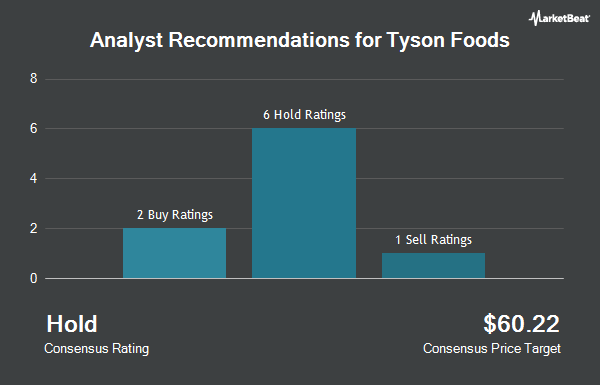

Tyson Foods, Inc. (NYSE:TSN - Get Free Report) has been given an average recommendation of "Reduce" by the nine brokerages that are covering the firm, MarketBeat reports. Two equities research analysts have rated the stock with a sell recommendation, six have issued a hold recommendation and one has issued a buy recommendation on the company. The average 12-month price target among brokerages that have updated their coverage on the stock in the last year is $60.67.

A number of equities analysts have issued reports on TSN shares. StockNews.com upgraded shares of Tyson Foods from a "hold" rating to a "buy" rating in a research report on Tuesday, August 6th. BMO Capital Markets lifted their price target on shares of Tyson Foods from $60.00 to $62.00 and gave the stock a "market perform" rating in a report on Wednesday, November 13th. JPMorgan Chase & Co. lifted their price target on shares of Tyson Foods from $61.00 to $63.00 and gave the stock a "neutral" rating in a report on Tuesday, August 6th. Stephens lifted their price target on shares of Tyson Foods from $57.00 to $60.00 and gave the stock an "equal weight" rating in a report on Wednesday, November 13th. Finally, Citigroup lowered their price target on shares of Tyson Foods from $63.00 to $60.00 and set a "neutral" rating for the company in a report on Wednesday, October 9th.

View Our Latest Stock Report on Tyson Foods

Tyson Foods Stock Up 0.0 %

Shares of NYSE TSN opened at $63.81 on Wednesday. The company has a quick ratio of 0.95, a current ratio of 2.04 and a debt-to-equity ratio of 0.52. Tyson Foods has a 52 week low of $46.51 and a 52 week high of $66.88. The firm has a 50-day moving average price of $60.21 and a 200 day moving average price of $59.93. The stock has a market capitalization of $22.71 billion, a price-to-earnings ratio of 28.36, a price-to-earnings-growth ratio of 0.96 and a beta of 0.78.

Insider Transactions at Tyson Foods

In related news, Chairman John H. Tyson sold 185,394 shares of the company's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $63.77, for a total value of $11,822,575.38. Following the sale, the chairman now directly owns 3,003,374 shares of the company's stock, valued at $191,525,159.98. This represents a 5.81 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, General Counsel Adam S. Deckinger sold 10,500 shares of the company's stock in a transaction on Friday, November 15th. The shares were sold at an average price of $64.80, for a total transaction of $680,400.00. Following the completion of the sale, the general counsel now directly owns 19,260 shares in the company, valued at $1,248,048. This represents a 35.28 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 414,814 shares of company stock valued at $26,450,955. Corporate insiders own 2.05% of the company's stock.

Institutional Trading of Tyson Foods

Institutional investors have recently added to or reduced their stakes in the stock. Catalyst Capital Advisors LLC raised its holdings in Tyson Foods by 56.1% in the third quarter. Catalyst Capital Advisors LLC now owns 584 shares of the company's stock valued at $35,000 after acquiring an additional 210 shares in the last quarter. Harvest Fund Management Co. Ltd acquired a new stake in shares of Tyson Foods during the third quarter worth $36,000. Thurston Springer Miller Herd & Titak Inc. raised its holdings in shares of Tyson Foods by 301.6% during the third quarter. Thurston Springer Miller Herd & Titak Inc. now owns 747 shares of the company's stock worth $44,000 after purchasing an additional 561 shares during the period. Hantz Financial Services Inc. acquired a new stake in shares of Tyson Foods during the second quarter worth $54,000. Finally, Northwest Investment Counselors LLC acquired a new stake in shares of Tyson Foods during the third quarter worth $59,000. 67.00% of the stock is owned by institutional investors and hedge funds.

Tyson Foods Company Profile

(

Get Free ReportTyson Foods, Inc, together with its subsidiaries, operates as a food company worldwide. It operates through four segments: Beef, Pork, Chicken, and Prepared Foods. The company processes live fed cattle and hogs; fabricates dressed beef and pork carcasses into primal and sub-primal meat cuts, as well as case ready beef and pork, and fully cooked meats; raises and processes chickens into fresh, frozen, and value-added chicken products, including breaded chicken strips, nuggets, patties, and other ready-to-fix or fully cooked chicken parts; and supplies poultry breeding stock.

See Also

Before you consider Tyson Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyson Foods wasn't on the list.

While Tyson Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.