Townsquare Capital LLC boosted its holdings in UFP Technologies, Inc. (NASDAQ:UFPT - Free Report) by 7.6% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 22,554 shares of the industrial products company's stock after acquiring an additional 1,598 shares during the quarter. Townsquare Capital LLC owned about 0.29% of UFP Technologies worth $7,143,000 as of its most recent filing with the SEC.

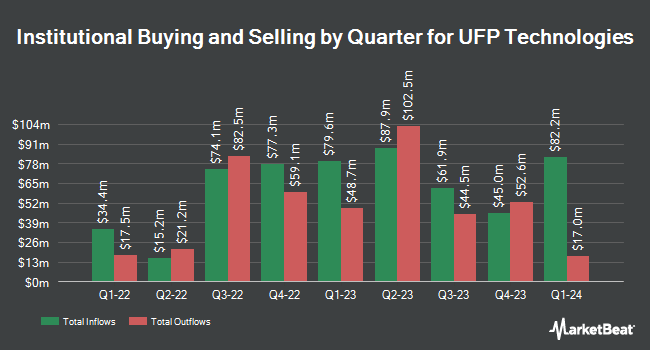

Several other institutional investors and hedge funds also recently added to or reduced their stakes in UFPT. Northwest Investment Counselors LLC acquired a new position in UFP Technologies in the third quarter valued at approximately $32,000. EverSource Wealth Advisors LLC raised its stake in shares of UFP Technologies by 1,614.3% in the first quarter. EverSource Wealth Advisors LLC now owns 120 shares of the industrial products company's stock worth $30,000 after acquiring an additional 113 shares during the last quarter. Advisors Asset Management Inc. acquired a new stake in shares of UFP Technologies during the first quarter worth $35,000. Point72 Asia Singapore Pte. Ltd. acquired a new position in shares of UFP Technologies in the second quarter valued at approximately $36,000. Finally, GAMMA Investing LLC raised its stake in shares of UFP Technologies by 77.9% during the 3rd quarter. GAMMA Investing LLC now owns 137 shares of the industrial products company's stock worth $43,000 after purchasing an additional 60 shares in the last quarter. 87.28% of the stock is currently owned by institutional investors and hedge funds.

UFP Technologies Price Performance

NASDAQ:UFPT traded up $1.00 during trading hours on Friday, reaching $322.92. 47,056 shares of the company were exchanged, compared to its average volume of 61,451. The business has a 50 day moving average of $306.97 and a 200 day moving average of $298.93. The company has a market capitalization of $2.48 billion, a P/E ratio of 46.07 and a beta of 0.96. The company has a debt-to-equity ratio of 0.64, a current ratio of 2.57 and a quick ratio of 1.43. UFP Technologies, Inc. has a 1-year low of $152.43 and a 1-year high of $366.41.

Insider Activity at UFP Technologies

In other news, CEO R Jeffrey Bailly sold 12,533 shares of UFP Technologies stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of $346.46, for a total transaction of $4,342,183.18. Following the completion of the transaction, the chief executive officer now directly owns 31,194 shares in the company, valued at approximately $10,807,473.24. This trade represents a 28.66 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Cynthia L. Feldmann sold 647 shares of the company's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $352.30, for a total value of $227,938.10. Following the completion of the sale, the director now owns 4,049 shares of the company's stock, valued at approximately $1,426,462.70. The trade was a 13.78 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 13,326 shares of company stock worth $4,620,154 in the last quarter. Company insiders own 6.17% of the company's stock.

UFP Technologies Profile

(

Free Report)

UFP Technologies, Inc designs and manufactures solutions for medical devices, sterile packaging, and other highly engineered custom products. The company offers protective drapes for robotic surgery, single patient use surfaces, advanced wound care, infection prevention, disposables for surgical and endoscopic procedures, packaging for medical devices, orthopedic implants, biopharma drug manufacturing, and coils for catheters; and molded components for applications in acoustic insulation, interior trim, load floors, sunshades, SUV cargo cover handles, driveshaft damping, engine and manifold covers, quarter panels, and wheel liners.

See Also

Before you consider UFP Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UFP Technologies wasn't on the list.

While UFP Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.