UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lessened its holdings in The Southern Company (NYSE:SO - Free Report) by 11.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 4,229,116 shares of the utilities provider's stock after selling 529,364 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.39% of Southern worth $381,382,000 as of its most recent SEC filing.

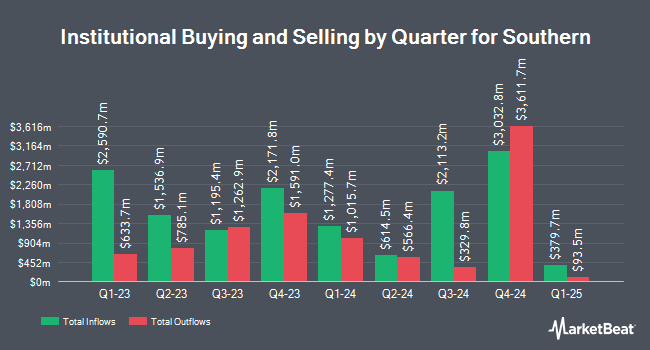

Other institutional investors and hedge funds have also modified their holdings of the company. Noesis Capital Mangement Corp acquired a new stake in shares of Southern during the third quarter worth approximately $209,000. Public Sector Pension Investment Board boosted its stake in shares of Southern by 2.8% during the 3rd quarter. Public Sector Pension Investment Board now owns 190,678 shares of the utilities provider's stock valued at $17,195,000 after buying an additional 5,242 shares during the period. Fiduciary Trust Co grew its holdings in shares of Southern by 4.0% during the 3rd quarter. Fiduciary Trust Co now owns 7,568 shares of the utilities provider's stock valued at $682,000 after acquiring an additional 289 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Southern by 4.7% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 213,985 shares of the utilities provider's stock worth $19,297,000 after acquiring an additional 9,689 shares during the last quarter. Finally, Providence Capital Advisors LLC raised its holdings in shares of Southern by 1.0% during the third quarter. Providence Capital Advisors LLC now owns 40,953 shares of the utilities provider's stock worth $3,693,000 after acquiring an additional 418 shares in the last quarter. Hedge funds and other institutional investors own 64.10% of the company's stock.

Southern Stock Performance

NYSE:SO traded down $0.59 during mid-day trading on Friday, hitting $89.15. 2,363,965 shares of the company's stock traded hands, compared to its average volume of 4,430,489. The company has a current ratio of 0.91, a quick ratio of 0.66 and a debt-to-equity ratio of 1.66. The firm has a 50 day moving average of $89.72 and a two-hundred day moving average of $85.08. The firm has a market capitalization of $97.68 billion, a price-to-earnings ratio of 20.73, a price-to-earnings-growth ratio of 3.27 and a beta of 0.52. The Southern Company has a 12 month low of $65.80 and a 12 month high of $94.45.

Southern (NYSE:SO - Get Free Report) last announced its earnings results on Thursday, October 31st. The utilities provider reported $1.43 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.33 by $0.10. Southern had a net margin of 17.87% and a return on equity of 12.78%. The business had revenue of $7.27 billion for the quarter, compared to analyst estimates of $7.14 billion. During the same quarter in the previous year, the firm posted $1.42 earnings per share. Southern's revenue was up 4.2% compared to the same quarter last year. On average, equities analysts forecast that The Southern Company will post 4.03 earnings per share for the current fiscal year.

Southern Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Monday, November 18th will be given a dividend of $0.72 per share. This represents a $2.88 dividend on an annualized basis and a yield of 3.23%. The ex-dividend date of this dividend is Monday, November 18th. Southern's dividend payout ratio (DPR) is presently 66.98%.

Analyst Ratings Changes

A number of research analysts have commented on the company. Wolfe Research downgraded Southern from an "outperform" rating to a "peer perform" rating in a research note on Friday, August 2nd. Barclays increased their price objective on Southern from $71.00 to $83.00 and gave the stock an "equal weight" rating in a report on Tuesday, October 15th. JPMorgan Chase & Co. lifted their target price on shares of Southern from $80.00 to $87.00 and gave the company an "underweight" rating in a research note on Monday, August 12th. The Goldman Sachs Group increased their price target on shares of Southern from $83.00 to $94.00 and gave the stock a "buy" rating in a research note on Friday, August 2nd. Finally, Mizuho lowered shares of Southern from an "outperform" rating to a "neutral" rating and set a $90.00 price objective for the company. in a research note on Monday, September 16th. One analyst has rated the stock with a sell rating, eight have issued a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $89.47.

Read Our Latest Stock Analysis on Southern

Insider Activity at Southern

In related news, CEO James Y. Kerr II sold 30,000 shares of the stock in a transaction dated Friday, October 4th. The shares were sold at an average price of $89.64, for a total value of $2,689,200.00. Following the completion of the transaction, the chief executive officer now owns 145,088 shares of the company's stock, valued at $13,005,688.32. This represents a 17.13 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, EVP Bryan D. Anderson sold 6,565 shares of Southern stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $89.54, for a total value of $587,830.10. Following the sale, the executive vice president now directly owns 44,467 shares in the company, valued at $3,981,575.18. The trade was a 12.86 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.18% of the company's stock.

About Southern

(

Free Report)

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, gas distribution operations, and gas pipeline investments operations.

Featured Stories

Before you consider Southern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern wasn't on the list.

While Southern currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.