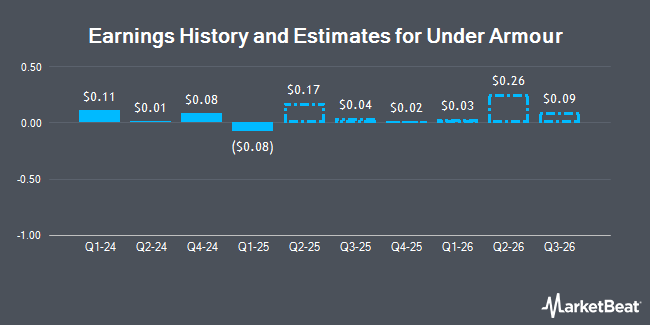

Under Armour, Inc. (NYSE:UAA - Free Report) - Stock analysts at Telsey Advisory Group cut their Q3 2025 earnings estimates for shares of Under Armour in a research note issued to investors on Friday, November 8th. Telsey Advisory Group analyst C. Fernandez now anticipates that the company will post earnings of $0.04 per share for the quarter, down from their previous estimate of $0.05. Telsey Advisory Group has a "Market Perform" rating and a $8.00 price objective on the stock. The consensus estimate for Under Armour's current full-year earnings is $0.26 per share. Telsey Advisory Group also issued estimates for Under Armour's FY2025 earnings at $0.28 EPS, Q1 2026 earnings at $0.03 EPS, Q2 2026 earnings at $0.30 EPS and Q3 2026 earnings at $0.09 EPS.

A number of other research analysts have also weighed in on UAA. Argus raised Under Armour to a "strong-buy" rating in a research note on Thursday, August 15th. UBS Group raised their price target on Under Armour from $12.00 to $16.00 and gave the stock a "buy" rating in a research note on Friday. Stifel Nicolaus upped their price objective on shares of Under Armour from $9.00 to $10.00 and gave the company a "buy" rating in a research note on Friday, August 9th. TD Cowen raised their target price on shares of Under Armour from $7.00 to $8.00 and gave the stock a "hold" rating in a research report on Monday, November 4th. Finally, Wells Fargo & Company boosted their target price on shares of Under Armour from $8.00 to $11.00 and gave the company an "equal weight" rating in a report on Friday. Three equities research analysts have rated the stock with a sell rating, twelve have given a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $9.03.

Get Our Latest Stock Report on Under Armour

Under Armour Price Performance

Shares of NYSE:UAA traded down $0.17 during trading on Monday, hitting $9.51. 5,761,199 shares of the stock were exchanged, compared to its average volume of 10,195,121. Under Armour has a 12-month low of $6.17 and a 12-month high of $11.89. The company has a market cap of $4.11 billion, a PE ratio of -320.00, a P/E/G ratio of 4.40 and a beta of 1.66. The company has a fifty day moving average price of $8.47 and a two-hundred day moving average price of $7.53. The company has a current ratio of 1.73, a quick ratio of 1.08 and a debt-to-equity ratio of 0.33.

Under Armour (NYSE:UAA - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported $0.30 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.19 by $0.11. The firm had revenue of $1.40 billion during the quarter, compared to analysts' expectations of $1.38 billion. Under Armour had a positive return on equity of 13.10% and a negative net margin of 0.27%.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Allspring Global Investments Holdings LLC acquired a new position in shares of Under Armour during the third quarter worth approximately $56,000. Optas LLC bought a new position in shares of Under Armour in the second quarter worth $72,000. CWM LLC increased its holdings in shares of Under Armour by 20.7% during the third quarter. CWM LLC now owns 8,211 shares of the company's stock valued at $73,000 after purchasing an additional 1,409 shares during the period. Koss Olinger Consulting LLC acquired a new stake in Under Armour in the second quarter worth about $79,000. Finally, DekaBank Deutsche Girozentrale bought a new position in Under Armour in the 2nd quarter valued at about $80,000. 34.58% of the stock is owned by institutional investors and hedge funds.

Under Armour Company Profile

(

Get Free Report)

Under Armour, Inc, together with its subsidiaries, engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth. The company provides its apparel in compression, fitted, and loose fit types. It also offers footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications.

Further Reading

Before you consider Under Armour, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Under Armour wasn't on the list.

While Under Armour currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.