Intech Investment Management LLC decreased its holdings in shares of UGI Co. (NYSE:UGI - Free Report) by 54.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 17,522 shares of the utilities provider's stock after selling 21,138 shares during the quarter. Intech Investment Management LLC's holdings in UGI were worth $438,000 as of its most recent SEC filing.

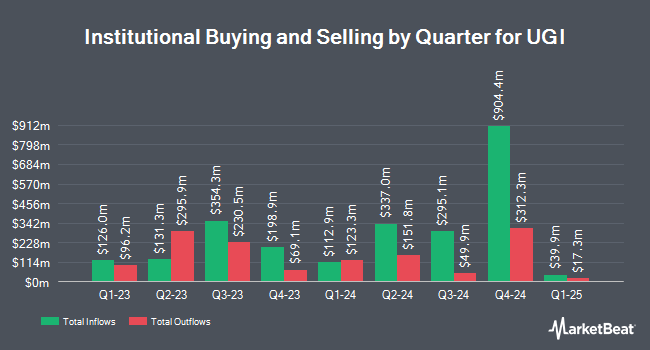

Several other institutional investors and hedge funds also recently bought and sold shares of the company. Federated Hermes Inc. increased its holdings in UGI by 28.7% during the 2nd quarter. Federated Hermes Inc. now owns 3,537,729 shares of the utilities provider's stock worth $81,014,000 after purchasing an additional 788,457 shares during the period. LSV Asset Management raised its position in shares of UGI by 13.3% in the 2nd quarter. LSV Asset Management now owns 3,024,750 shares of the utilities provider's stock valued at $69,267,000 after purchasing an additional 356,200 shares during the last quarter. ProShare Advisors LLC lifted its position in UGI by 84.9% during the 2nd quarter. ProShare Advisors LLC now owns 2,445,010 shares of the utilities provider's stock worth $55,991,000 after acquiring an additional 1,122,766 shares during the period. Jupiter Asset Management Ltd. purchased a new stake in UGI in the second quarter valued at approximately $53,371,000. Finally, Dimensional Fund Advisors LP raised its stake in shares of UGI by 32.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,327,248 shares of the utilities provider's stock valued at $53,293,000 after buying an additional 566,416 shares during the last quarter. 82.34% of the stock is owned by hedge funds and other institutional investors.

UGI Stock Up 1.3 %

UGI stock traded up $0.38 during trading on Tuesday, reaching $29.15. The stock had a trading volume of 2,762,234 shares, compared to its average volume of 2,218,041. The company has a current ratio of 0.80, a quick ratio of 0.60 and a debt-to-equity ratio of 1.48. The firm has a fifty day moving average price of $25.08 and a 200 day moving average price of $24.30. The company has a market capitalization of $6.26 billion, a P/E ratio of 23.44 and a beta of 1.21. UGI Co. has a 1-year low of $21.51 and a 1-year high of $30.48.

UGI Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Monday, December 16th will be issued a dividend of $0.375 per share. This represents a $1.50 annualized dividend and a dividend yield of 5.15%. The ex-dividend date is Monday, December 16th. UGI's dividend payout ratio is 120.97%.

Wall Street Analyst Weigh In

A number of research analysts have recently issued reports on the company. Wells Fargo & Company increased their target price on UGI from $26.00 to $27.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 16th. StockNews.com lowered UGI from a "buy" rating to a "hold" rating in a research note on Tuesday, August 6th. Mizuho raised shares of UGI from a "neutral" rating to an "outperform" rating and raised their price target for the company from $27.00 to $30.00 in a research report on Friday, November 15th. Finally, Jefferies Financial Group began coverage on UGI in a research report on Friday, November 22nd. They set a "buy" rating and a $28.00 target price on the stock. Two investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $28.33.

Check Out Our Latest Stock Report on UGI

UGI Profile

(

Free Report)

UGI Corporation, together with its subsidiaries, distributes, stores, transports, and markets energy products and related services in the United States and internationally. The company operates through four segments: AmeriGas Propane, UGI International, Midstream & Marketing, and UGI Utilities. It distributes propane to approximately 1.3 million residential, commercial/industrial, motor fuel, agricultural, and wholesale customers through 1,400 propane distribution locations.

Featured Articles

Before you consider UGI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UGI wasn't on the list.

While UGI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.