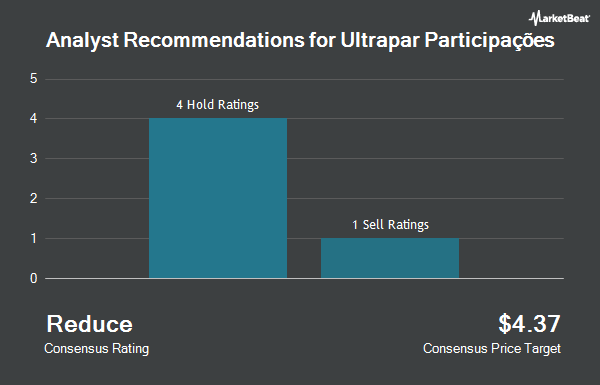

Shares of Ultrapar Participações S.A. (NYSE:UGP - Get Free Report) have received an average recommendation of "Hold" from the five analysts that are covering the firm, Marketbeat reports. Four investment analysts have rated the stock with a hold rating and one has issued a buy rating on the company. The average 1-year target price among brokers that have updated their coverage on the stock in the last year is $5.20.

Separately, StockNews.com lowered shares of Ultrapar Participações from a "buy" rating to a "hold" rating in a report on Wednesday, November 13th.

Read Our Latest Analysis on Ultrapar Participações

Ultrapar Participações Trading Down 3.9 %

Shares of NYSE:UGP traded down $0.11 during midday trading on Monday, reaching $2.70. The company's stock had a trading volume of 1,109,813 shares, compared to its average volume of 1,511,234. Ultrapar Participações has a fifty-two week low of $2.69 and a fifty-two week high of $6.34. The company has a debt-to-equity ratio of 0.76, a quick ratio of 1.11 and a current ratio of 1.57. The firm has a 50 day moving average price of $3.39 and a two-hundred day moving average price of $3.85. The firm has a market capitalization of $3.01 billion, a price-to-earnings ratio of 5.87, a PEG ratio of 2.21 and a beta of 1.53.

Hedge Funds Weigh In On Ultrapar Participações

Several institutional investors have recently bought and sold shares of UGP. Sequoia Financial Advisors LLC bought a new position in Ultrapar Participações in the 3rd quarter valued at $46,000. Freedom Investment Management Inc. purchased a new position in Ultrapar Participações during the third quarter worth about $48,000. Cutter & CO Brokerage Inc. bought a new position in Ultrapar Participações in the 2nd quarter worth about $57,000. D Orazio & Associates Inc. raised its holdings in shares of Ultrapar Participações by 30.3% in the 2nd quarter. D Orazio & Associates Inc. now owns 15,046 shares of the oil and gas company's stock valued at $59,000 after acquiring an additional 3,498 shares in the last quarter. Finally, Blue Trust Inc. boosted its position in shares of Ultrapar Participações by 567.5% during the 2nd quarter. Blue Trust Inc. now owns 15,833 shares of the oil and gas company's stock valued at $62,000 after acquiring an additional 13,461 shares during the last quarter. Hedge funds and other institutional investors own 3.58% of the company's stock.

Ultrapar Participações Company Profile

(

Get Free ReportUltrapar Participações SA, through its subsidiaries, operates in the energy and infrastructure business in Brazil. The company distributes liquefied petroleum gas to residential, commercial, and industrial consumers, in addition to renewable electricity and compressed natural gas. It also operates in the distribution and marketing of gasoline, ethanol, diesel, fuel oil, kerosene, natural gas for vehicles, and lubricants; and holds AmPm convenience stores and provides JetOil lubricant services.

See Also

Before you consider Ultrapar Participações, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ultrapar Participações wasn't on the list.

While Ultrapar Participações currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.