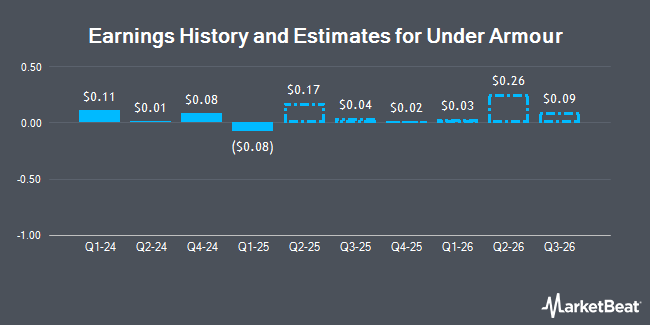

Under Armour (NYSE:UAA - Get Free Report) updated its FY 2025 earnings guidance on Saturday. The company provided earnings per share guidance of 0.240-0.270 for the period, compared to the consensus earnings per share estimate of 0.230. The company issued revenue guidance of -.

Under Armour Stock Performance

UAA stock traded up $0.09 on Friday, hitting $9.94. The company had a trading volume of 10,204,180 shares, compared to its average volume of 10,259,854. The stock has a market cap of $4.30 billion, a price-to-earnings ratio of -331.22, a P/E/G ratio of 3.66 and a beta of 1.66. The company has a current ratio of 2.18, a quick ratio of 1.24 and a debt-to-equity ratio of 0.30. The stock's 50-day simple moving average is $8.65 and its 200 day simple moving average is $7.63. Under Armour has a 12-month low of $6.17 and a 12-month high of $11.89.

Analyst Upgrades and Downgrades

Several brokerages recently commented on UAA. UBS Group lifted their price objective on Under Armour from $12.00 to $16.00 and gave the stock a "buy" rating in a report on Friday, November 8th. Truist Financial upped their price target on shares of Under Armour from $8.00 to $11.00 and gave the company a "hold" rating in a research report on Friday, November 8th. Stifel Nicolaus increased their price objective on shares of Under Armour from $9.00 to $10.00 and gave the stock a "buy" rating in a research note on Friday, August 9th. TD Cowen boosted their target price on shares of Under Armour from $7.00 to $8.00 and gave the company a "hold" rating in a research report on Monday, November 4th. Finally, Morgan Stanley downgraded shares of Under Armour from an "equal weight" rating to an "underweight" rating and decreased their price target for the stock from $8.00 to $4.00 in a research report on Tuesday, July 23rd. Three research analysts have rated the stock with a sell rating, twelve have issued a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $9.03.

View Our Latest Report on UAA

Under Armour Company Profile

(

Get Free Report)

Under Armour, Inc, together with its subsidiaries, engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth. The company provides its apparel in compression, fitted, and loose fit types. It also offers footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications.

Featured Stories

Before you consider Under Armour, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Under Armour wasn't on the list.

While Under Armour currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.