UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lowered its stake in shares of CRISPR Therapeutics AG (NASDAQ:CRSP - Free Report) by 2.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 676,326 shares of the company's stock after selling 17,632 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned approximately 0.79% of CRISPR Therapeutics worth $31,774,000 as of its most recent filing with the Securities and Exchange Commission.

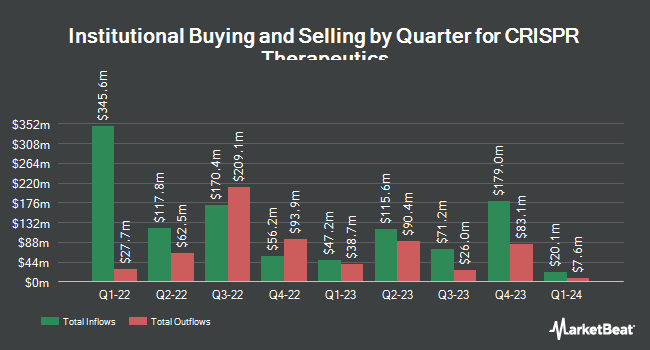

A number of other institutional investors and hedge funds also recently made changes to their positions in the stock. FMR LLC raised its stake in CRISPR Therapeutics by 1.0% during the 3rd quarter. FMR LLC now owns 2,376,166 shares of the company's stock worth $111,632,000 after buying an additional 23,075 shares during the period. Dimensional Fund Advisors LP raised its holdings in shares of CRISPR Therapeutics by 2.1% in the 2nd quarter. Dimensional Fund Advisors LP now owns 950,149 shares of the company's stock worth $51,326,000 after acquiring an additional 19,094 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in shares of CRISPR Therapeutics by 0.9% in the third quarter. Charles Schwab Investment Management Inc. now owns 724,241 shares of the company's stock valued at $34,025,000 after purchasing an additional 6,635 shares in the last quarter. Farallon Capital Management LLC bought a new position in CRISPR Therapeutics during the 2nd quarter valued at $28,625,000. Finally, Baillie Gifford & Co. boosted its holdings in CRISPR Therapeutics by 2.4% during the second quarter. Baillie Gifford & Co. now owns 405,425 shares of the company's stock worth $21,897,000 after purchasing an additional 9,510 shares during the last quarter. Institutional investors own 69.20% of the company's stock.

Insiders Place Their Bets

In related news, General Counsel James R. Kasinger sold 1,089 shares of the business's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $46.28, for a total value of $50,398.92. Following the completion of the sale, the general counsel now owns 62,597 shares in the company, valued at $2,896,989.16. The trade was a 1.71 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Samarth Kulkarni sold 15,000 shares of the stock in a transaction that occurred on Monday, December 2nd. The shares were sold at an average price of $55.10, for a total transaction of $826,500.00. Following the transaction, the chief executive officer now owns 181,540 shares in the company, valued at $10,002,854. The trade was a 7.63 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 50,382 shares of company stock valued at $2,744,179 in the last quarter. Corporate insiders own 4.10% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on the company. Cantor Fitzgerald restated a "neutral" rating on shares of CRISPR Therapeutics in a research note on Thursday, August 8th. Needham & Company LLC reaffirmed a "buy" rating and issued a $84.00 price objective on shares of CRISPR Therapeutics in a research report on Wednesday, November 6th. Royal Bank of Canada restated a "sector perform" rating and set a $53.00 price target on shares of CRISPR Therapeutics in a research note on Wednesday, November 6th. Truist Financial dropped their price objective on CRISPR Therapeutics from $120.00 to $100.00 and set a "buy" rating on the stock in a research note on Monday, August 12th. Finally, StockNews.com raised CRISPR Therapeutics to a "sell" rating in a research report on Thursday, November 7th. Three research analysts have rated the stock with a sell rating, eight have assigned a hold rating and nine have given a buy rating to the company. According to data from MarketBeat.com, CRISPR Therapeutics currently has a consensus rating of "Hold" and a consensus price target of $74.94.

Get Our Latest Analysis on CRISPR Therapeutics

CRISPR Therapeutics Price Performance

NASDAQ:CRSP traded down $1.63 during trading hours on Thursday, hitting $49.51. The stock had a trading volume of 1,441,622 shares, compared to its average volume of 1,495,792. The firm has a market capitalization of $4.23 billion, a price-to-earnings ratio of -17.49 and a beta of 1.62. CRISPR Therapeutics AG has a one year low of $43.42 and a one year high of $91.10. The company has a 50 day simple moving average of $48.56 and a two-hundred day simple moving average of $51.53.

CRISPR Therapeutics (NASDAQ:CRSP - Get Free Report) last announced its earnings results on Tuesday, November 5th. The company reported ($1.01) earnings per share for the quarter, topping analysts' consensus estimates of ($1.42) by $0.41. The business had revenue of $0.60 million for the quarter, compared to analyst estimates of $6.65 million. CRISPR Therapeutics had a negative return on equity of 12.15% and a negative net margin of 118.13%. During the same period in the prior year, the company earned ($1.41) EPS. Equities research analysts anticipate that CRISPR Therapeutics AG will post -5.14 earnings per share for the current year.

CRISPR Therapeutics Company Profile

(

Free Report)

CRISPR Therapeutics is a gene-editing company focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR/Cas9 is a revolutionary gene-editing technology that allows for precise, directed changes to genomic DNA. CRISPR Therapeutics has established a portfolio of therapeutic programs across a broad range of disease areas including hemoglobinopathies, oncology, regenerative medicine and rare diseases.

Further Reading

Before you consider CRISPR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRISPR Therapeutics wasn't on the list.

While CRISPR Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.