UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in e.l.f. Beauty, Inc. (NYSE:ELF - Free Report) by 2.4% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 192,221 shares of the company's stock after acquiring an additional 4,434 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned 0.34% of e.l.f. Beauty worth $20,958,000 at the end of the most recent quarter.

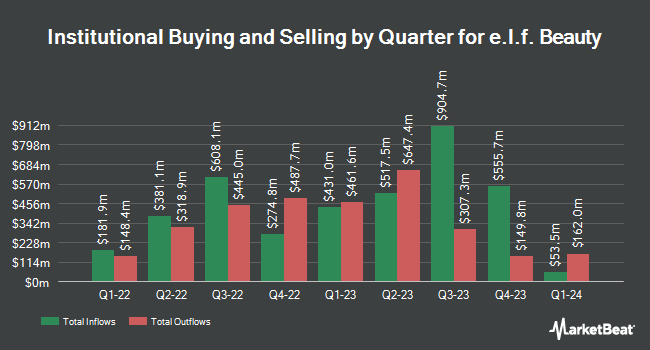

A number of other hedge funds have also recently made changes to their positions in ELF. Cetera Advisors LLC acquired a new stake in e.l.f. Beauty in the first quarter valued at approximately $640,000. GAMMA Investing LLC increased its position in e.l.f. Beauty by 27.8% during the 2nd quarter. GAMMA Investing LLC now owns 451 shares of the company's stock valued at $95,000 after buying an additional 98 shares in the last quarter. Kingswood Wealth Advisors LLC purchased a new stake in e.l.f. Beauty in the second quarter valued at about $229,000. Park Avenue Securities LLC boosted its holdings in e.l.f. Beauty by 15.9% in the second quarter. Park Avenue Securities LLC now owns 5,226 shares of the company's stock worth $1,101,000 after acquiring an additional 715 shares in the last quarter. Finally, CWM LLC grew its stake in shares of e.l.f. Beauty by 1,668.9% during the second quarter. CWM LLC now owns 14,328 shares of the company's stock worth $3,019,000 after acquiring an additional 13,518 shares during the last quarter. 92.44% of the stock is currently owned by hedge funds and other institutional investors.

e.l.f. Beauty Price Performance

Shares of ELF stock traded up $8.37 during mid-day trading on Friday, hitting $139.60. 2,648,336 shares of the stock were exchanged, compared to its average volume of 1,971,643. e.l.f. Beauty, Inc. has a 52-week low of $98.50 and a 52-week high of $221.83. The company has a quick ratio of 1.01, a current ratio of 1.78 and a debt-to-equity ratio of 0.22. The company has a market cap of $7.86 billion, a PE ratio of 75.46, a price-to-earnings-growth ratio of 2.79 and a beta of 1.49. The firm has a fifty day moving average of $115.83 and a 200 day moving average of $150.58.

e.l.f. Beauty (NYSE:ELF - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported $0.77 EPS for the quarter, beating the consensus estimate of $0.43 by $0.34. The company had revenue of $301.10 million for the quarter, compared to analyst estimates of $289.43 million. e.l.f. Beauty had a return on equity of 19.34% and a net margin of 8.87%. e.l.f. Beauty's quarterly revenue was up 39.7% compared to the same quarter last year. During the same period last year, the company earned $0.66 earnings per share. Research analysts anticipate that e.l.f. Beauty, Inc. will post 2.8 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages recently commented on ELF. Morgan Stanley decreased their price objective on shares of e.l.f. Beauty from $184.00 to $139.00 and set an "equal weight" rating for the company in a research report on Monday, September 30th. JPMorgan Chase & Co. dropped their price objective on shares of e.l.f. Beauty from $167.00 to $154.00 and set an "overweight" rating on the stock in a report on Thursday, November 7th. Stifel Nicolaus reduced their target price on e.l.f. Beauty from $131.00 to $115.00 and set a "hold" rating for the company in a research note on Thursday, November 7th. UBS Group dropped their price target on e.l.f. Beauty from $250.00 to $230.00 and set a "buy" rating on the stock in a research note on Friday, August 9th. Finally, Jefferies Financial Group reduced their price objective on e.l.f. Beauty from $220.00 to $175.00 and set a "buy" rating for the company in a research note on Wednesday, October 30th. One research analyst has rated the stock with a sell rating, two have given a hold rating, twelve have given a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, e.l.f. Beauty has a consensus rating of "Moderate Buy" and a consensus price target of $173.53.

View Our Latest Stock Analysis on ELF

Insiders Place Their Bets

In other news, Director Maureen C. Watson sold 785 shares of the firm's stock in a transaction that occurred on Friday, November 29th. The stock was sold at an average price of $130.00, for a total value of $102,050.00. Following the transaction, the director now owns 1,888 shares in the company, valued at $245,440. This trade represents a 29.37 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 3.50% of the stock is currently owned by company insiders.

About e.l.f. Beauty

(

Free Report)

e.l.f. Beauty, Inc, together with its subsidiaries, provides cosmetic and skin care products under the e.l.f. Cosmetics, e.l.f. Skin, Well People, and Keys Soulcare brand names worldwide. The company offers eye, lip, face, face, paw, and skin care products. It sells its products through national and international retailers and direct-to-consumer channels, which include e-commerce platforms in the United States, and internationally primarily through distributors.

Featured Articles

Before you consider e.l.f. Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and e.l.f. Beauty wasn't on the list.

While e.l.f. Beauty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.