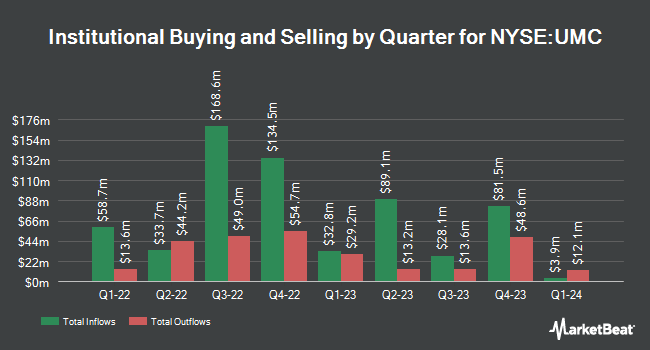

Two Sigma Advisers LP grew its holdings in United Microelectronics Co. (NYSE:UMC - Free Report) by 314.1% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 1,279,600 shares of the semiconductor company's stock after purchasing an additional 970,600 shares during the quarter. Two Sigma Advisers LP owned approximately 0.05% of United Microelectronics worth $10,774,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of UMC. State Street Corp grew its position in United Microelectronics by 1.5% during the 3rd quarter. State Street Corp now owns 3,661,624 shares of the semiconductor company's stock worth $30,831,000 after purchasing an additional 53,105 shares during the last quarter. Quantinno Capital Management LP grew its position in United Microelectronics by 30.0% during the 3rd quarter. Quantinno Capital Management LP now owns 186,050 shares of the semiconductor company's stock worth $1,567,000 after purchasing an additional 42,919 shares during the last quarter. Verition Fund Management LLC purchased a new stake in United Microelectronics during the 3rd quarter worth approximately $1,099,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in United Microelectronics by 3.8% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 327,100 shares of the semiconductor company's stock worth $2,754,000 after purchasing an additional 12,100 shares during the last quarter. Finally, Glenmede Trust Co. NA grew its position in United Microelectronics by 23.5% during the 3rd quarter. Glenmede Trust Co. NA now owns 24,696 shares of the semiconductor company's stock worth $208,000 after purchasing an additional 4,696 shares during the last quarter. Institutional investors own 5.05% of the company's stock.

United Microelectronics Stock Performance

NYSE UMC traded down $0.13 on Tuesday, hitting $6.56. 11,155,637 shares of the company's stock traded hands, compared to its average volume of 10,304,601. The company has a current ratio of 2.19, a quick ratio of 1.76 and a debt-to-equity ratio of 0.16. The firm's 50-day moving average price is $7.33 and its two-hundred day moving average price is $8.06. United Microelectronics Co. has a 1-year low of $6.53 and a 1-year high of $9.00. The firm has a market capitalization of $16.44 billion, a PE ratio of 10.09, a P/E/G ratio of 3.25 and a beta of 1.17.

Analyst Ratings Changes

Several analysts have weighed in on the stock. StockNews.com downgraded shares of United Microelectronics from a "buy" rating to a "hold" rating in a research report on Sunday, November 17th. Morgan Stanley downgraded shares of United Microelectronics from an "overweight" rating to an "equal weight" rating in a research report on Monday, October 28th. The Goldman Sachs Group cut shares of United Microelectronics from a "buy" rating to a "neutral" rating and set a $7.40 price objective for the company. in a research note on Thursday, October 17th. Finally, JPMorgan Chase & Co. cut shares of United Microelectronics from an "overweight" rating to a "neutral" rating in a research note on Wednesday, October 30th. Five research analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $7.40.

Read Our Latest Report on United Microelectronics

About United Microelectronics

(

Free Report)

United Microelectronics Corporation operates as a semiconductor wafer foundry in Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and internationally. The company provides circuit design, mask tooling, wafer fabrication, and assembly and testing services. It serves fabless design companies and integrated device manufacturers.

Featured Stories

Before you consider United Microelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Microelectronics wasn't on the list.

While United Microelectronics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.