPR) is presently 63.97%.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on BDX. StockNews.com upgraded shares of Becton, Dickinson and Company from a "hold" rating to a "buy" rating in a report on Thursday, August 8th. Evercore ISI increased their price objective on Becton, Dickinson and Company from $286.00 to $290.00 and gave the company an "outperform" rating in a research report on Tuesday, October 1st. Finally, Citigroup raised Becton, Dickinson and Company from a "neutral" rating to a "buy" rating and raised their price objective for the stock from $255.00 to $275.00 in a research note on Tuesday, October 1st. Seven investment analysts have rated the stock with a buy rating, Based on data from MarketBeat, Becton, Dickinson and Company currently has an average rating of "Buy" and a consensus target price of $283.50.

View Our Latest Stock Report on Becton, Dickinson and Company

Becton, Dickinson and Company Profile

(

Free Report)

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide. The company operates in three segments: BD Medical, BD Life Sciences, and BD Interventional.

Featured Stories

Before you consider Becton, Dickinson and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Becton, Dickinson and Company wasn't on the list.

While Becton, Dickinson and Company currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.