UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC decreased its stake in SS&C Technologies Holdings, Inc. (NASDAQ:SSNC - Free Report) by 1.0% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,285,109 shares of the technology company's stock after selling 13,544 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned approximately 0.52% of SS&C Technologies worth $95,368,000 as of its most recent SEC filing.

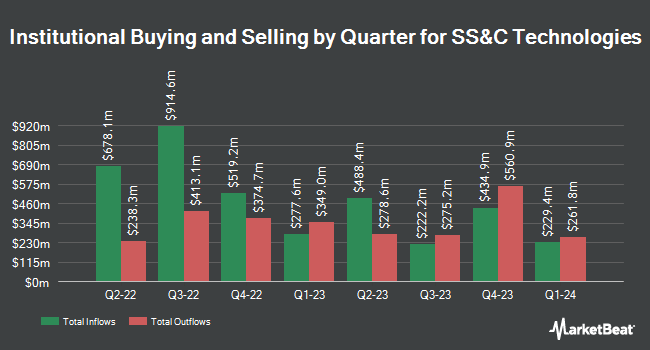

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Diamond Hill Capital Management Inc. boosted its holdings in SS&C Technologies by 0.7% in the second quarter. Diamond Hill Capital Management Inc. now owns 7,798,723 shares of the technology company's stock valued at $488,746,000 after purchasing an additional 53,080 shares during the period. Burgundy Asset Management Ltd. boosted its holdings in shares of SS&C Technologies by 4.3% in the second quarter. Burgundy Asset Management Ltd. now owns 4,942,374 shares of the technology company's stock valued at $309,739,000 after acquiring an additional 201,632 shares in the last quarter. FMR LLC lifted its holdings in SS&C Technologies by 1.5% in the third quarter. FMR LLC now owns 3,984,057 shares of the technology company's stock valued at $295,657,000 after acquiring an additional 58,389 shares during the period. Millennium Management LLC grew its holdings in SS&C Technologies by 49.2% in the second quarter. Millennium Management LLC now owns 3,399,874 shares of the technology company's stock valued at $213,070,000 after purchasing an additional 1,120,961 shares during the last quarter. Finally, Dimensional Fund Advisors LP lifted its position in shares of SS&C Technologies by 14.9% in the second quarter. Dimensional Fund Advisors LP now owns 2,696,702 shares of the technology company's stock valued at $168,995,000 after acquiring an additional 349,911 shares in the last quarter. Hedge funds and other institutional investors own 96.95% of the company's stock.

SS&C Technologies Stock Performance

SSNC stock traded down $0.11 on Monday, reaching $76.98. The company's stock had a trading volume of 1,029,838 shares, compared to its average volume of 1,090,755. The company has a market capitalization of $19.07 billion, a P/E ratio of 27.72 and a beta of 1.39. The company has a debt-to-equity ratio of 1.04, a current ratio of 1.21 and a quick ratio of 1.21. SS&C Technologies Holdings, Inc. has a 52 week low of $56.10 and a 52 week high of $77.69. The firm has a fifty day moving average of $74.26 and a two-hundred day moving average of $69.92.

SS&C Technologies (NASDAQ:SSNC - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The technology company reported $1.29 EPS for the quarter, topping analysts' consensus estimates of $1.26 by $0.03. SS&C Technologies had a return on equity of 17.33% and a net margin of 12.26%. The company had revenue of $1.47 billion for the quarter, compared to the consensus estimate of $1.44 billion. During the same quarter in the previous year, the business earned $1.04 EPS. The company's quarterly revenue was up 7.3% compared to the same quarter last year. As a group, analysts predict that SS&C Technologies Holdings, Inc. will post 4.62 EPS for the current fiscal year.

SS&C Technologies Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be given a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 1.30%. The ex-dividend date is Monday, December 2nd. SS&C Technologies's dividend payout ratio is 35.84%.

Wall Street Analyst Weigh In

Several research firms have commented on SSNC. Raymond James lifted their price target on SS&C Technologies from $79.00 to $85.00 and gave the company a "strong-buy" rating in a report on Friday, October 25th. DA Davidson reiterated a "buy" rating and set a $92.00 target price on shares of SS&C Technologies in a report on Thursday, October 10th. Needham & Company LLC restated a "buy" rating and issued a $90.00 price target on shares of SS&C Technologies in a report on Friday, October 25th. Royal Bank of Canada lifted their price objective on shares of SS&C Technologies from $75.00 to $86.00 and gave the company an "outperform" rating in a research note on Thursday, September 19th. Finally, StockNews.com cut shares of SS&C Technologies from a "strong-buy" rating to a "buy" rating in a research report on Friday, November 15th. Two investment analysts have rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $77.75.

Check Out Our Latest Report on SS&C Technologies

Insiders Place Their Bets

In other SS&C Technologies news, Director Normand A. Boulanger sold 130,000 shares of the stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $75.38, for a total value of $9,799,400.00. Following the transaction, the director now owns 333,576 shares of the company's stock, valued at approximately $25,144,958.88. This represents a 28.04 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, SVP Jason Douglas White sold 69,000 shares of SS&C Technologies stock in a transaction dated Tuesday, November 26th. The stock was sold at an average price of $77.07, for a total value of $5,317,830.00. Following the transaction, the senior vice president now owns 6,412 shares in the company, valued at approximately $494,172.84. This represents a 91.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 218,000 shares of company stock valued at $16,560,660 over the last three months. 15.40% of the stock is currently owned by insiders.

SS&C Technologies Profile

(

Free Report)

SS&C Technologies Holdings, Inc, together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions comprising portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions consisting of claims adjudication, benefit management, care management, and business intelligence solutions.

Read More

Before you consider SS&C Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SS&C Technologies wasn't on the list.

While SS&C Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report