OPAL Fuels (NASDAQ:OPAL - Free Report) had its target price reduced by UBS Group from $7.00 to $3.50 in a report released on Monday morning,Benzinga reports. They currently have a buy rating on the stock.

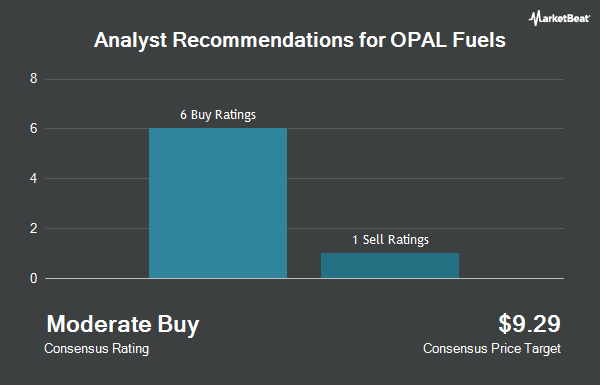

Separately, The Goldman Sachs Group reduced their target price on OPAL Fuels from $3.90 to $3.40 and set a "sell" rating on the stock in a report on Thursday, January 23rd. One research analyst has rated the stock with a sell rating, one has assigned a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $5.70.

Check Out Our Latest Stock Report on OPAL Fuels

OPAL Fuels Stock Performance

Shares of NASDAQ OPAL traded down $0.07 during mid-day trading on Monday, reaching $1.90. The company had a trading volume of 146,086 shares, compared to its average volume of 101,709. The firm has a market cap of $328.38 million, a price-to-earnings ratio of 10.56 and a beta of 0.56. The business's 50-day simple moving average is $2.80 and its 200 day simple moving average is $3.32. OPAL Fuels has a one year low of $1.88 and a one year high of $5.18.

OPAL Fuels (NASDAQ:OPAL - Get Free Report) last released its earnings results on Thursday, March 13th. The company reported ($0.05) EPS for the quarter, missing the consensus estimate of $0.44 by ($0.49). OPAL Fuels had a net margin of 3.30% and a negative return on equity of 4.08%. The firm had revenue of $80.02 million during the quarter, compared to the consensus estimate of $90.94 million. On average, sell-side analysts anticipate that OPAL Fuels will post 0.8 EPS for the current year.

Institutional Trading of OPAL Fuels

Hedge funds have recently added to or reduced their stakes in the stock. Janus Henderson Group PLC lifted its stake in shares of OPAL Fuels by 83.5% in the 3rd quarter. Janus Henderson Group PLC now owns 21,727 shares of the company's stock valued at $79,000 after acquiring an additional 9,885 shares during the last quarter. Squarepoint Ops LLC increased its holdings in OPAL Fuels by 20.2% in the 4th quarter. Squarepoint Ops LLC now owns 31,983 shares of the company's stock worth $108,000 after purchasing an additional 5,377 shares in the last quarter. Levin Capital Strategies L.P. raised its position in OPAL Fuels by 250.0% in the fourth quarter. Levin Capital Strategies L.P. now owns 35,000 shares of the company's stock valued at $119,000 after purchasing an additional 25,000 shares during the last quarter. Jane Street Group LLC acquired a new stake in shares of OPAL Fuels during the fourth quarter valued at about $238,000. Finally, GSA Capital Partners LLP grew its holdings in shares of OPAL Fuels by 69.3% during the third quarter. GSA Capital Partners LLP now owns 96,056 shares of the company's stock worth $351,000 after purchasing an additional 39,325 shares during the last quarter. Institutional investors and hedge funds own 12.16% of the company's stock.

OPAL Fuels Company Profile

(

Get Free Report)

OPAL Fuels Inc, together with its subsidiaries, engages in the production and distribution of renewable natural gas for use as a vehicle fuel for heavy and medium-duty trucking fleets. It also designs, develops, constructs, operates, and services fueling stations for trucking fleets that use natural gas to displace diesel as transportation fuel.

Further Reading

Before you consider OPAL Fuels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OPAL Fuels wasn't on the list.

While OPAL Fuels currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.