Two Sigma Advisers LP lessened its stake in shares of Beacon Roofing Supply, Inc. (NASDAQ:BECN - Free Report) by 27.9% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 231,200 shares of the company's stock after selling 89,500 shares during the quarter. Two Sigma Advisers LP owned approximately 0.37% of Beacon Roofing Supply worth $19,983,000 as of its most recent filing with the Securities and Exchange Commission.

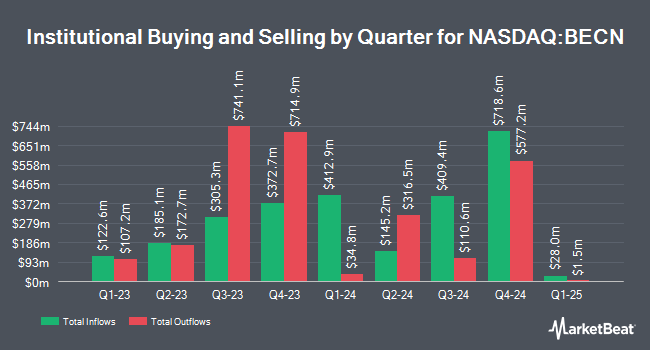

Other institutional investors have also recently added to or reduced their stakes in the company. Intech Investment Management LLC purchased a new position in shares of Beacon Roofing Supply during the 3rd quarter worth $1,441,000. BNP Paribas Financial Markets increased its stake in Beacon Roofing Supply by 23.0% in the third quarter. BNP Paribas Financial Markets now owns 42,441 shares of the company's stock valued at $3,668,000 after purchasing an additional 7,924 shares during the last quarter. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in Beacon Roofing Supply during the third quarter worth about $4,331,000. Vaughan Nelson Investment Management L.P. boosted its stake in Beacon Roofing Supply by 18.7% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 963,077 shares of the company's stock worth $83,239,000 after buying an additional 152,030 shares during the last quarter. Finally, Citigroup Inc. grew its holdings in Beacon Roofing Supply by 1,192.1% in the 3rd quarter. Citigroup Inc. now owns 513,692 shares of the company's stock valued at $44,398,000 after buying an additional 473,937 shares during the period. Institutional investors and hedge funds own 98.45% of the company's stock.

Insider Activity

In other news, insider Jason L. Taylor sold 2,600 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $90.00, for a total transaction of $234,000.00. Following the completion of the sale, the insider now directly owns 9,131 shares in the company, valued at $821,790. This trade represents a 22.16 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Clement Munroe Best III sold 5,637 shares of the business's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $100.47, for a total value of $566,349.39. Following the completion of the transaction, the insider now owns 69,514 shares in the company, valued at approximately $6,984,071.58. This trade represents a 7.50 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 17,874 shares of company stock worth $1,812,146. 1.30% of the stock is currently owned by company insiders.

Beacon Roofing Supply Stock Down 1.6 %

Shares of NASDAQ:BECN traded down $1.74 during mid-day trading on Monday, hitting $109.83. 532,378 shares of the company traded hands, compared to its average volume of 721,860. The firm has a market cap of $6.80 billion, a P/E ratio of 18.86 and a beta of 1.59. Beacon Roofing Supply, Inc. has a 52-week low of $77.54 and a 52-week high of $116.30. The firm's 50 day simple moving average is $99.83 and its 200 day simple moving average is $94.14. The company has a debt-to-equity ratio of 1.60, a quick ratio of 1.14 and a current ratio of 1.91.

Analyst Ratings Changes

BECN has been the subject of several research analyst reports. JPMorgan Chase & Co. upped their price target on shares of Beacon Roofing Supply from $119.00 to $136.00 and gave the stock an "overweight" rating in a research report on Tuesday, November 19th. Royal Bank of Canada upped their price objective on Beacon Roofing Supply from $113.00 to $114.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. Benchmark reiterated a "buy" rating and issued a $140.00 target price on shares of Beacon Roofing Supply in a report on Friday, November 1st. Robert W. Baird raised their price objective on Beacon Roofing Supply from $115.00 to $120.00 and gave the stock an "outperform" rating in a report on Wednesday, October 16th. Finally, Stephens reiterated an "equal weight" rating and set a $103.00 target price on shares of Beacon Roofing Supply in a report on Tuesday, November 19th. Three research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $118.00.

View Our Latest Stock Analysis on BECN

Beacon Roofing Supply Profile

(

Free Report)

Beacon Roofing Supply, Inc, together with its subsidiaries, engages in the distribution of residential and non-residential roofing materials, and complementary building products to contractors, home builders, building owners, lumberyards, and retailers in the United States and Canada. The company offers pitched roofing and low slope roof products; gutters and sidings; building materials, such as lumber and composite, skylights and window, plywood and OSB, decking and railing, and HVAC products; and foam board, spray foam, roll, batt, mineral wool, fiberglass, and commercial insulation products, as well as radiant barriers and blown-in insulation and equipment.

See Also

Before you consider Beacon Roofing Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beacon Roofing Supply wasn't on the list.

While Beacon Roofing Supply currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.