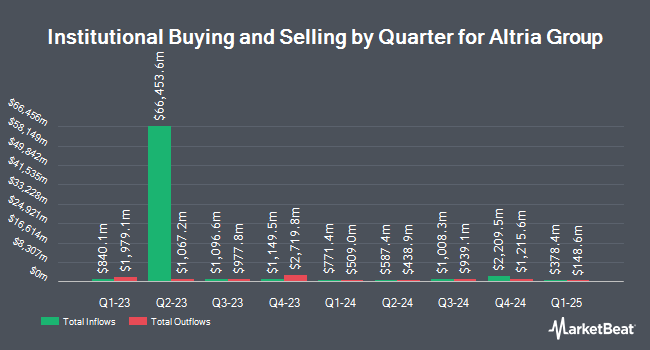

Two Sigma Advisers LP trimmed its holdings in Altria Group, Inc. (NYSE:MO - Free Report) by 81.7% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 452,900 shares of the company's stock after selling 2,015,400 shares during the quarter. Two Sigma Advisers LP's holdings in Altria Group were worth $23,116,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. True Wealth Design LLC boosted its holdings in shares of Altria Group by 420.0% in the third quarter. True Wealth Design LLC now owns 572 shares of the company's stock valued at $29,000 after acquiring an additional 462 shares during the period. MFA Wealth Advisors LLC acquired a new stake in shares of Altria Group in the second quarter valued at approximately $27,000. Hobbs Group Advisors LLC acquired a new stake in shares of Altria Group in the second quarter valued at approximately $30,000. Valley Wealth Managers Inc. boosted its holdings in shares of Altria Group by 63.9% in the second quarter. Valley Wealth Managers Inc. now owns 667 shares of the company's stock valued at $30,000 after acquiring an additional 260 shares during the period. Finally, Peterson Financial Group Inc. purchased a new stake in shares of Altria Group during the third quarter worth approximately $41,000. 57.41% of the stock is owned by institutional investors and hedge funds.

Altria Group Trading Up 0.7 %

Shares of MO stock traded up $0.41 during mid-day trading on Friday, reaching $57.32. The stock had a trading volume of 5,732,967 shares, compared to its average volume of 6,749,983. Altria Group, Inc. has a 12-month low of $39.25 and a 12-month high of $58.03. The company has a market cap of $97.15 billion, a P/E ratio of 9.68, a price-to-earnings-growth ratio of 3.21 and a beta of 0.63. The business has a 50-day simple moving average of $53.14 and a 200 day simple moving average of $50.51.

Altria Group (NYSE:MO - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The company reported $1.38 earnings per share for the quarter, beating analysts' consensus estimates of $1.35 by $0.03. The business had revenue of $6.26 billion during the quarter, compared to analysts' expectations of $5.33 billion. Altria Group had a negative return on equity of 233.80% and a net margin of 42.82%. The business's revenue for the quarter was up 18.6% on a year-over-year basis. During the same quarter last year, the business posted $1.28 earnings per share. Research analysts anticipate that Altria Group, Inc. will post 5.11 EPS for the current year.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on the company. StockNews.com upgraded Altria Group from a "hold" rating to a "buy" rating in a research note on Monday, November 4th. UBS Group increased their price objective on Altria Group from $39.00 to $41.00 and gave the stock a "sell" rating in a research report on Monday, September 9th. Barclays increased their price objective on Altria Group from $45.00 to $46.00 and gave the stock an "underweight" rating in a research report on Wednesday, November 6th. Deutsche Bank Aktiengesellschaft increased their price objective on Altria Group from $52.00 to $60.00 and gave the stock a "buy" rating in a research report on Friday, November 1st. Finally, Bank of America upgraded Altria Group from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $55.00 to $65.00 in a research report on Friday. Two investment analysts have rated the stock with a sell rating, two have assigned a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $53.33.

Get Our Latest Stock Analysis on MO

About Altria Group

(

Free Report)

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

Read More

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.