Dollar Tree (NASDAQ:DLTR - Get Free Report) had its price target reduced by equities researchers at UBS Group from $105.00 to $95.00 in a research note issued on Friday,Benzinga reports. The firm presently has a "buy" rating on the stock. UBS Group's price target points to a potential upside of 41.50% from the stock's current price.

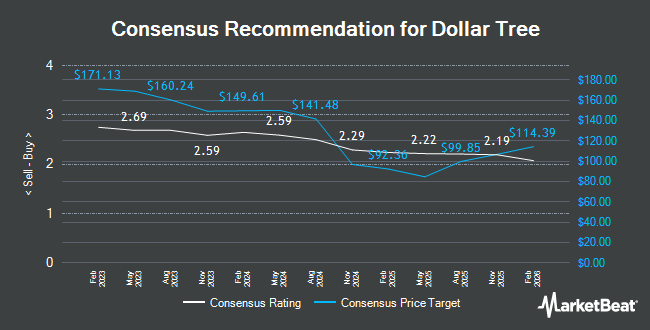

Several other equities analysts have also recently weighed in on DLTR. Jefferies Financial Group raised their price objective on Dollar Tree from $70.00 to $75.00 and gave the company a "hold" rating in a report on Wednesday, December 4th. Citigroup raised their target price on shares of Dollar Tree from $64.00 to $76.00 and gave the company a "neutral" rating in a research note on Thursday, December 5th. Guggenheim dropped their price target on shares of Dollar Tree from $120.00 to $100.00 and set a "buy" rating on the stock in a research report on Friday, December 6th. Wells Fargo & Company decreased their price objective on shares of Dollar Tree from $100.00 to $85.00 and set an "overweight" rating for the company in a research report on Friday, March 7th. Finally, Piper Sandler reaffirmed a "neutral" rating and issued a $72.00 target price (up from $67.00) on shares of Dollar Tree in a report on Thursday, December 5th. Sixteen equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $83.89.

Read Our Latest Stock Report on Dollar Tree

Dollar Tree Stock Down 3.7 %

NASDAQ DLTR traded down $2.60 during trading on Friday, hitting $67.14. The stock had a trading volume of 5,238,644 shares, compared to its average volume of 3,389,977. Dollar Tree has a 12 month low of $60.49 and a 12 month high of $137.14. The company has a debt-to-equity ratio of 0.32, a quick ratio of 0.17 and a current ratio of 1.03. The company's 50-day moving average price is $71.06 and its two-hundred day moving average price is $70.13. The company has a market capitalization of $14.43 billion, a PE ratio of -14.08, a P/E/G ratio of 2.16 and a beta of 0.91.

Institutional Investors Weigh In On Dollar Tree

Hedge funds and other institutional investors have recently made changes to their positions in the business. Vanguard Group Inc. raised its holdings in Dollar Tree by 0.7% in the 4th quarter. Vanguard Group Inc. now owns 23,450,228 shares of the company's stock valued at $1,757,360,000 after acquiring an additional 163,368 shares in the last quarter. T. Rowe Price Investment Management Inc. boosted its position in shares of Dollar Tree by 5.7% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 9,920,748 shares of the company's stock worth $743,461,000 after acquiring an additional 533,920 shares in the last quarter. State Street Corp increased its stake in Dollar Tree by 6.8% in the third quarter. State Street Corp now owns 9,427,910 shares of the company's stock valued at $662,971,000 after acquiring an additional 596,191 shares during the last quarter. Capital International Investors raised its position in Dollar Tree by 30.1% during the fourth quarter. Capital International Investors now owns 8,753,693 shares of the company's stock valued at $656,000,000 after purchasing an additional 2,023,819 shares in the last quarter. Finally, EdgePoint Investment Group Inc. lifted its stake in Dollar Tree by 14.4% during the fourth quarter. EdgePoint Investment Group Inc. now owns 7,940,163 shares of the company's stock worth $595,036,000 after purchasing an additional 1,000,637 shares during the last quarter. 97.40% of the stock is currently owned by institutional investors and hedge funds.

Dollar Tree Company Profile

(

Get Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Read More

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.