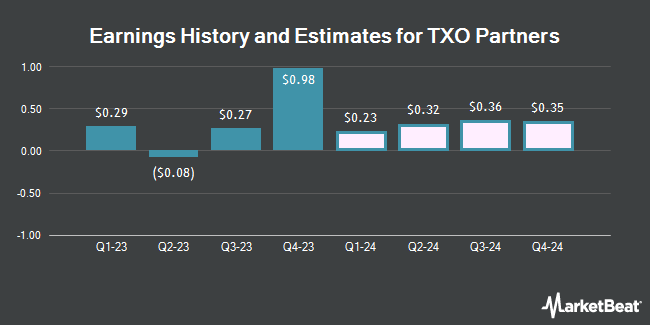

TXO Partners, L.P. (NYSE:TXO - Free Report) - Stock analysts at Capital One Financial dropped their FY2024 earnings estimates for shares of TXO Partners in a note issued to investors on Wednesday, November 13th. Capital One Financial analyst P. Johnston now anticipates that the company will post earnings of $0.81 per share for the year, down from their prior forecast of $0.88. The consensus estimate for TXO Partners' current full-year earnings is $0.82 per share. Capital One Financial also issued estimates for TXO Partners' Q4 2024 earnings at $0.27 EPS, Q1 2025 earnings at $0.25 EPS, Q2 2025 earnings at $0.26 EPS, Q3 2025 earnings at $0.26 EPS and Q4 2025 earnings at $0.27 EPS.

TXO Partners Price Performance

Shares of NYSE:TXO traded down $0.70 on Friday, reaching $18.31. 61,758 shares of the company traded hands, compared to its average volume of 67,827. The company's 50 day moving average is $18.94 and its 200-day moving average is $19.20. The stock has a market capitalization of $749.06 million, a PE ratio of -3.08 and a beta of 0.11. The company has a debt-to-equity ratio of 0.25, a current ratio of 1.02 and a quick ratio of 1.02. TXO Partners has a fifty-two week low of $17.20 and a fifty-two week high of $23.56.

Institutional Trading of TXO Partners

A number of hedge funds have recently modified their holdings of the business. Thurston Springer Miller Herd & Titak Inc. acquired a new position in TXO Partners in the 3rd quarter valued at approximately $84,000. Glenmede Trust Co. NA raised its holdings in shares of TXO Partners by 13.9% during the third quarter. Glenmede Trust Co. NA now owns 47,678 shares of the company's stock worth $943,000 after acquiring an additional 5,831 shares in the last quarter. Pin Oak Investment Advisors Inc. grew its stake in TXO Partners by 7.1% in the third quarter. Pin Oak Investment Advisors Inc. now owns 291,061 shares of the company's stock valued at $5,757,000 after purchasing an additional 19,241 shares in the last quarter. Deroy & Devereaux Private Investment Counsel Inc. acquired a new position in TXO Partners in the 3rd quarter worth about $559,000. Finally, PFG Investments LLC purchased a new stake in shares of TXO Partners during the 3rd quarter worth about $639,000. Hedge funds and other institutional investors own 27.44% of the company's stock.

TXO Partners Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, November 22nd. Investors of record on Friday, November 15th will be given a $0.58 dividend. This represents a $2.32 annualized dividend and a dividend yield of 12.67%. The ex-dividend date of this dividend is Friday, November 15th. This is an increase from TXO Partners's previous quarterly dividend of $0.57. TXO Partners's dividend payout ratio is -38.38%.

TXO Partners Company Profile

(

Get Free Report)

TXO Partners, L.P., an oil and natural gas company, focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America. Its acreage positions are concentrated in the Permian Basin of West Texas and New Mexico and the San Juan Basin of New Mexico and Colorado.

Read More

Before you consider TXO Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TXO Partners wasn't on the list.

While TXO Partners currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.