UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC reduced its position in Hims & Hers Health, Inc. (NYSE:HIMS - Free Report) by 9.9% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 258,661 shares of the company's stock after selling 28,276 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned approximately 0.12% of Hims & Hers Health worth $4,765,000 as of its most recent filing with the SEC.

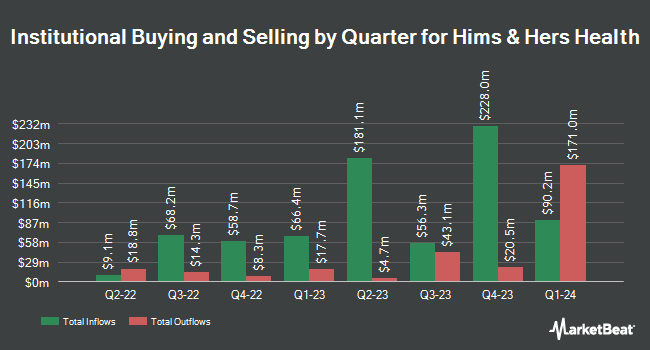

Other hedge funds have also bought and sold shares of the company. Nisa Investment Advisors LLC raised its holdings in shares of Hims & Hers Health by 679.2% in the second quarter. Nisa Investment Advisors LLC now owns 1,839 shares of the company's stock valued at $37,000 after purchasing an additional 1,603 shares during the last quarter. Quest Partners LLC lifted its stake in Hims & Hers Health by 5,944.1% in the second quarter. Quest Partners LLC now owns 3,566 shares of the company's stock valued at $72,000 after purchasing an additional 3,507 shares during the last quarter. Van ECK Associates Corp bought a new stake in shares of Hims & Hers Health in the second quarter valued at $111,000. CWM LLC lifted its position in shares of Hims & Hers Health by 21.4% during the 3rd quarter. CWM LLC now owns 5,982 shares of the company's stock valued at $110,000 after buying an additional 1,054 shares during the last quarter. Finally, Amalgamated Bank grew its stake in shares of Hims & Hers Health by 55.9% during the 2nd quarter. Amalgamated Bank now owns 6,566 shares of the company's stock worth $133,000 after acquiring an additional 2,354 shares during the period. Institutional investors own 63.52% of the company's stock.

Insider Buying and Selling at Hims & Hers Health

In other news, insider Michael Chi sold 2,054 shares of the stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $33.56, for a total value of $68,932.24. Following the transaction, the insider now directly owns 184,947 shares of the company's stock, valued at approximately $6,206,821.32. This represents a 1.10 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Andrew Dudum sold 33,513 shares of Hims & Hers Health stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $33.38, for a total value of $1,118,663.94. Following the transaction, the chief executive officer now owns 33,502 shares of the company's stock, valued at $1,118,296.76. The trade was a 50.01 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 1,067,315 shares of company stock valued at $25,435,489. Company insiders own 17.71% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on HIMS. Deutsche Bank Aktiengesellschaft upped their price target on shares of Hims & Hers Health from $23.00 to $27.00 and gave the company a "hold" rating in a research note on Wednesday, November 6th. Needham & Company LLC initiated coverage on Hims & Hers Health in a research note on Thursday, August 22nd. They issued a "buy" rating and a $24.00 target price on the stock. Piper Sandler reiterated a "neutral" rating and set a $21.00 price target (up previously from $18.00) on shares of Hims & Hers Health in a research report on Tuesday, November 5th. Canaccord Genuity Group raised their target price on shares of Hims & Hers Health from $28.00 to $38.00 and gave the company a "buy" rating in a research note on Monday, December 2nd. Finally, Bank of America lowered shares of Hims & Hers Health from a "buy" rating to an "underperform" rating and dropped their target price for the company from $32.00 to $18.00 in a research report on Thursday, November 14th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating and seven have given a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $21.43.

Read Our Latest Stock Analysis on HIMS

Hims & Hers Health Stock Performance

Shares of HIMS traded down $0.09 during mid-day trading on Thursday, hitting $30.10. 8,470,645 shares of the stock were exchanged, compared to its average volume of 9,937,356. Hims & Hers Health, Inc. has a 52-week low of $8.09 and a 52-week high of $35.02. The company has a market cap of $6.58 billion, a PE ratio of 69.91 and a beta of 1.25. The firm has a 50-day moving average of $24.28 and a two-hundred day moving average of $20.80.

Hims & Hers Health (NYSE:HIMS - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The company reported $0.32 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.06 by $0.26. Hims & Hers Health had a return on equity of 10.97% and a net margin of 8.19%. The business had revenue of $401.56 million for the quarter, compared to the consensus estimate of $382.20 million. During the same period in the prior year, the business posted ($0.04) earnings per share. The company's quarterly revenue was up 77.1% compared to the same quarter last year. On average, sell-side analysts predict that Hims & Hers Health, Inc. will post 0.29 EPS for the current year.

Hims & Hers Health Company Profile

(

Free Report)

Hims & Hers Health, Inc operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally. The company offers a range of curated prescription and non-prescription health and wellness products and services available to purchase on its websites and mobile application directly by customers.

Recommended Stories

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.