UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in shares of Equitable Holdings, Inc. (NYSE:EQH - Free Report) by 2.5% during the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 2,220,356 shares of the company's stock after purchasing an additional 54,380 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned 0.71% of Equitable worth $93,322,000 as of its most recent filing with the SEC.

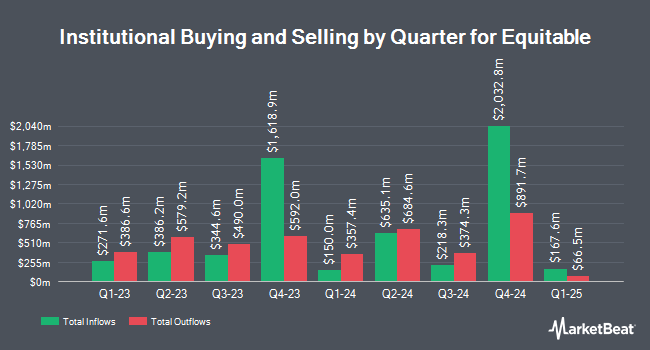

A number of other hedge funds and other institutional investors also recently modified their holdings of EQH. Covestor Ltd raised its position in Equitable by 61.5% during the third quarter. Covestor Ltd now owns 646 shares of the company's stock valued at $27,000 after buying an additional 246 shares during the period. LRI Investments LLC grew its holdings in shares of Equitable by 892.9% during the 2nd quarter. LRI Investments LLC now owns 1,112 shares of the company's stock valued at $45,000 after acquiring an additional 1,000 shares in the last quarter. Carolina Wealth Advisors LLC purchased a new position in Equitable in the third quarter valued at about $48,000. UMB Bank n.a. increased its position in Equitable by 86.3% in the 3rd quarter. UMB Bank n.a. now owns 1,550 shares of the company's stock worth $65,000 after purchasing an additional 718 shares during the last quarter. Finally, Quarry LP raised its stake in shares of Equitable by 623.5% during the 2nd quarter. Quarry LP now owns 2,366 shares of the company's stock worth $97,000 after purchasing an additional 2,039 shares in the last quarter. Institutional investors own 92.70% of the company's stock.

Equitable Price Performance

Shares of NYSE EQH traded up $0.21 during trading hours on Tuesday, reaching $47.56. The stock had a trading volume of 3,397,000 shares, compared to its average volume of 2,501,242. Equitable Holdings, Inc. has a twelve month low of $31.31 and a twelve month high of $50.51. The company has a debt-to-equity ratio of 1.63, a quick ratio of 0.12 and a current ratio of 0.12. The business's fifty day moving average is $45.49 and its two-hundred day moving average is $42.49.

Equitable (NYSE:EQH - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported $1.53 earnings per share for the quarter, meeting the consensus estimate of $1.53. Equitable had a negative net margin of 2.64% and a positive return on equity of 76.47%. The business had revenue of $3.08 billion for the quarter, compared to analyst estimates of $3.78 billion. During the same period in the previous year, the business earned $1.15 EPS. The firm's revenue was down 15.1% on a year-over-year basis. As a group, equities analysts anticipate that Equitable Holdings, Inc. will post 6.05 earnings per share for the current fiscal year.

Equitable Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Tuesday, November 26th will be paid a dividend of $0.24 per share. The ex-dividend date is Tuesday, November 26th. This represents a $0.96 annualized dividend and a yield of 2.02%. Equitable's dividend payout ratio is currently -88.07%.

Insider Activity at Equitable

In related news, CAO William James Iv Eckert sold 3,500 shares of the firm's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $42.42, for a total value of $148,470.00. Following the transaction, the chief accounting officer now owns 19,321 shares in the company, valued at $819,596.82. This trade represents a 15.34 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Mark Pearson sold 30,000 shares of Equitable stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $40.78, for a total transaction of $1,223,400.00. Following the sale, the chief executive officer now owns 668,555 shares of the company's stock, valued at approximately $27,263,672.90. This represents a 4.29 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 100,166 shares of company stock valued at $4,443,605 in the last ninety days. Insiders own 1.10% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on the stock. Morgan Stanley decreased their price objective on shares of Equitable from $48.00 to $46.00 and set an "overweight" rating for the company in a report on Monday, August 19th. Wells Fargo & Company upped their price target on shares of Equitable from $43.00 to $47.00 and gave the company an "overweight" rating in a report on Thursday, October 10th. Finally, Barclays boosted their price objective on Equitable from $59.00 to $60.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 8th. Three equities research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $48.70.

Get Our Latest Analysis on EQH

About Equitable

(

Free Report)

Equitable Holdings, Inc, together with its consolidated subsidiaries, operates as a diversified financial services company worldwide. The company operates through six segments: Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

Read More

Before you consider Equitable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equitable wasn't on the list.

While Equitable currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.