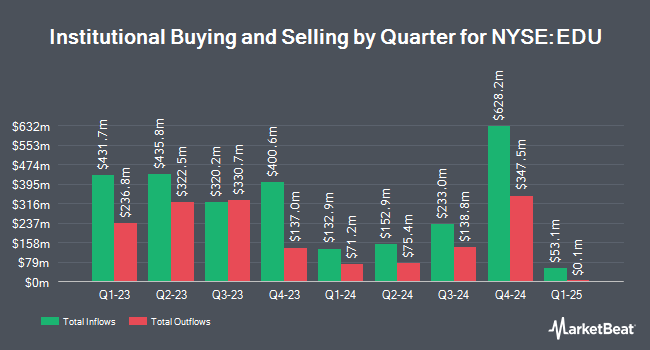

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in New Oriental Education & Technology Group Inc. (NYSE:EDU - Free Report) by 20,215.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 994,431 shares of the company's stock after buying an additional 989,536 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned approximately 0.59% of New Oriental Education & Technology Group worth $75,418,000 at the end of the most recent quarter.

Several other large investors have also recently added to or reduced their stakes in EDU. Ridgewood Investments LLC bought a new position in shares of New Oriental Education & Technology Group during the second quarter worth about $43,000. Ashton Thomas Private Wealth LLC bought a new stake in New Oriental Education & Technology Group during the second quarter worth approximately $50,000. Blue Trust Inc. grew its holdings in shares of New Oriental Education & Technology Group by 782.4% in the 2nd quarter. Blue Trust Inc. now owns 803 shares of the company's stock worth $62,000 after acquiring an additional 712 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in New Oriental Education & Technology Group by 14.2% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,658 shares of the company's stock valued at $126,000 after buying an additional 206 shares in the last quarter. Finally, Hancock Whitney Corp acquired a new position in New Oriental Education & Technology Group in the 2nd quarter worth approximately $212,000.

Analysts Set New Price Targets

A number of research analysts recently commented on the stock. StockNews.com raised shares of New Oriental Education & Technology Group from a "sell" rating to a "hold" rating in a research report on Thursday, October 24th. Morgan Stanley set a $83.00 price target on New Oriental Education & Technology Group in a report on Thursday, October 17th.

Get Our Latest Report on New Oriental Education & Technology Group

New Oriental Education & Technology Group Trading Up 6.5 %

New Oriental Education & Technology Group stock traded up $3.92 on Tuesday, reaching $63.84. 2,659,716 shares of the stock were exchanged, compared to its average volume of 1,848,493. The stock has a market cap of $10.83 billion, a PE ratio of 27.28 and a beta of 0.46. The firm has a fifty day moving average price of $65.13 and a two-hundred day moving average price of $69.33. New Oriental Education & Technology Group Inc. has a twelve month low of $54.00 and a twelve month high of $98.20.

New Oriental Education & Technology Group (NYSE:EDU - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $1.60 earnings per share for the quarter, beating the consensus estimate of $1.33 by $0.27. The company had revenue of $1.44 billion during the quarter, compared to analysts' expectations of $1.45 billion. New Oriental Education & Technology Group had a return on equity of 9.43% and a net margin of 8.38%. New Oriental Education & Technology Group's revenue for the quarter was up 30.5% compared to the same quarter last year. During the same period in the prior year, the business earned $0.99 earnings per share. Equities analysts anticipate that New Oriental Education & Technology Group Inc. will post 2.94 EPS for the current fiscal year.

About New Oriental Education & Technology Group

(

Free Report)

New Oriental Education & Technology Group Inc provides private educational services under the New Oriental brand in the People's Republic of China. The company operates through four segments: Educational Services and Test Preparation Courses; Online Education and Other Services; Overseas Study Consulting Services; and Educational Materials and Distribution.

Featured Stories

Before you consider New Oriental Education & Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Oriental Education & Technology Group wasn't on the list.

While New Oriental Education & Technology Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.