Two Sigma Advisers LP lifted its position in Travere Therapeutics, Inc. (NASDAQ:TVTX - Free Report) by 30.2% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 720,400 shares of the company's stock after buying an additional 167,100 shares during the period. Two Sigma Advisers LP owned approximately 0.92% of Travere Therapeutics worth $10,078,000 as of its most recent SEC filing.

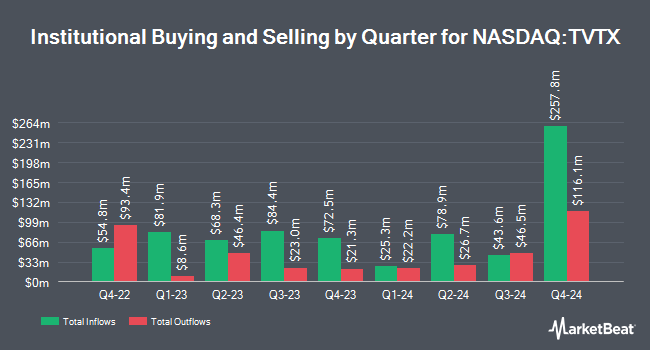

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Millennium Management LLC grew its position in shares of Travere Therapeutics by 33.9% in the 2nd quarter. Millennium Management LLC now owns 2,949,335 shares of the company's stock worth $24,244,000 after buying an additional 747,406 shares during the last quarter. Assenagon Asset Management S.A. grew its position in shares of Travere Therapeutics by 912.5% in the 2nd quarter. Assenagon Asset Management S.A. now owns 2,214,099 shares of the company's stock worth $18,200,000 after buying an additional 1,995,419 shares during the last quarter. Emerald Advisers LLC grew its position in shares of Travere Therapeutics by 19.8% in the 3rd quarter. Emerald Advisers LLC now owns 1,960,659 shares of the company's stock worth $27,430,000 after buying an additional 323,513 shares during the last quarter. Finepoint Capital LP grew its position in shares of Travere Therapeutics by 0.3% in the 3rd quarter. Finepoint Capital LP now owns 1,782,267 shares of the company's stock worth $24,934,000 after buying an additional 5,539 shares during the last quarter. Finally, Emerald Mutual Fund Advisers Trust boosted its stake in Travere Therapeutics by 26.0% in the 3rd quarter. Emerald Mutual Fund Advisers Trust now owns 1,185,709 shares of the company's stock worth $16,588,000 after purchasing an additional 244,444 shares in the last quarter.

Insider Buying and Selling

In other news, CAO Sandra Calvin sold 12,090 shares of the company's stock in a transaction on Monday, November 25th. The shares were sold at an average price of $18.30, for a total transaction of $221,247.00. Following the completion of the sale, the chief accounting officer now owns 54,927 shares of the company's stock, valued at $1,005,164.10. This represents a 18.04 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Gary A. Lyons sold 40,000 shares of the company's stock in a transaction on Friday, October 4th. The stock was sold at an average price of $14.73, for a total transaction of $589,200.00. Following the sale, the director now directly owns 51,000 shares of the company's stock, valued at $751,230. The trade was a 43.96 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 92,090 shares of company stock valued at $1,372,847. 3.75% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of analysts recently commented on the stock. Wells Fargo & Company upgraded shares of Travere Therapeutics from an "equal weight" rating to an "overweight" rating and lifted their target price for the stock from $9.00 to $27.00 in a research note on Monday, October 21st. Wedbush lifted their target price on shares of Travere Therapeutics from $17.00 to $25.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 9th. Barclays lifted their target price on shares of Travere Therapeutics from $18.00 to $20.00 and gave the stock an "overweight" rating in a research note on Friday, November 1st. Canaccord Genuity Group lowered their target price on shares of Travere Therapeutics from $23.00 to $22.00 and set a "buy" rating for the company in a research note on Monday, September 30th. Finally, Leerink Partners restated an "outperform" rating and set a $20.00 price objective on shares of Travere Therapeutics in a research note on Tuesday, October 8th. Two investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $22.62.

Check Out Our Latest Analysis on TVTX

Travere Therapeutics Stock Performance

Shares of TVTX traded down $0.02 during trading hours on Tuesday, hitting $18.75. The stock had a trading volume of 1,635,754 shares, compared to its average volume of 1,384,948. The company has a debt-to-equity ratio of 24.96, a quick ratio of 1.68 and a current ratio of 1.71. The firm has a 50-day moving average price of $17.76 and a 200 day moving average price of $12.41. Travere Therapeutics, Inc. has a fifty-two week low of $5.12 and a fifty-two week high of $20.33. The firm has a market capitalization of $1.46 billion, a price-to-earnings ratio of -4.13 and a beta of 0.69.

Travere Therapeutics (NASDAQ:TVTX - Get Free Report) last posted its earnings results on Thursday, October 31st. The company reported ($0.70) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.71) by $0.01. The firm had revenue of $62.90 million during the quarter, compared to analysts' expectations of $60.87 million. Travere Therapeutics had a negative net margin of 172.75% and a negative return on equity of 537.74%. The business's revenue was up 69.6% compared to the same quarter last year. During the same period in the previous year, the business posted ($1.17) EPS. As a group, research analysts anticipate that Travere Therapeutics, Inc. will post -3.94 EPS for the current year.

About Travere Therapeutics

(

Free Report)

Travere Therapeutics, Inc, a biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases. Its products include FILSPARI (sparsentan), a once-daily, oral medication designed to target two critical pathways in the disease progression of IgA Nephropathy (endothelin 1 and angiotensin-II); and Thiola and Thiola EC (tiopronin tablets) for the treatment of cystinuria, a rare genetic cystine transport disorder that causes high cystine levels in the urine and the formation of recurring kidney stones.

See Also

Before you consider Travere Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travere Therapeutics wasn't on the list.

While Travere Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.