U S Global Investors Inc. lifted its position in Hecla Mining (NYSE:HL - Free Report) by 150.0% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 500,000 shares of the basic materials company's stock after buying an additional 300,000 shares during the quarter. U S Global Investors Inc. owned about 0.08% of Hecla Mining worth $2,455,000 as of its most recent filing with the SEC.

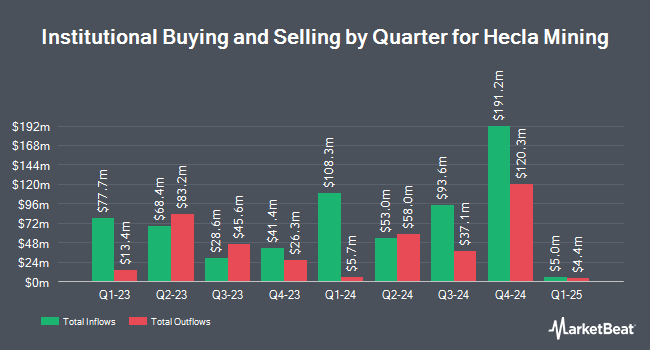

Several other large investors also recently added to or reduced their stakes in HL. Van ECK Associates Corp grew its position in shares of Hecla Mining by 4.3% in the third quarter. Van ECK Associates Corp now owns 54,680,051 shares of the basic materials company's stock valued at $391,510,000 after purchasing an additional 2,238,559 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in Hecla Mining during the third quarter worth $14,623,000. FMR LLC lifted its holdings in Hecla Mining by 51.3% during the 3rd quarter. FMR LLC now owns 5,435,909 shares of the basic materials company's stock valued at $36,258,000 after purchasing an additional 1,842,991 shares during the last quarter. JPMorgan Chase & Co. raised its stake in shares of Hecla Mining by 43.8% in the third quarter. JPMorgan Chase & Co. now owns 3,481,761 shares of the basic materials company's stock valued at $23,223,000 after acquiring an additional 1,059,929 shares during the last quarter. Finally, Geode Capital Management LLC boosted its stake in Hecla Mining by 5.4% in the third quarter. Geode Capital Management LLC now owns 13,865,241 shares of the basic materials company's stock worth $92,499,000 after purchasing an additional 711,676 shares in the last quarter. 63.01% of the stock is owned by institutional investors.

Insider Activity at Hecla Mining

In other news, CEO Robert Krcmarov acquired 6,570 shares of the stock in a transaction dated Wednesday, February 19th. The stock was bought at an average price of $5.29 per share, with a total value of $34,755.30. Following the completion of the purchase, the chief executive officer now directly owns 331,856 shares of the company's stock, valued at $1,755,518.24. This represents a 2.02 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Russell Douglas Lawlar sold 16,333 shares of the firm's stock in a transaction on Wednesday, February 26th. The stock was sold at an average price of $5.18, for a total value of $84,604.94. Following the transaction, the chief financial officer now directly owns 297,983 shares of the company's stock, valued at approximately $1,543,551.94. This represents a 5.20 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 57,915 shares of company stock valued at $300,000 over the last quarter. 1.40% of the stock is owned by corporate insiders.

Hecla Mining Stock Performance

Shares of HL traded up $0.04 during mid-day trading on Tuesday, reaching $5.12. The company's stock had a trading volume of 20,476,862 shares, compared to its average volume of 11,138,277. The business has a 50-day simple moving average of $5.42 and a two-hundred day simple moving average of $5.87. Hecla Mining has a 1-year low of $3.78 and a 1-year high of $7.68. The stock has a market cap of $3.23 billion, a P/E ratio of 102.32 and a beta of 1.91. The company has a current ratio of 1.08, a quick ratio of 0.55 and a debt-to-equity ratio of 0.25.

Hecla Mining (NYSE:HL - Get Free Report) last released its quarterly earnings results on Thursday, February 13th. The basic materials company reported $0.04 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.05 by ($0.01). Hecla Mining had a net margin of 3.85% and a return on equity of 3.10%. The firm had revenue of $249.66 million during the quarter, compared to the consensus estimate of $229.21 million. As a group, equities research analysts anticipate that Hecla Mining will post 0.21 earnings per share for the current fiscal year.

Hecla Mining Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, March 24th. Shareholders of record on Monday, March 10th will be paid a dividend of $0.0038 per share. The ex-dividend date is Monday, March 10th. This represents a $0.02 dividend on an annualized basis and a yield of 0.29%. Hecla Mining's dividend payout ratio (DPR) is presently 20.00%.

Analyst Ratings Changes

A number of brokerages have recently issued reports on HL. StockNews.com upgraded shares of Hecla Mining from a "sell" rating to a "hold" rating in a research report on Monday, February 17th. National Bank Financial downgraded shares of Hecla Mining from a "strong-buy" rating to a "hold" rating in a research note on Friday, November 8th. Roth Mkm dropped their price target on Hecla Mining from $6.60 to $6.50 and set a "buy" rating on the stock in a research report on Tuesday, February 18th. TD Securities reduced their target price on shares of Hecla Mining from $7.00 to $6.50 and set a "buy" rating for the company in a research note on Friday, February 21st. Finally, HC Wainwright reaffirmed a "buy" rating and set a $11.50 price target on shares of Hecla Mining in a research note on Friday, February 14th. Four research analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $8.00.

Read Our Latest Stock Analysis on HL

Hecla Mining Profile

(

Free Report)

Hecla Mining Company, together with its subsidiaries, provides precious and base metal properties in the United States, Canada, Japan, Korea, and China. The company mines for silver, gold, lead, and zinc concentrates, as well as carbon material containing silver and gold for custom smelters, metal traders, and third-party processors; and doré containing silver and gold.

Recommended Stories

Before you consider Hecla Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hecla Mining wasn't on the list.

While Hecla Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report