Jabil (NYSE:JBL - Free Report) had its target price upped by UBS Group from $128.00 to $152.00 in a research report report published on Thursday morning,Benzinga reports. The firm currently has a neutral rating on the technology company's stock.

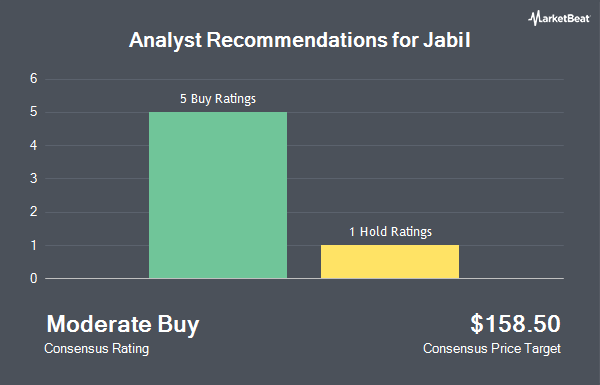

JBL has been the topic of several other reports. Stifel Nicolaus lifted their target price on Jabil from $140.00 to $150.00 and gave the stock a "buy" rating in a report on Wednesday, December 4th. StockNews.com upgraded Jabil from a "buy" rating to a "strong-buy" rating in a report on Wednesday, November 27th. Bank of America upped their price objective on shares of Jabil from $135.00 to $150.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Barclays increased their target price on shares of Jabil from $135.00 to $157.00 and gave the company an "overweight" rating in a research report on Friday, September 27th. Finally, JPMorgan Chase & Co. reduced their price target on Jabil from $137.00 to $133.00 and set an "overweight" rating for the company in a research report on Tuesday, September 3rd. Two analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Jabil presently has a consensus rating of "Moderate Buy" and a consensus price target of $149.50.

View Our Latest Research Report on Jabil

Jabil Price Performance

Shares of NYSE:JBL traded down $3.25 during trading on Thursday, reaching $140.44. The company had a trading volume of 2,413,553 shares, compared to its average volume of 1,433,563. The firm's fifty day moving average is $130.72 and its 200 day moving average is $118.12. Jabil has a twelve month low of $95.85 and a twelve month high of $156.94. The company has a debt-to-equity ratio of 1.66, a quick ratio of 0.72 and a current ratio of 1.09. The firm has a market capitalization of $15.69 billion, a PE ratio of 12.74, a price-to-earnings-growth ratio of 1.57 and a beta of 1.25.

Jabil (NYSE:JBL - Get Free Report) last posted its quarterly earnings data on Wednesday, December 18th. The technology company reported $2.00 EPS for the quarter, beating the consensus estimate of $1.88 by $0.12. The business had revenue of $6.99 billion for the quarter, compared to analysts' expectations of $6.61 billion. Jabil had a net margin of 4.81% and a return on equity of 42.64%. The firm's revenue was down 16.6% compared to the same quarter last year. During the same period in the previous year, the firm posted $2.60 EPS. On average, equities analysts forecast that Jabil will post 7.89 EPS for the current year.

Jabil Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, December 3rd. Shareholders of record on Friday, November 15th were paid a dividend of $0.08 per share. The ex-dividend date was Friday, November 15th. This represents a $0.32 annualized dividend and a yield of 0.23%. Jabil's payout ratio is currently 2.90%.

Insider Buying and Selling at Jabil

In other Jabil news, Director Steven A. Raymund sold 20,000 shares of the firm's stock in a transaction on Thursday, October 24th. The stock was sold at an average price of $124.70, for a total value of $2,494,000.00. Following the sale, the director now directly owns 139,108 shares in the company, valued at approximately $17,346,767.60. This trade represents a 12.57 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, EVP Frederic E. Mccoy sold 4,000 shares of Jabil stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $118.70, for a total value of $474,800.00. Following the transaction, the executive vice president now directly owns 108,753 shares in the company, valued at approximately $12,908,981.10. This trade represents a 3.55 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 43,689 shares of company stock worth $5,377,431 over the last three months. Corporate insiders own 1.73% of the company's stock.

Institutional Investors Weigh In On Jabil

Hedge funds have recently bought and sold shares of the company. Pacer Advisors Inc. boosted its holdings in shares of Jabil by 12,251.7% in the 3rd quarter. Pacer Advisors Inc. now owns 2,206,384 shares of the technology company's stock valued at $264,391,000 after purchasing an additional 2,188,521 shares in the last quarter. Point72 Asset Management L.P. purchased a new stake in shares of Jabil in the second quarter worth approximately $78,660,000. AQR Capital Management LLC increased its stake in Jabil by 195.8% in the 2nd quarter. AQR Capital Management LLC now owns 1,060,799 shares of the technology company's stock valued at $115,404,000 after buying an additional 702,199 shares during the last quarter. Two Sigma Advisers LP grew its stake in Jabil by 406.5% in the 3rd quarter. Two Sigma Advisers LP now owns 722,800 shares of the technology company's stock valued at $86,613,000 after buying an additional 580,100 shares in the last quarter. Finally, FMR LLC lifted its holdings in shares of Jabil by 11.3% during the 3rd quarter. FMR LLC now owns 5,116,308 shares of the technology company's stock worth $613,087,000 after acquiring an additional 520,672 shares during the last quarter. 93.39% of the stock is currently owned by institutional investors and hedge funds.

Jabil Company Profile

(

Get Free Report)

Jabil Inc provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services. The company offers electronics design, production, and product management services; electronic circuit design services, such as application-specific integrated circuit design, firmware development, and rapid prototyping services; and designs plastic and metal enclosures that include the electro-mechanics, such as the printed circuit board assemblies (PCBA).

Read More

Before you consider Jabil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jabil wasn't on the list.

While Jabil currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.