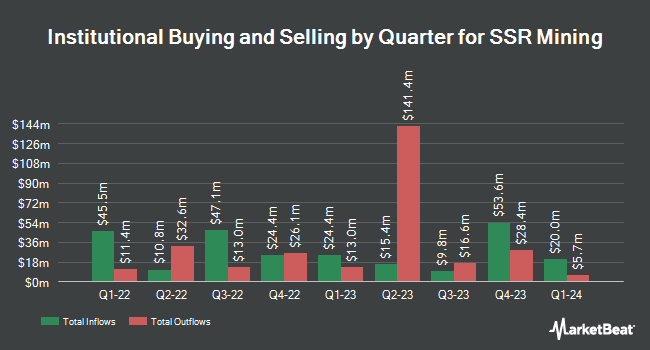

Two Sigma Advisers LP raised its position in shares of SSR Mining Inc. (NASDAQ:SSRM - Free Report) TSE: SSO by 16.2% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 3,320,384 shares of the basic materials company's stock after purchasing an additional 462,000 shares during the quarter. Two Sigma Advisers LP owned 1.64% of SSR Mining worth $18,860,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently made changes to their positions in the business. Quadrature Capital Ltd increased its stake in shares of SSR Mining by 42.8% in the 3rd quarter. Quadrature Capital Ltd now owns 692,800 shares of the basic materials company's stock worth $3,938,000 after purchasing an additional 207,700 shares in the last quarter. Quantinno Capital Management LP grew its holdings in SSR Mining by 9.8% during the third quarter. Quantinno Capital Management LP now owns 31,107 shares of the basic materials company's stock valued at $177,000 after purchasing an additional 2,788 shares during the period. Point72 DIFC Ltd bought a new position in shares of SSR Mining in the third quarter worth about $47,000. HighTower Advisors LLC raised its stake in shares of SSR Mining by 24.8% in the third quarter. HighTower Advisors LLC now owns 13,163 shares of the basic materials company's stock worth $75,000 after buying an additional 2,619 shares during the period. Finally, Verition Fund Management LLC grew its stake in shares of SSR Mining by 177.5% during the 3rd quarter. Verition Fund Management LLC now owns 105,763 shares of the basic materials company's stock valued at $601,000 after acquiring an additional 67,657 shares during the period. Hedge funds and other institutional investors own 68.30% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have commented on SSRM. UBS Group raised their target price on shares of SSR Mining from $6.30 to $6.80 and gave the stock a "buy" rating in a research note on Tuesday, October 15th. StockNews.com cut shares of SSR Mining from a "hold" rating to a "sell" rating in a research note on Wednesday, November 27th. Two analysts have rated the stock with a sell rating, four have given a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $5.18.

Read Our Latest Stock Analysis on SSR Mining

SSR Mining Price Performance

SSRM stock traded up $0.79 during mid-day trading on Monday, hitting $7.14. The company had a trading volume of 4,500,593 shares, compared to its average volume of 3,376,633. The company has a market capitalization of $1.44 billion, a price-to-earnings ratio of -2.96, a P/E/G ratio of 1.05 and a beta of 0.69. The company has a 50-day moving average price of $5.88 and a 200 day moving average price of $5.40. The company has a quick ratio of 1.97, a current ratio of 3.91 and a debt-to-equity ratio of 0.08. SSR Mining Inc. has a 12-month low of $3.76 and a 12-month high of $11.35.

About SSR Mining

(

Free Report)

SSR Mining Inc, together with its subsidiaries, engages in the operation, acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina. The company explores for gold doré, copper, silver, lead, and zinc deposits. Its mines include the Çöpler, located in Erzincan province, Turkey; the Marigold, located in Nevada, the United States; the Seabee, located in Saskatchewan, Canada; and the Puna, located in Jujuy province, Argentina.

See Also

Before you consider SSR Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SSR Mining wasn't on the list.

While SSR Mining currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.