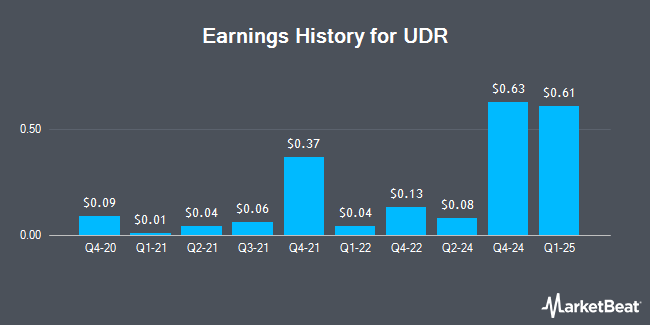

UDR (NYSE:UDR - Get Free Report) is expected to announce its earnings results after the market closes on Wednesday, February 5th. Analysts expect the company to announce earnings of $0.10 per share and revenue of $421.17 million for the quarter. Investors interested in listening to the company's conference call can do so using this link.

UDR Price Performance

NYSE UDR traded up $0.31 during trading hours on Friday, reaching $41.74. 2,865,214 shares of the company's stock were exchanged, compared to its average volume of 1,810,043. The firm has a fifty day moving average of $43.02 and a 200-day moving average of $43.41. The company has a current ratio of 5.91, a quick ratio of 5.91 and a debt-to-equity ratio of 1.69. The stock has a market cap of $13.77 billion, a PE ratio of 112.81, a price-to-earnings-growth ratio of 11.12 and a beta of 0.89. UDR has a one year low of $34.19 and a one year high of $47.55.

UDR Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, January 31st. Investors of record on Thursday, January 9th were given a dividend of $0.425 per share. The ex-dividend date of this dividend was Friday, January 10th. This represents a $1.70 annualized dividend and a yield of 4.07%. UDR's dividend payout ratio (DPR) is 459.47%.

Wall Street Analysts Forecast Growth

UDR has been the subject of a number of research analyst reports. Barclays dropped their target price on shares of UDR from $50.00 to $48.00 and set an "overweight" rating for the company in a research note on Friday, January 24th. Scotiabank reduced their price objective on UDR from $49.00 to $48.00 and set a "sector perform" rating on the stock in a report on Thursday, November 14th. Wells Fargo & Company lowered their target price on UDR from $48.00 to $45.00 and set an "overweight" rating for the company in a research note on Friday, January 24th. StockNews.com lowered UDR from a "hold" rating to a "sell" rating in a research note on Thursday, January 2nd. Finally, Mizuho lowered their price objective on UDR from $47.00 to $45.00 and set a "neutral" rating for the company in a research report on Monday, January 6th. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat, UDR presently has an average rating of "Hold" and an average target price of $46.06.

View Our Latest Stock Analysis on UDR

UDR Company Profile

(

Get Free Report)

UDR, Inc NYSE: UDR, an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

Featured Stories

Before you consider UDR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UDR wasn't on the list.

While UDR currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.