UMB Bank n.a. reduced its stake in Texas Instruments Incorporated (NASDAQ:TXN - Free Report) by 1.0% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 167,361 shares of the semiconductor company's stock after selling 1,768 shares during the period. UMB Bank n.a.'s holdings in Texas Instruments were worth $31,382,000 as of its most recent filing with the Securities and Exchange Commission.

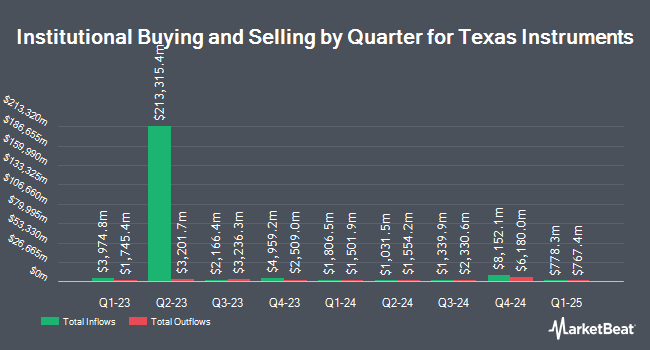

A number of other large investors have also added to or reduced their stakes in TXN. Intech Investment Management LLC boosted its position in shares of Texas Instruments by 5.9% during the 2nd quarter. Intech Investment Management LLC now owns 23,106 shares of the semiconductor company's stock worth $4,495,000 after acquiring an additional 1,289 shares in the last quarter. AE Wealth Management LLC increased its stake in shares of Texas Instruments by 24.7% in the 2nd quarter. AE Wealth Management LLC now owns 34,225 shares of the semiconductor company's stock valued at $6,658,000 after purchasing an additional 6,774 shares during the last quarter. Pacer Advisors Inc. lifted its position in shares of Texas Instruments by 3.0% during the 2nd quarter. Pacer Advisors Inc. now owns 108,216 shares of the semiconductor company's stock worth $21,051,000 after buying an additional 3,178 shares during the last quarter. Thrivent Financial for Lutherans boosted its stake in Texas Instruments by 25.4% in the second quarter. Thrivent Financial for Lutherans now owns 73,210 shares of the semiconductor company's stock valued at $14,241,000 after buying an additional 14,828 shares in the last quarter. Finally, Summit Trail Advisors LLC grew its position in Texas Instruments by 2.3% in the second quarter. Summit Trail Advisors LLC now owns 6,294 shares of the semiconductor company's stock valued at $1,224,000 after acquiring an additional 142 shares during the last quarter. Institutional investors and hedge funds own 84.99% of the company's stock.

Insider Transactions at Texas Instruments

In other news, Director Ronald Kirk sold 10,539 shares of the company's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $203.33, for a total transaction of $2,142,894.87. Following the transaction, the director now directly owns 14,323 shares of the company's stock, valued at $2,912,295.59. This represents a 42.39 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Robert E. Sanchez sold 9,990 shares of Texas Instruments stock in a transaction on Friday, October 25th. The shares were sold at an average price of $208.80, for a total transaction of $2,085,912.00. Following the completion of the sale, the director now directly owns 20,461 shares of the company's stock, valued at approximately $4,272,256.80. The trade was a 32.81 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.68% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on TXN. Wells Fargo & Company dropped their target price on shares of Texas Instruments from $215.00 to $208.00 and set an "equal weight" rating for the company in a report on Monday, January 13th. Susquehanna cut their target price on shares of Texas Instruments from $250.00 to $240.00 and set a "positive" rating on the stock in a research report on Monday, October 21st. Barclays lowered their price target on shares of Texas Instruments from $210.00 to $200.00 and set an "equal weight" rating for the company in a report on Wednesday, October 23rd. Summit Insights raised Texas Instruments from a "hold" rating to a "buy" rating in a report on Wednesday, October 23rd. Finally, Benchmark reaffirmed a "buy" rating and issued a $230.00 target price on shares of Texas Instruments in a report on Wednesday, October 23rd. Two analysts have rated the stock with a sell rating, twelve have assigned a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $210.45.

Check Out Our Latest Stock Analysis on Texas Instruments

Texas Instruments Trading Up 2.7 %

NASDAQ TXN traded up $5.05 during mid-day trading on Monday, reaching $192.42. 5,388,038 shares of the stock were exchanged, compared to its average volume of 4,167,320. The company has a debt-to-equity ratio of 0.74, a current ratio of 4.31 and a quick ratio of 3.14. The stock has a market cap of $175.53 billion, a P/E ratio of 35.77, a P/E/G ratio of 3.69 and a beta of 0.98. The stock has a 50 day simple moving average of $194.79 and a 200-day simple moving average of $199.65. Texas Instruments Incorporated has a one year low of $155.46 and a one year high of $220.38.

Texas Instruments (NASDAQ:TXN - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The semiconductor company reported $1.47 earnings per share for the quarter, topping the consensus estimate of $1.38 by $0.09. Texas Instruments had a return on equity of 29.05% and a net margin of 31.60%. The firm had revenue of $4.15 billion during the quarter, compared to analyst estimates of $4.12 billion. During the same period last year, the company posted $1.80 EPS. The business's quarterly revenue was down 8.4% on a year-over-year basis. On average, analysts anticipate that Texas Instruments Incorporated will post 5.08 EPS for the current year.

Texas Instruments Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, February 11th. Shareholders of record on Friday, January 31st will be issued a dividend of $1.36 per share. This represents a $5.44 dividend on an annualized basis and a dividend yield of 2.83%. The ex-dividend date of this dividend is Friday, January 31st. Texas Instruments's payout ratio is 101.12%.

Texas Instruments Profile

(

Free Report)

Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products.

Further Reading

Before you consider Texas Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Instruments wasn't on the list.

While Texas Instruments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report