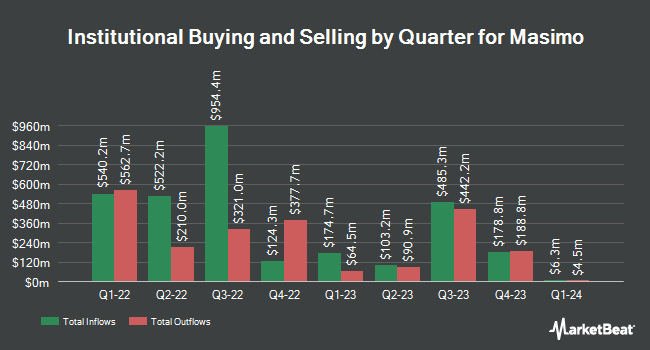

Two Sigma Advisers LP increased its holdings in shares of Masimo Co. (NASDAQ:MASI - Free Report) by 95.9% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 218,600 shares of the medical equipment provider's stock after purchasing an additional 107,000 shares during the period. Two Sigma Advisers LP owned approximately 0.41% of Masimo worth $29,146,000 at the end of the most recent quarter.

Other hedge funds have also recently added to or reduced their stakes in the company. NBC Securities Inc. lifted its holdings in Masimo by 47.1% during the third quarter. NBC Securities Inc. now owns 228 shares of the medical equipment provider's stock worth $30,000 after acquiring an additional 73 shares during the period. Fifth Third Bancorp raised its stake in shares of Masimo by 16.4% in the second quarter. Fifth Third Bancorp now owns 695 shares of the medical equipment provider's stock valued at $88,000 after buying an additional 98 shares during the period. Oak Thistle LLC raised its stake in shares of Masimo by 5.2% in the second quarter. Oak Thistle LLC now owns 2,079 shares of the medical equipment provider's stock valued at $262,000 after buying an additional 103 shares during the period. GAMMA Investing LLC raised its stake in shares of Masimo by 75.0% in the second quarter. GAMMA Investing LLC now owns 259 shares of the medical equipment provider's stock valued at $33,000 after buying an additional 111 shares during the period. Finally, HHM Wealth Advisors LLC raised its stake in shares of Masimo by 25.0% in the second quarter. HHM Wealth Advisors LLC now owns 625 shares of the medical equipment provider's stock valued at $79,000 after buying an additional 125 shares during the period. Institutional investors and hedge funds own 85.96% of the company's stock.

Masimo Trading Up 0.2 %

MASI traded up $0.40 during midday trading on Friday, reaching $169.79. 253,379 shares of the company's stock traded hands, compared to its average volume of 513,913. Masimo Co. has a 52 week low of $101.35 and a 52 week high of $178.27. The firm has a fifty day moving average of $153.35 and a two-hundred day moving average of $131.52. The company has a debt-to-equity ratio of 0.50, a current ratio of 2.01 and a quick ratio of 1.11. The stock has a market capitalization of $9.09 billion, a price-to-earnings ratio of 117.10 and a beta of 1.01.

Masimo (NASDAQ:MASI - Get Free Report) last posted its earnings results on Tuesday, November 5th. The medical equipment provider reported $0.98 earnings per share for the quarter, topping analysts' consensus estimates of $0.84 by $0.14. Masimo had a return on equity of 14.98% and a net margin of 3.85%. The firm had revenue of $504.60 million for the quarter, compared to the consensus estimate of $502.87 million. During the same quarter in the prior year, the business earned $0.63 EPS. The business's revenue for the quarter was up 5.4% on a year-over-year basis. On average, equities analysts anticipate that Masimo Co. will post 4.03 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the company. Stifel Nicolaus reiterated a "buy" rating and issued a $190.00 price target (up from $170.00) on shares of Masimo in a research report on Friday, November 22nd. Needham & Company LLC reiterated a "hold" rating on shares of Masimo in a research report on Wednesday, November 6th. Wells Fargo & Company lifted their price target on Masimo from $160.00 to $171.00 and gave the company an "overweight" rating in a research report on Wednesday, November 6th. Piper Sandler boosted their target price on Masimo from $165.00 to $180.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. Finally, Raymond James upgraded Masimo from a "market perform" rating to an "outperform" rating and set a $170.00 target price for the company in a research report on Wednesday, November 6th. Three research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, Masimo has an average rating of "Moderate Buy" and a consensus price target of $167.00.

Get Our Latest Research Report on Masimo

Masimo Company Profile

(

Free Report)

Masimo Corporation develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide. The company offers masimo signal extraction technology (SET) pulse oximetry with measure-through motion and low perfusion pulse oximetry monitoring to address the primary limitations of conventional pulse oximetry; Masimo rainbow SET platform, including rainbow SET Pulse CO-Oximetry products that allows noninvasive monitoring of carboxyhemoglobin, methemoglobin, hemoglobin concentration, fractional arterial oxygen saturation, oxygen content, pleth variability index, rainbow pleth variability index, respiration rate from the pleth, and oxygen reserve index, as well as acoustic respiration monitoring, SedLine brain function monitoring, NomoLine capnography and gas monitoring, and regional oximetry.

Read More

Before you consider Masimo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masimo wasn't on the list.

While Masimo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.