US Foods (NYSE:USFD - Free Report) had its target price upped by UBS Group from $67.00 to $77.00 in a research report sent to investors on Friday,Benzinga reports. The brokerage currently has a buy rating on the stock.

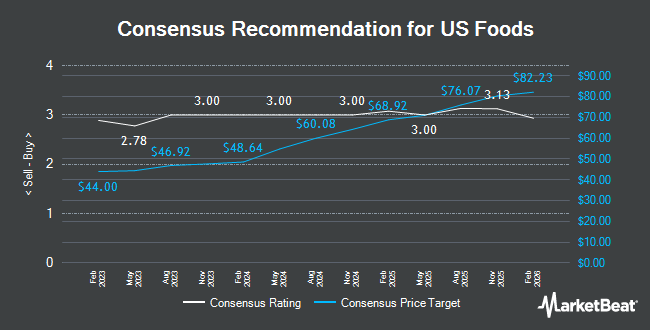

USFD has been the topic of several other reports. Wells Fargo & Company increased their target price on US Foods from $66.00 to $75.00 and gave the stock an "overweight" rating in a research report on Wednesday, September 18th. JPMorgan Chase & Co. raised their target price on shares of US Foods from $68.00 to $69.00 and gave the stock a "neutral" rating in a research report on Friday. StockNews.com raised shares of US Foods from a "buy" rating to a "strong-buy" rating in a research report on Thursday, October 10th. Jefferies Financial Group increased their price target on shares of US Foods from $66.00 to $71.00 and gave the stock a "buy" rating in a research note on Wednesday, September 25th. Finally, Truist Financial boosted their price objective on shares of US Foods from $66.00 to $74.00 and gave the company a "buy" rating in a research note on Friday. One equities research analyst has rated the stock with a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, US Foods currently has an average rating of "Buy" and an average price target of $69.82.

Get Our Latest Stock Analysis on US Foods

US Foods Price Performance

Shares of USFD traded up $0.33 during trading hours on Friday, reaching $66.89. 2,016,807 shares of the company traded hands, compared to its average volume of 1,808,182. The stock has a market capitalization of $16.36 billion, a PE ratio of 31.85, a price-to-earnings-growth ratio of 1.08 and a beta of 1.66. The stock has a fifty day simple moving average of $61.23 and a 200 day simple moving average of $56.21. US Foods has a fifty-two week low of $40.23 and a fifty-two week high of $67.79. The company has a quick ratio of 0.81, a current ratio of 1.29 and a debt-to-equity ratio of 0.92.

US Foods (NYSE:USFD - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported $0.93 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.93. The company had revenue of $9.71 billion for the quarter, compared to analysts' expectations of $9.62 billion. US Foods had a net margin of 1.42% and a return on equity of 13.43%. The firm's revenue for the quarter was up 7.7% compared to the same quarter last year. During the same period last year, the company earned $0.73 EPS. As a group, research analysts predict that US Foods will post 2.9 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, CFO Dirk J. Locascio sold 10,000 shares of the firm's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $57.95, for a total transaction of $579,500.00. Following the sale, the chief financial officer now directly owns 88,563 shares in the company, valued at approximately $5,132,225.85. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. 0.70% of the stock is currently owned by insiders.

Institutional Investors Weigh In On US Foods

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Lord Abbett & CO. LLC acquired a new position in shares of US Foods in the 1st quarter valued at approximately $22,937,000. Janus Henderson Group PLC raised its holdings in US Foods by 46.3% in the first quarter. Janus Henderson Group PLC now owns 162,338 shares of the company's stock valued at $8,759,000 after acquiring an additional 51,402 shares in the last quarter. Entropy Technologies LP bought a new position in US Foods during the 1st quarter valued at $232,000. Vanguard Group Inc. grew its holdings in US Foods by 3.6% during the 1st quarter. Vanguard Group Inc. now owns 23,019,003 shares of the company's stock worth $1,242,336,000 after acquiring an additional 796,434 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its position in shares of US Foods by 6.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 162,128 shares of the company's stock worth $8,751,000 after purchasing an additional 9,652 shares during the last quarter. Hedge funds and other institutional investors own 98.76% of the company's stock.

About US Foods

(

Get Free Report)

US Foods Holding Corp., together with its subsidiaries, engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States. The company's customers include independently owned single and multi-unit restaurants, regional concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail locations.

Read More

Before you consider US Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and US Foods wasn't on the list.

While US Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.