Amer Sports (NYSE:AS - Get Free Report) had its price target raised by research analysts at UBS Group from $19.00 to $24.00 in a report released on Tuesday, Benzinga reports. The brokerage presently has a "buy" rating on the stock. UBS Group's price target indicates a potential upside of 28.24% from the stock's current price.

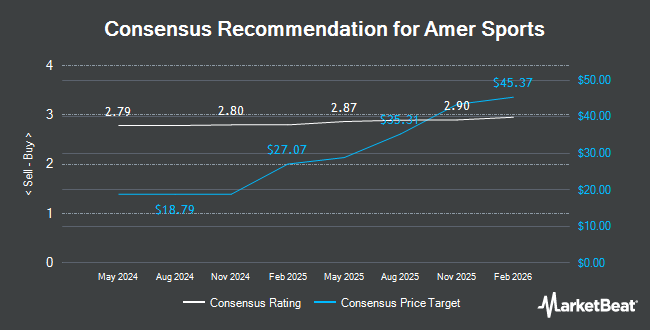

AS has been the subject of several other research reports. Nomura Securities raised shares of Amer Sports to a "strong-buy" rating in a research note on Tuesday, September 24th. TD Cowen boosted their price target on Amer Sports from $17.00 to $21.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Wells Fargo & Company lowered Amer Sports from an "overweight" rating to an "equal weight" rating and increased their price objective for the company from $17.00 to $19.00 in a report on Monday, October 14th. Evercore ISI restated an "outperform" rating and issued a $21.00 target price on shares of Amer Sports in a report on Wednesday, August 21st. Finally, The Goldman Sachs Group upped their target price on Amer Sports from $19.00 to $21.00 and gave the stock a "buy" rating in a research report on Monday, October 21st. Four research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $19.21.

View Our Latest Stock Report on Amer Sports

Amer Sports Price Performance

AS stock remained flat at $18.72 during midday trading on Tuesday. 1,318,214 shares of the company's stock were exchanged, compared to its average volume of 1,666,353. The company's 50-day moving average price is $16.42 and its 200 day moving average price is $14.44. Amer Sports has a 12 month low of $10.11 and a 12 month high of $19.73. The company has a quick ratio of 0.81, a current ratio of 1.87 and a debt-to-equity ratio of 0.58.

Amer Sports (NYSE:AS - Get Free Report) last posted its quarterly earnings results on Tuesday, August 20th. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of ($0.06) by $0.11. The business had revenue of $993.80 million for the quarter, compared to the consensus estimate of $947.59 million. Amer Sports had a negative net margin of 2.79% and a negative return on equity of 0.63%. The firm's revenue for the quarter was up 16.0% compared to the same quarter last year. On average, equities analysts anticipate that Amer Sports will post 0.44 earnings per share for the current fiscal year.

Institutional Trading of Amer Sports

Several institutional investors have recently modified their holdings of the company. Sei Investments Co. bought a new position in shares of Amer Sports during the 1st quarter worth about $968,000. Value Star Asset Management Hong Kong Ltd acquired a new stake in Amer Sports during the first quarter valued at approximately $2,061,000. Tocqueville Asset Management L.P. bought a new stake in shares of Amer Sports in the 1st quarter valued at approximately $813,000. Healthcare of Ontario Pension Plan Trust Fund bought a new stake in shares of Amer Sports in the 1st quarter valued at approximately $5,705,000. Finally, Quadrature Capital Ltd bought a new position in shares of Amer Sports during the 1st quarter worth approximately $390,000. Institutional investors and hedge funds own 40.25% of the company's stock.

Amer Sports Company Profile

(

Get Free Report)

Amer Sports, Inc designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific. It operates through three segments: Technical Apparel, Outdoor Performance, and Ball & Racquet Sports.

Featured Articles

Before you consider Amer Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amer Sports wasn't on the list.

While Amer Sports currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.