UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC trimmed its holdings in Qualys, Inc. (NASDAQ:QLYS - Free Report) by 3.4% in the third quarter, according to the company in its most recent filing with the SEC. The fund owned 387,507 shares of the software maker's stock after selling 13,545 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned 1.06% of Qualys worth $49,779,000 at the end of the most recent quarter.

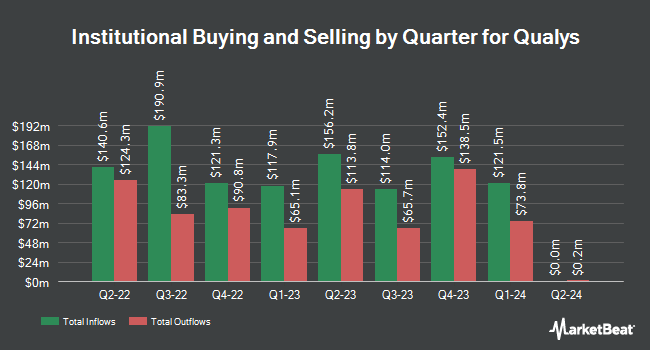

A number of other institutional investors also recently made changes to their positions in QLYS. Tidal Investments LLC lifted its position in Qualys by 192.8% in the first quarter. Tidal Investments LLC now owns 3,402 shares of the software maker's stock valued at $568,000 after purchasing an additional 2,240 shares during the last quarter. Comerica Bank boosted its position in Qualys by 3.3% during the 1st quarter. Comerica Bank now owns 21,380 shares of the software maker's stock valued at $3,568,000 after buying an additional 688 shares during the period. Cetera Advisors LLC purchased a new stake in Qualys during the 1st quarter valued at $209,000. DekaBank Deutsche Girozentrale grew its holdings in Qualys by 36.6% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 20,576 shares of the software maker's stock worth $3,374,000 after acquiring an additional 5,508 shares during the last quarter. Finally, Park Avenue Securities LLC increased its position in shares of Qualys by 165.1% in the second quarter. Park Avenue Securities LLC now owns 6,371 shares of the software maker's stock valued at $908,000 after acquiring an additional 3,968 shares during the period. Hedge funds and other institutional investors own 99.31% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on QLYS shares. Truist Financial increased their target price on shares of Qualys from $120.00 to $145.00 and gave the stock a "hold" rating in a report on Wednesday, November 6th. DA Davidson lifted their price objective on Qualys from $120.00 to $147.00 and gave the stock a "neutral" rating in a research report on Wednesday, November 6th. Jefferies Financial Group upped their target price on Qualys from $135.00 to $155.00 and gave the company a "hold" rating in a report on Wednesday, November 6th. Royal Bank of Canada lifted their price target on shares of Qualys from $150.00 to $162.00 and gave the company a "sector perform" rating in a report on Wednesday, November 6th. Finally, Scotiabank decreased their price objective on shares of Qualys from $167.00 to $150.00 and set a "sector perform" rating for the company in a report on Wednesday, August 7th. Three equities research analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and two have given a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $152.80.

Get Our Latest Analysis on Qualys

Insider Transactions at Qualys

In other news, CFO Joo Mi Kim sold 634 shares of the company's stock in a transaction on Monday, October 7th. The stock was sold at an average price of $122.19, for a total transaction of $77,468.46. Following the transaction, the chief financial officer now directly owns 85,942 shares of the company's stock, valued at $10,501,252.98. This represents a 0.73 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider Bruce K. Posey sold 1,330 shares of the stock in a transaction on Friday, September 20th. The shares were sold at an average price of $123.80, for a total value of $164,654.00. Following the sale, the insider now directly owns 55,618 shares in the company, valued at $6,885,508.40. This trade represents a 2.34 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 30,474 shares of company stock worth $4,315,774. Corporate insiders own 1.00% of the company's stock.

Qualys Trading Up 0.7 %

NASDAQ:QLYS traded up $1.16 during trading hours on Wednesday, reaching $158.77. 129,881 shares of the company traded hands, compared to its average volume of 439,545. The business's 50-day moving average price is $135.57 and its two-hundred day moving average price is $135.00. Qualys, Inc. has a 1 year low of $119.17 and a 1 year high of $206.35. The stock has a market capitalization of $5.81 billion, a P/E ratio of 34.72 and a beta of 0.54.

Qualys (NASDAQ:QLYS - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The software maker reported $1.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.33 by $0.23. Qualys had a return on equity of 40.24% and a net margin of 28.72%. The firm had revenue of $153.87 million during the quarter, compared to analyst estimates of $150.74 million. During the same quarter in the previous year, the firm earned $1.24 EPS. Qualys's quarterly revenue was up 8.4% compared to the same quarter last year. As a group, equities analysts anticipate that Qualys, Inc. will post 4.34 EPS for the current year.

Qualys Profile

(

Free Report)

Qualys, Inc, together with its subsidiaries, provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally. It offers Qualys Cloud Apps, which include Cybersecurity Asset Management and External Attack Surface Management; Vulnerability Management, Detection and Response; Web Application Scanning; Patch Management; Custom Assessment and Remediation; Multi-Vector Endpoint Detection and Response; Context Extended Detection and Response; Policy Compliance; File Integrity Monitoring; and Qualys TotalCloud, as well as Cloud Workload Protection, Cloud Detection and Response, Cloud Security Posture Management, Infrastructure as Code, and Container Security.

See Also

Before you consider Qualys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qualys wasn't on the list.

While Qualys currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.