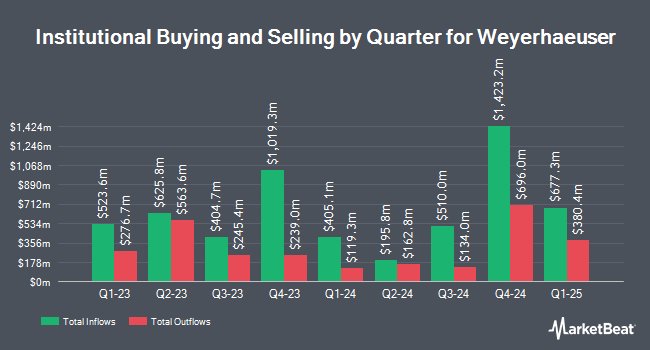

Unified Investment Management bought a new position in Weyerhaeuser (NYSE:WY - Free Report) during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 13,813 shares of the real estate investment trust's stock, valued at approximately $389,000.

Several other hedge funds have also recently made changes to their positions in the business. Wellington Management Group LLP grew its stake in Weyerhaeuser by 12.7% during the 3rd quarter. Wellington Management Group LLP now owns 35,755,865 shares of the real estate investment trust's stock valued at $1,210,694,000 after purchasing an additional 4,035,048 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its holdings in Weyerhaeuser by 257.2% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,472,451 shares of the real estate investment trust's stock valued at $151,437,000 after acquiring an additional 3,220,235 shares in the last quarter. Daiwa Securities Group Inc. grew its holdings in shares of Weyerhaeuser by 2,664.4% during the third quarter. Daiwa Securities Group Inc. now owns 2,195,958 shares of the real estate investment trust's stock worth $74,355,000 after purchasing an additional 2,116,520 shares during the last quarter. Point72 Asset Management L.P. acquired a new position in shares of Weyerhaeuser in the third quarter valued at approximately $40,773,000. Finally, Van ECK Associates Corp boosted its holdings in Weyerhaeuser by 2,221.8% during the third quarter. Van ECK Associates Corp now owns 1,245,633 shares of the real estate investment trust's stock worth $39,674,000 after buying an additional 1,191,983 shares in the last quarter. 82.99% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts have commented on WY shares. Raymond James upgraded Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $32.00 price target for the company in a research note on Monday, December 23rd. StockNews.com raised Weyerhaeuser from a "sell" rating to a "hold" rating in a research report on Thursday, February 6th. BMO Capital Markets upgraded shares of Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $38.00 price objective for the company in a research report on Friday, December 6th. Citigroup reduced their target price on shares of Weyerhaeuser from $38.00 to $35.00 and set a "buy" rating for the company in a research note on Wednesday, January 15th. Finally, CIBC upgraded Weyerhaeuser from a "neutral" rating to an "outperformer" rating and set a $35.00 target price on the stock in a research note on Wednesday, January 15th. Three research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $35.00.

Get Our Latest Analysis on WY

Weyerhaeuser Stock Performance

Shares of Weyerhaeuser stock traded down $0.72 during trading hours on Thursday, reaching $30.21. The company's stock had a trading volume of 3,996,906 shares, compared to its average volume of 3,371,554. Weyerhaeuser has a one year low of $26.73 and a one year high of $36.27. The stock has a market cap of $21.92 billion, a P/E ratio of 54.93, a price-to-earnings-growth ratio of 4.74 and a beta of 1.43. The company's 50 day simple moving average is $29.60 and its 200 day simple moving average is $30.81. The company has a debt-to-equity ratio of 0.50, a quick ratio of 1.17 and a current ratio of 1.79.

Weyerhaeuser (NYSE:WY - Get Free Report) last issued its earnings results on Thursday, January 30th. The real estate investment trust reported $0.11 earnings per share for the quarter, beating the consensus estimate of $0.07 by $0.04. Weyerhaeuser had a net margin of 5.56% and a return on equity of 3.86%. As a group, analysts expect that Weyerhaeuser will post 0.78 EPS for the current fiscal year.

Weyerhaeuser Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, March 21st. Stockholders of record on Friday, March 7th will be given a dividend of $0.21 per share. This is an increase from Weyerhaeuser's previous quarterly dividend of $0.20. The ex-dividend date is Friday, March 7th. This represents a $0.84 annualized dividend and a dividend yield of 2.78%. Weyerhaeuser's dividend payout ratio (DPR) is 152.73%.

Weyerhaeuser Profile

(

Free Report)

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards.

Read More

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.