UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC cut its stake in shares of Logitech International S.A. (NASDAQ:LOGI - Free Report) by 15.2% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 4,062,988 shares of the technology company's stock after selling 730,620 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 2.57% of Logitech International worth $364,572,000 at the end of the most recent reporting period.

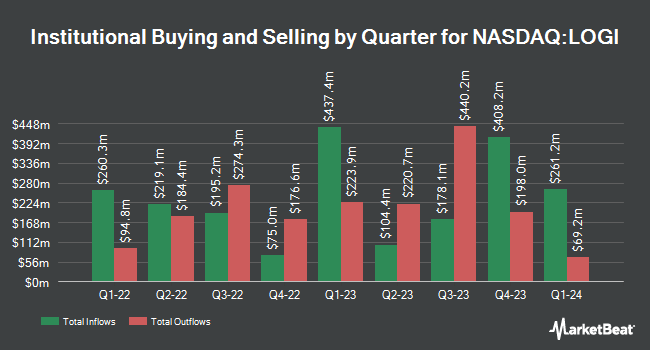

Several other large investors have also recently added to or reduced their stakes in the stock. Hsbc Holdings PLC grew its holdings in shares of Logitech International by 380.7% during the 2nd quarter. Hsbc Holdings PLC now owns 122,926 shares of the technology company's stock valued at $11,883,000 after acquiring an additional 97,353 shares in the last quarter. Assenagon Asset Management S.A. boosted its position in Logitech International by 166.2% during the second quarter. Assenagon Asset Management S.A. now owns 1,279,414 shares of the technology company's stock valued at $123,759,000 after purchasing an additional 798,759 shares during the last quarter. Toronto Dominion Bank grew its stake in Logitech International by 2,085.3% in the second quarter. Toronto Dominion Bank now owns 63,439 shares of the technology company's stock valued at $6,146,000 after purchasing an additional 60,536 shares in the last quarter. SpiderRock Advisors LLC acquired a new position in Logitech International in the 3rd quarter worth about $1,431,000. Finally, Summit Global Investments purchased a new stake in shares of Logitech International during the 3rd quarter worth about $1,299,000. Institutional investors and hedge funds own 45.76% of the company's stock.

Logitech International Stock Performance

Shares of NASDAQ:LOGI traded up $1.64 during midday trading on Friday, hitting $80.89. The company's stock had a trading volume of 284,732 shares, compared to its average volume of 497,619. The stock's 50 day simple moving average is $83.32 and its 200 day simple moving average is $88.96. The stock has a market capitalization of $12.79 billion, a price-to-earnings ratio of 17.65, a PEG ratio of 1.80 and a beta of 0.81. Logitech International S.A. has a fifty-two week low of $74.72 and a fifty-two week high of $102.59.

Logitech International Increases Dividend

The firm also recently declared an annual dividend, which was paid on Wednesday, September 25th. Shareholders of record on Tuesday, September 24th were given a $1.3687 dividend. This is an increase from Logitech International's previous annual dividend of $1.19. This represents a yield of 1.4%. The ex-dividend date was Tuesday, September 24th.

Insider Transactions at Logitech International

In related news, Director Guy Gecht bought 2,500 shares of Logitech International stock in a transaction that occurred on Thursday, October 24th. The stock was acquired at an average price of $81.12 per share, for a total transaction of $202,800.00. Following the completion of the purchase, the director now owns 18,503 shares in the company, valued at approximately $1,500,963.36. This represents a 15.62 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Corporate insiders own 0.16% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently commented on LOGI shares. Wedbush restated a "neutral" rating and issued a $88.00 price objective on shares of Logitech International in a report on Wednesday, October 23rd. UBS Group upgraded shares of Logitech International from a "sell" rating to a "neutral" rating in a research note on Wednesday, November 20th. Barclays reduced their price objective on shares of Logitech International from $105.00 to $103.00 and set an "overweight" rating for the company in a research note on Wednesday, October 23rd. JPMorgan Chase & Co. lowered their target price on shares of Logitech International from $98.00 to $93.00 and set a "neutral" rating on the stock in a research report on Wednesday, October 23rd. Finally, Loop Capital reduced their price target on Logitech International from $88.00 to $81.00 and set a "hold" rating for the company in a research report on Monday, October 28th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat.com, Logitech International has an average rating of "Hold" and an average price target of $93.00.

View Our Latest Research Report on LOGI

Logitech International Company Profile

(

Free Report)

Logitech International SA, through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, gaming, and streaming worldwide. The company offers products for gamers and streamers, including mice, racing wheels, headsets, keyboards, microphones, and streaming services; corded and cordless keyboards and keyboard-and-mouse combinations; pointing devices, such as wireless mice and wireless mouse products; conference room cameras, such as ConferenceCams; controllers for video conferencing room solutions; PC-based webcams, including streaming cameras and VC webcams; tablet accessories that includes keyboards for tablets; PC and VC headsets, in-ear headphones, and premium wireless earbuds; and mobile speakers and PC speakers, as well as portable wireless Bluetooth speakers.

Featured Stories

Before you consider Logitech International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Logitech International wasn't on the list.

While Logitech International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.