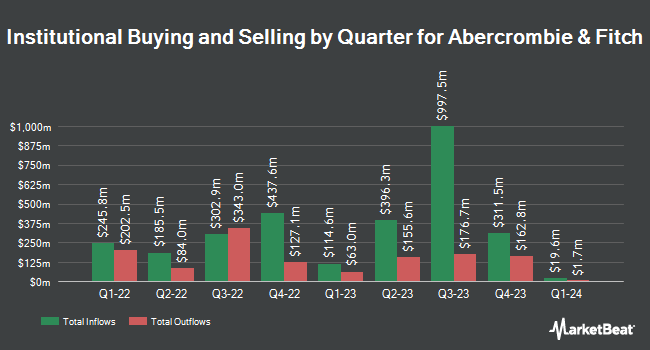

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC decreased its stake in shares of Abercrombie & Fitch Co. (NYSE:ANF - Free Report) by 10.8% during the third quarter, according to the company in its most recent filing with the SEC. The fund owned 93,742 shares of the apparel retailer's stock after selling 11,324 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned 0.18% of Abercrombie & Fitch worth $13,115,000 as of its most recent filing with the SEC.

A number of other institutional investors have also made changes to their positions in the stock. Westfield Capital Management Co. LP acquired a new stake in shares of Abercrombie & Fitch in the third quarter valued at about $73,048,000. Renaissance Technologies LLC grew its holdings in Abercrombie & Fitch by 146.3% in the 2nd quarter. Renaissance Technologies LLC now owns 863,100 shares of the apparel retailer's stock valued at $153,494,000 after buying an additional 512,700 shares during the last quarter. Assenagon Asset Management S.A. increased its position in Abercrombie & Fitch by 2,036.5% in the 2nd quarter. Assenagon Asset Management S.A. now owns 419,560 shares of the apparel retailer's stock worth $74,615,000 after buying an additional 399,922 shares during the period. Driehaus Capital Management LLC lifted its holdings in shares of Abercrombie & Fitch by 283.0% during the second quarter. Driehaus Capital Management LLC now owns 303,896 shares of the apparel retailer's stock worth $54,045,000 after buying an additional 224,555 shares during the last quarter. Finally, Bank of Montreal Can boosted its position in shares of Abercrombie & Fitch by 293.7% in the second quarter. Bank of Montreal Can now owns 286,434 shares of the apparel retailer's stock valued at $51,043,000 after acquiring an additional 213,684 shares during the period.

Abercrombie & Fitch Stock Performance

NYSE ANF traded up $1.40 during trading on Friday, reaching $151.35. 1,519,156 shares of the company traded hands, compared to its average volume of 1,774,912. Abercrombie & Fitch Co. has a 1-year low of $76.82 and a 1-year high of $196.99. The company has a market cap of $7.73 billion, a price-to-earnings ratio of 14.97 and a beta of 1.52. The stock's 50 day moving average price is $145.42 and its two-hundred day moving average price is $154.26.

Abercrombie & Fitch (NYSE:ANF - Get Free Report) last announced its quarterly earnings results on Tuesday, November 26th. The apparel retailer reported $2.50 EPS for the quarter, beating the consensus estimate of $2.32 by $0.18. Abercrombie & Fitch had a return on equity of 46.50% and a net margin of 11.16%. The business had revenue of $1.21 billion for the quarter, compared to analyst estimates of $1.19 billion. During the same quarter in the previous year, the firm earned $1.83 EPS. Abercrombie & Fitch's quarterly revenue was up 14.4% on a year-over-year basis. Equities research analysts expect that Abercrombie & Fitch Co. will post 10.52 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

ANF has been the topic of a number of research reports. Telsey Advisory Group reaffirmed an "outperform" rating and set a $190.00 target price on shares of Abercrombie & Fitch in a research report on Tuesday, November 26th. Raymond James assumed coverage on shares of Abercrombie & Fitch in a report on Friday. They set an "outperform" rating and a $180.00 price objective on the stock. JPMorgan Chase & Co. increased their target price on shares of Abercrombie & Fitch from $194.00 to $195.00 and gave the company an "overweight" rating in a research note on Friday, October 4th. Jefferies Financial Group boosted their price target on Abercrombie & Fitch from $215.00 to $220.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Finally, Citigroup upgraded Abercrombie & Fitch from a "neutral" rating to a "buy" rating and set a $190.00 price objective for the company in a research report on Friday, August 30th. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $178.38.

View Our Latest Stock Report on Abercrombie & Fitch

Insider Transactions at Abercrombie & Fitch

In other news, EVP Samir Desai sold 5,926 shares of the stock in a transaction on Friday, November 29th. The stock was sold at an average price of $148.51, for a total transaction of $880,070.26. Following the sale, the executive vice president now owns 22,059 shares in the company, valued at approximately $3,275,982.09. This represents a 21.18 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Suzanne M. Coulter sold 2,870 shares of Abercrombie & Fitch stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $160.00, for a total value of $459,200.00. Following the completion of the transaction, the director now directly owns 6,405 shares of the company's stock, valued at $1,024,800. This represents a 30.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 17,401 shares of company stock valued at $2,631,741. 2.58% of the stock is owned by insiders.

Abercrombie & Fitch Company Profile

(

Free Report)

Abercrombie & Fitch Co, through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally. The company offers an assortment of apparel, personal care products, and accessories for men, women, and kids under the Abercrombie & Fitch, abercrombie kids, Hollister, and Gilly Hicks brands.

Featured Articles

Before you consider Abercrombie & Fitch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abercrombie & Fitch wasn't on the list.

While Abercrombie & Fitch currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.