SCP Investment LP boosted its position in shares of Uber Technologies, Inc. (NYSE:UBER - Free Report) by 11.1% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 350,000 shares of the ride-sharing company's stock after purchasing an additional 35,000 shares during the quarter. Uber Technologies comprises about 19.1% of SCP Investment LP's portfolio, making the stock its 2nd biggest position. SCP Investment LP's holdings in Uber Technologies were worth $26,306,000 at the end of the most recent reporting period.

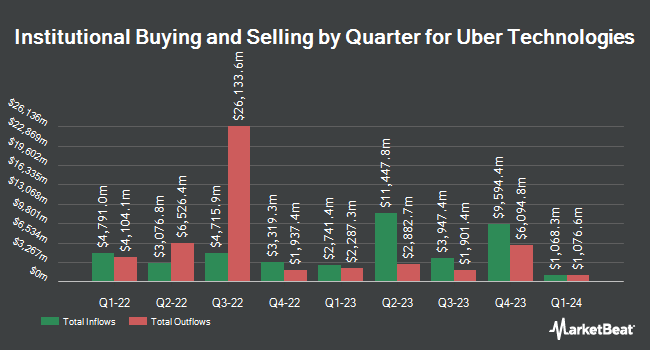

A number of other institutional investors and hedge funds have also made changes to their positions in UBER. Bessemer Group Inc. increased its stake in Uber Technologies by 73.5% during the 1st quarter. Bessemer Group Inc. now owns 32,769 shares of the ride-sharing company's stock worth $2,523,000 after buying an additional 13,887 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in shares of Uber Technologies during the first quarter worth about $599,000. Ossiam lifted its holdings in shares of Uber Technologies by 19,034.1% in the 1st quarter. Ossiam now owns 109,447 shares of the ride-sharing company's stock valued at $8,426,000 after buying an additional 108,875 shares during the period. Crewe Advisors LLC purchased a new position in shares of Uber Technologies in the 1st quarter valued at about $219,000. Finally, LGT Group Foundation acquired a new stake in shares of Uber Technologies during the 1st quarter worth about $77,000. 80.24% of the stock is currently owned by hedge funds and other institutional investors.

Uber Technologies Price Performance

UBER stock traded up $0.49 during midday trading on Wednesday, reaching $69.62. The company had a trading volume of 16,645,781 shares, compared to its average volume of 18,310,824. The company has a market capitalization of $146.60 billion, a P/E ratio of 34.53, a P/E/G ratio of 0.73 and a beta of 1.34. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.41 and a quick ratio of 1.41. Uber Technologies, Inc. has a 1 year low of $53.89 and a 1 year high of $87.00. The firm has a 50-day moving average price of $75.47 and a 200-day moving average price of $71.11.

Uber Technologies (NYSE:UBER - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The ride-sharing company reported $1.20 EPS for the quarter, topping the consensus estimate of $0.41 by $0.79. Uber Technologies had a net margin of 10.49% and a return on equity of 33.46%. The business had revenue of $11.19 billion during the quarter, compared to analyst estimates of $10.99 billion. During the same period in the prior year, the business earned $0.10 EPS. The company's revenue for the quarter was up 20.4% on a year-over-year basis. On average, research analysts anticipate that Uber Technologies, Inc. will post 1.83 earnings per share for the current fiscal year.

Insider Activity at Uber Technologies

In other Uber Technologies news, insider Jill Hazelbaker sold 40,000 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $72.00, for a total transaction of $2,880,000.00. Following the sale, the insider now owns 127,352 shares in the company, valued at approximately $9,169,344. This trade represents a 23.90 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 3.80% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on UBER shares. Loop Capital lifted their price target on shares of Uber Technologies from $84.00 to $86.00 and gave the company a "buy" rating in a research report on Wednesday, November 6th. Roth Mkm lifted their price target on shares of Uber Technologies from $89.00 to $90.00 and gave the company a "buy" rating in a research report on Wednesday, August 7th. Royal Bank of Canada lifted their price objective on shares of Uber Technologies from $80.00 to $82.00 and gave the company an "outperform" rating in a research note on Friday, November 1st. Gordon Haskett upgraded shares of Uber Technologies from a "hold" rating to a "buy" rating and set a $85.00 price objective on the stock in a research note on Thursday, October 31st. Finally, TD Cowen lifted their price target on shares of Uber Technologies from $88.00 to $90.00 and gave the stock a "buy" rating in a research note on Tuesday, July 23rd. Six investment analysts have rated the stock with a hold rating, thirty-two have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $90.32.

Check Out Our Latest Research Report on Uber Technologies

Uber Technologies Profile

(

Free Report)

Uber Technologies, Inc develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services.

Recommended Stories

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.