UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lowered its holdings in United Therapeutics Co. (NASDAQ:UTHR - Free Report) by 12.8% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 212,657 shares of the biotechnology company's stock after selling 31,298 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned 0.48% of United Therapeutics worth $76,206,000 as of its most recent SEC filing.

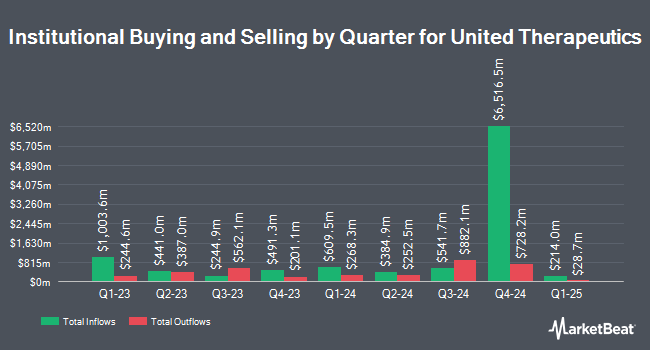

Several other institutional investors have also recently added to or reduced their stakes in the business. CreativeOne Wealth LLC purchased a new stake in United Therapeutics during the third quarter worth approximately $215,000. Glenmede Trust Co. NA increased its holdings in United Therapeutics by 6.4% in the 3rd quarter. Glenmede Trust Co. NA now owns 68,605 shares of the biotechnology company's stock valued at $24,585,000 after purchasing an additional 4,145 shares in the last quarter. Bridgewater Associates LP raised its position in United Therapeutics by 384.3% in the third quarter. Bridgewater Associates LP now owns 61,755 shares of the biotechnology company's stock valued at $22,130,000 after purchasing an additional 49,003 shares during the period. Townsquare Capital LLC acquired a new position in shares of United Therapeutics during the third quarter worth about $426,000. Finally, Brooklyn Investment Group purchased a new stake in shares of United Therapeutics in the third quarter worth about $33,000. 94.08% of the stock is currently owned by institutional investors and hedge funds.

United Therapeutics Stock Down 0.4 %

NASDAQ:UTHR traded down $1.33 during mid-day trading on Tuesday, reaching $368.79. 233,175 shares of the company were exchanged, compared to its average volume of 455,166. United Therapeutics Co. has a 12 month low of $208.62 and a 12 month high of $417.82. The stock has a market cap of $16.47 billion, a PE ratio of 16.20, a PEG ratio of 1.08 and a beta of 0.54. The company has a fifty day moving average of $368.07 and a 200 day moving average of $336.78.

United Therapeutics (NASDAQ:UTHR - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The biotechnology company reported $6.39 earnings per share for the quarter, topping analysts' consensus estimates of $6.16 by $0.23. United Therapeutics had a net margin of 40.31% and a return on equity of 19.22%. The business had revenue of $748.90 million during the quarter, compared to the consensus estimate of $722.62 million. During the same period in the previous year, the firm posted $5.38 earnings per share. United Therapeutics's revenue for the quarter was up 22.9% compared to the same quarter last year. On average, equities research analysts anticipate that United Therapeutics Co. will post 25.22 EPS for the current fiscal year.

Insider Transactions at United Therapeutics

In other news, COO Michael Benkowitz sold 15,000 shares of the firm's stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $401.44, for a total transaction of $6,021,600.00. Following the completion of the transaction, the chief operating officer now directly owns 2,577 shares of the company's stock, valued at $1,034,510.88. This trade represents a 85.34 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO James Edgemond sold 7,802 shares of United Therapeutics stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $345.41, for a total transaction of $2,694,888.82. Following the completion of the sale, the chief financial officer now owns 3,210 shares in the company, valued at $1,108,766.10. This trade represents a 70.85 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 119,442 shares of company stock valued at $44,577,770 over the last three months. 11.90% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several analysts have issued reports on UTHR shares. Argus lifted their price objective on shares of United Therapeutics from $360.00 to $400.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. HC Wainwright lifted their price target on shares of United Therapeutics from $400.00 to $425.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. StockNews.com upgraded shares of United Therapeutics from a "buy" rating to a "strong-buy" rating in a report on Thursday, October 17th. Wells Fargo & Company raised their price objective on shares of United Therapeutics from $350.00 to $380.00 and gave the stock an "overweight" rating in a report on Tuesday, August 20th. Finally, Jefferies Financial Group upped their target price on shares of United Therapeutics from $315.00 to $432.00 and gave the company a "buy" rating in a research note on Monday, September 23rd. One equities research analyst has rated the stock with a sell rating, two have given a hold rating, twelve have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $370.86.

View Our Latest Stock Analysis on United Therapeutics

United Therapeutics Profile

(

Free Report)

United Therapeutics Corporation, a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally. The company offers Tyvaso DPI, an inhaled dry powder via pre-filled and single-use cartridges; Tyvaso, an inhaled solution via ultrasonic nebulizer; Remodulin (treprostinil) injection to treat patients with pulmonary arterial hypertension (PAH) to diminish symptoms associated with exercise; Orenitram, a tablet dosage form of treprostinil, to delay disease progression and improve exercise capacity in PAH patients; and Adcirca, an oral PDE-5 inhibitor to enhance the exercise ability in PAH patients.

See Also

Before you consider United Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Therapeutics wasn't on the list.

While United Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.