Two Sigma Advisers LP boosted its stake in Tapestry, Inc. (NYSE:TPR - Free Report) by 32.1% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 545,500 shares of the luxury accessories retailer's stock after purchasing an additional 132,700 shares during the period. Two Sigma Advisers LP owned about 0.23% of Tapestry worth $25,628,000 at the end of the most recent quarter.

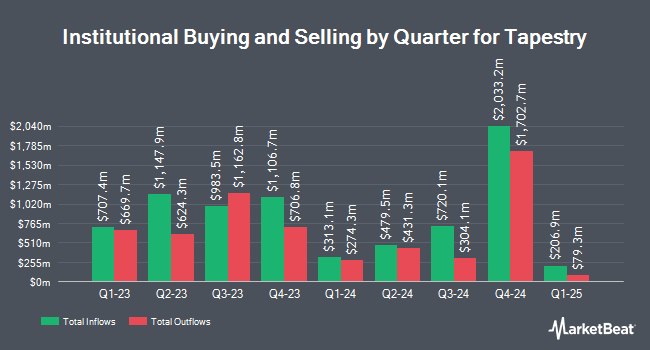

Several other institutional investors have also recently added to or reduced their stakes in the stock. SYM FINANCIAL Corp acquired a new stake in Tapestry in the 3rd quarter valued at approximately $337,000. Systematic Financial Management LP grew its stake in shares of Tapestry by 9.4% in the third quarter. Systematic Financial Management LP now owns 395,316 shares of the luxury accessories retailer's stock worth $18,572,000 after acquiring an additional 33,940 shares in the last quarter. Quantinno Capital Management LP grew its stake in shares of Tapestry by 1.0% in the third quarter. Quantinno Capital Management LP now owns 66,271 shares of the luxury accessories retailer's stock worth $3,113,000 after acquiring an additional 633 shares in the last quarter. Quarry LP grew its stake in shares of Tapestry by 486.9% in the third quarter. Quarry LP now owns 11,726 shares of the luxury accessories retailer's stock worth $551,000 after acquiring an additional 9,728 shares in the last quarter. Finally, Redwood Investment Management LLC grew its stake in shares of Tapestry by 0.4% in the third quarter. Redwood Investment Management LLC now owns 47,407 shares of the luxury accessories retailer's stock worth $2,269,000 after acquiring an additional 204 shares in the last quarter. Institutional investors and hedge funds own 90.77% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have commented on TPR shares. Bank of America boosted their price target on shares of Tapestry from $52.00 to $60.00 and gave the stock a "buy" rating in a research note on Friday, October 25th. The Goldman Sachs Group boosted their price target on shares of Tapestry from $58.00 to $66.00 and gave the stock a "buy" rating in a research note on Friday, November 15th. JPMorgan Chase & Co. boosted their price target on shares of Tapestry from $51.00 to $66.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Evercore ISI boosted their target price on shares of Tapestry from $47.00 to $63.00 and gave the stock an "outperform" rating in a research note on Friday, October 25th. Finally, UBS Group lowered their target price on shares of Tapestry from $42.00 to $40.00 and set a "neutral" rating for the company in a research note on Friday, August 16th. Eight research analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $57.78.

View Our Latest Report on Tapestry

Insider Activity

In other news, VP Manesh Dadlani sold 8,872 shares of the company's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $57.96, for a total value of $514,221.12. Following the completion of the sale, the vice president now directly owns 35,003 shares of the company's stock, valued at approximately $2,028,773.88. This represents a 20.22 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 1.18% of the company's stock.

Tapestry Stock Performance

TPR traded down $1.32 on Friday, reaching $62.25. The company had a trading volume of 9,556,831 shares, compared to its average volume of 5,189,011. The stock has a 50-day moving average price of $51.61 and a 200-day moving average price of $45.04. Tapestry, Inc. has a 1 year low of $32.27 and a 1 year high of $65.30. The company has a quick ratio of 4.38, a current ratio of 4.93 and a debt-to-equity ratio of 2.35. The stock has a market capitalization of $14.51 billion, a PE ratio of 17.99, a P/E/G ratio of 2.21 and a beta of 1.60.

Tapestry Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Friday, December 6th will be issued a $0.35 dividend. The ex-dividend date is Friday, December 6th. This represents a $1.40 dividend on an annualized basis and a dividend yield of 2.25%. Tapestry's payout ratio is 40.46%.

Tapestry Company Profile

(

Free Report)

Tapestry, Inc provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman. It offers women's handbags; and women's accessories, such as small leather goods which includes mini and micro handbags, money pieces, wristlets, pouches, and cosmetic cases, as well as novelty accessories including address books, time management and travel accessories, sketchbooks, and portfolios; and belts, key rings, and charms.

See Also

Before you consider Tapestry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tapestry wasn't on the list.

While Tapestry currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.