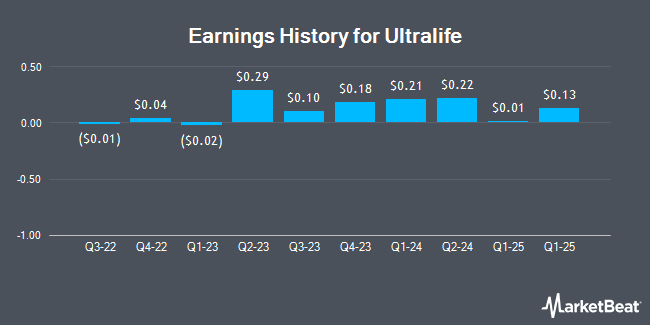

Ultralife (NASDAQ:ULBI - Get Free Report) posted its earnings results on Tuesday. The technology company reported $0.01 EPS for the quarter, missing the consensus estimate of $0.15 by ($0.14), RTT News reports. Ultralife had a net margin of 5.44% and a return on equity of 7.92%. The company had revenue of $43.85 million for the quarter, compared to the consensus estimate of $40.00 million. During the same period last year, the company posted $0.18 earnings per share.

Ultralife Stock Performance

Shares of NASDAQ:ULBI traded up $0.07 during trading on Friday, hitting $4.52. 84,854 shares of the stock were exchanged, compared to its average volume of 75,272. Ultralife has a 1-year low of $4.23 and a 1-year high of $13.39. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.62 and a current ratio of 3.30. The company's fifty day simple moving average is $6.35 and its 200-day simple moving average is $7.57. The company has a market capitalization of $75.15 million, a price-to-earnings ratio of 8.22 and a beta of 1.05.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut Ultralife from a "buy" rating to a "hold" rating in a report on Tuesday, March 18th.

View Our Latest Stock Analysis on ULBI

Hedge Funds Weigh In On Ultralife

A hedge fund recently raised its stake in Ultralife stock. Bank of America Corp DE raised its position in shares of Ultralife Co. (NASDAQ:ULBI - Free Report) by 30.7% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 12,067 shares of the technology company's stock after buying an additional 2,836 shares during the period. Bank of America Corp DE owned about 0.07% of Ultralife worth $90,000 as of its most recent filing with the Securities and Exchange Commission. Hedge funds and other institutional investors own 30.68% of the company's stock.

Ultralife Company Profile

(

Get Free Report)

Ultralife Corporation, together with its subsidiaries, designs, manufactures, installs, and maintains power, and communication and electronics systems worldwide. The company operates in two segments, Battery & Energy Products and Communications Systems. The Battery & Energy Products segment offers lithium 9-volt, cylindrical, thin lithium manganese dioxide, rechargeable, and other non-rechargeable batteries; lithium-ion cells, multi-kilowatt module lithium-ion battery systems, and uninterruptable power supplies; and rugged military and commercial battery charging systems and accessories, including smart chargers, multi-bay charging systems, and various cables.

Featured Stories

Before you consider Ultralife, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ultralife wasn't on the list.

While Ultralife currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.