Canada Pension Plan Investment Board raised its holdings in UiPath Inc. (NYSE:PATH - Free Report) by 35.1% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,604,800 shares of the company's stock after buying an additional 417,300 shares during the period. Canada Pension Plan Investment Board owned about 0.29% of UiPath worth $20,397,000 at the end of the most recent quarter.

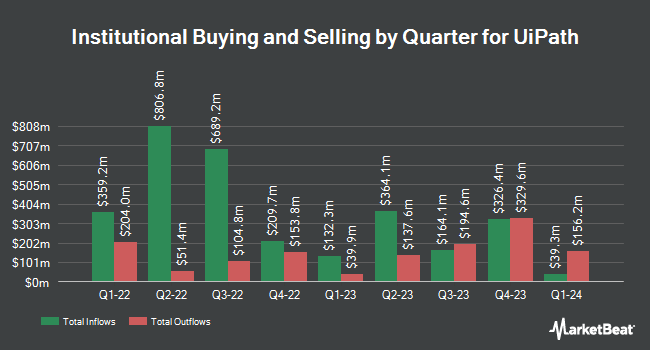

Other hedge funds have also recently bought and sold shares of the company. Marshall Wace LLP boosted its holdings in shares of UiPath by 111.8% during the 4th quarter. Marshall Wace LLP now owns 2,456,102 shares of the company's stock valued at $31,217,000 after acquiring an additional 1,296,382 shares in the last quarter. Brandywine Managers LLC grew its holdings in UiPath by 0.9% during the 4th quarter. Brandywine Managers LLC now owns 1,009,684 shares of the company's stock worth $12,833,000 after acquiring an additional 9,488 shares during the period. NewEdge Advisors LLC boosted its holdings in shares of UiPath by 6.8% during the 4th quarter. NewEdge Advisors LLC now owns 15,809 shares of the company's stock worth $201,000 after buying an additional 1,003 shares in the last quarter. United Capital Financial Advisors LLC grew its holdings in UiPath by 8.6% in the fourth quarter. United Capital Financial Advisors LLC now owns 12,238 shares of the company's stock worth $156,000 after purchasing an additional 971 shares during the period. Finally, Bridgewater Associates LP raised its stake in UiPath by 136.9% during the 4th quarter. Bridgewater Associates LP now owns 1,147,054 shares of the company's stock worth $14,579,000 after buying an additional 662,788 shares during the period. 62.50% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at UiPath

In other news, CAO Hitesh Ramani sold 12,500 shares of the business's stock in a transaction that occurred on Thursday, April 3rd. The shares were sold at an average price of $10.19, for a total value of $127,375.00. Following the sale, the chief accounting officer now directly owns 314,891 shares of the company's stock, valued at approximately $3,208,739.29. The trade was a 3.82 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 22.37% of the company's stock.

Analyst Ratings Changes

Several analysts have recently issued reports on the stock. Royal Bank of Canada reiterated a "sector perform" rating and issued a $13.00 target price on shares of UiPath in a research note on Wednesday, March 26th. Mizuho cut their price objective on shares of UiPath from $12.00 to $11.00 and set a "neutral" rating for the company in a report on Tuesday, April 15th. Canaccord Genuity Group decreased their price target on UiPath from $19.00 to $14.00 and set a "buy" rating on the stock in a research report on Thursday, March 13th. Scotiabank dropped their price objective on UiPath from $15.00 to $12.00 and set a "sector perform" rating for the company in a research note on Thursday, March 13th. Finally, Evercore ISI cut their price target on shares of UiPath from $16.00 to $12.00 and set an "in-line" rating for the company in a research note on Thursday, March 13th. Two analysts have rated the stock with a sell rating, fifteen have issued a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $12.72.

Read Our Latest Report on PATH

UiPath Stock Performance

Shares of PATH stock traded up $0.40 on Wednesday, reaching $10.87. 11,008,700 shares of the company were exchanged, compared to its average volume of 10,546,870. UiPath Inc. has a 1 year low of $9.38 and a 1 year high of $20.95. The company has a market cap of $5.99 billion, a price-to-earnings ratio of -67.91 and a beta of 1.04. The business has a 50-day moving average price of $11.48 and a 200 day moving average price of $12.77.

UiPath Profile

(

Free Report)

UiPath Inc provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally. The company offers a suite of interrelated software to build, manage, run, engage, measure, and govern automation within the organization.

Featured Articles

Before you consider UiPath, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UiPath wasn't on the list.

While UiPath currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.