UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in Credo Technology Group Holding Ltd (NASDAQ:CRDO - Free Report) by 94.1% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 243,719 shares of the company's stock after acquiring an additional 118,169 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.15% of Credo Technology Group worth $7,507,000 at the end of the most recent quarter.

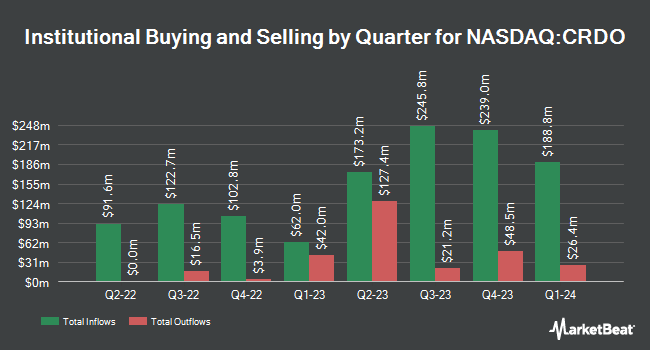

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Assetmark Inc. raised its position in shares of Credo Technology Group by 5.4% during the 3rd quarter. Assetmark Inc. now owns 4,978 shares of the company's stock valued at $153,000 after purchasing an additional 257 shares during the period. Fifth Third Bancorp lifted its position in shares of Credo Technology Group by 59.3% in the second quarter. Fifth Third Bancorp now owns 1,074 shares of the company's stock valued at $34,000 after acquiring an additional 400 shares in the last quarter. Advisors Asset Management Inc. boosted its stake in shares of Credo Technology Group by 11.3% in the third quarter. Advisors Asset Management Inc. now owns 4,722 shares of the company's stock worth $145,000 after acquiring an additional 478 shares during the period. CWM LLC grew its position in shares of Credo Technology Group by 78.1% during the second quarter. CWM LLC now owns 1,355 shares of the company's stock worth $43,000 after purchasing an additional 594 shares in the last quarter. Finally, US Bancorp DE raised its stake in Credo Technology Group by 4.2% during the 3rd quarter. US Bancorp DE now owns 16,210 shares of the company's stock valued at $499,000 after purchasing an additional 649 shares during the period. Institutional investors own 80.46% of the company's stock.

Credo Technology Group Price Performance

Shares of CRDO traded down $0.77 during midday trading on Tuesday, hitting $66.26. The stock had a trading volume of 3,918,050 shares, compared to its average volume of 2,414,106. The stock's 50 day moving average is $44.29 and its 200 day moving average is $34.49. The firm has a market cap of $11.08 billion, a PE ratio of -441.73 and a beta of 2.26. Credo Technology Group Holding Ltd has a 1 year low of $16.82 and a 1 year high of $75.32.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on CRDO shares. Mizuho increased their price objective on shares of Credo Technology Group from $35.00 to $41.00 and gave the company an "outperform" rating in a report on Monday, October 14th. Needham & Company LLC raised their target price on shares of Credo Technology Group from $43.00 to $70.00 and gave the company a "buy" rating in a research note on Tuesday, December 3rd. Bank of America upgraded shares of Credo Technology Group from an "underperform" rating to a "buy" rating and lifted their price target for the company from $27.00 to $80.00 in a report on Tuesday, December 3rd. TD Cowen raised their price objective on Credo Technology Group from $45.00 to $75.00 and gave the company a "buy" rating in a research report on Tuesday, December 3rd. Finally, Craig Hallum boosted their target price on Credo Technology Group from $38.00 to $75.00 and gave the stock a "buy" rating in a research report on Tuesday, December 3rd. Nine analysts have rated the stock with a buy rating, According to MarketBeat, the company presently has a consensus rating of "Buy" and an average price target of $67.33.

Get Our Latest Stock Analysis on Credo Technology Group

Insider Buying and Selling

In other Credo Technology Group news, Director Lip Bu Tan sold 150,000 shares of the stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $30.50, for a total value of $4,575,000.00. Following the sale, the director now owns 2,638,725 shares in the company, valued at $80,481,112.50. This trade represents a 5.38 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider James Laufman sold 20,000 shares of the business's stock in a transaction on Friday, September 27th. The shares were sold at an average price of $31.36, for a total transaction of $627,200.00. Following the sale, the insider now directly owns 302,466 shares of the company's stock, valued at $9,485,333.76. This represents a 6.20 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 1,341,120 shares of company stock valued at $51,364,455 in the last ninety days. 16.04% of the stock is owned by company insiders.

Credo Technology Group Company Profile

(

Free Report)

Credo Technology Group Holding Ltd provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally. Its products include HiWire active electrical cables, optical digital signal processors, low-power line card PHY, serializer/deserializer (SerDes) chiplets, and SerDes IP, as well as integrated circuits, active electrical cables.

See Also

Before you consider Credo Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credo Technology Group wasn't on the list.

While Credo Technology Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.