Unigestion Holding SA purchased a new stake in shares of SS&C Technologies Holdings, Inc. (NASDAQ:SSNC - Free Report) in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 9,914 shares of the technology company's stock, valued at approximately $736,000.

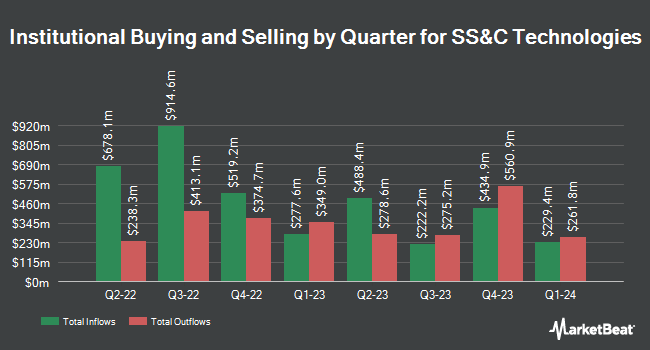

A number of other institutional investors and hedge funds also recently modified their holdings of the business. Innealta Capital LLC purchased a new position in SS&C Technologies in the second quarter valued at about $26,000. Ashton Thomas Private Wealth LLC bought a new stake in shares of SS&C Technologies in the 2nd quarter worth approximately $35,000. Benjamin Edwards Inc. lifted its stake in SS&C Technologies by 43.3% in the second quarter. Benjamin Edwards Inc. now owns 675 shares of the technology company's stock valued at $42,000 after purchasing an additional 204 shares during the last quarter. 1620 Investment Advisors Inc. bought a new position in SS&C Technologies during the second quarter valued at $47,000. Finally, Capital Performance Advisors LLP purchased a new stake in SS&C Technologies in the third quarter worth $68,000. 96.95% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research analysts have recently weighed in on SSNC shares. DA Davidson reiterated a "buy" rating and set a $92.00 price target on shares of SS&C Technologies in a research note on Thursday, October 10th. StockNews.com downgraded shares of SS&C Technologies from a "strong-buy" rating to a "buy" rating in a report on Friday, November 15th. Raymond James lifted their target price on shares of SS&C Technologies from $79.00 to $85.00 and gave the stock a "strong-buy" rating in a research note on Friday, October 25th. Royal Bank of Canada upped their price target on shares of SS&C Technologies from $75.00 to $86.00 and gave the company an "outperform" rating in a research note on Thursday, September 19th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $90.00 price objective on shares of SS&C Technologies in a research note on Friday, October 25th. Two research analysts have rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, SS&C Technologies presently has an average rating of "Moderate Buy" and a consensus target price of $77.75.

Read Our Latest Report on SS&C Technologies

SS&C Technologies Price Performance

NASDAQ SSNC traded down $0.35 on Thursday, hitting $76.90. The stock had a trading volume of 1,326,423 shares, compared to its average volume of 1,094,267. The firm has a 50-day moving average of $74.71 and a 200-day moving average of $70.67. The company has a debt-to-equity ratio of 1.04, a quick ratio of 1.21 and a current ratio of 1.21. SS&C Technologies Holdings, Inc. has a 52-week low of $58.14 and a 52-week high of $77.69. The company has a market capitalization of $19.05 billion, a price-to-earnings ratio of 27.56 and a beta of 1.38.

SS&C Technologies (NASDAQ:SSNC - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The technology company reported $1.29 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.26 by $0.03. SS&C Technologies had a return on equity of 17.33% and a net margin of 12.26%. The company had revenue of $1.47 billion for the quarter, compared to the consensus estimate of $1.44 billion. During the same quarter last year, the business posted $1.04 earnings per share. The firm's revenue was up 7.3% compared to the same quarter last year. Equities analysts expect that SS&C Technologies Holdings, Inc. will post 4.62 EPS for the current year.

SS&C Technologies Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be issued a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a dividend yield of 1.30%. The ex-dividend date of this dividend is Monday, December 2nd. SS&C Technologies's payout ratio is 35.84%.

Insider Buying and Selling

In other SS&C Technologies news, Director Michael Jay Zamkow sold 19,000 shares of SS&C Technologies stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $75.97, for a total transaction of $1,443,430.00. Following the completion of the sale, the director now owns 22,576 shares of the company's stock, valued at $1,715,098.72. The trade was a 45.70 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, SVP Jason Douglas White sold 69,000 shares of the stock in a transaction dated Tuesday, November 26th. The shares were sold at an average price of $77.07, for a total value of $5,317,830.00. Following the transaction, the senior vice president now owns 6,412 shares in the company, valued at $494,172.84. This trade represents a 91.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 598,000 shares of company stock worth $45,704,308. Insiders own 15.40% of the company's stock.

About SS&C Technologies

(

Free Report)

SS&C Technologies Holdings, Inc, together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions comprising portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions consisting of claims adjudication, benefit management, care management, and business intelligence solutions.

Read More

Before you consider SS&C Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SS&C Technologies wasn't on the list.

While SS&C Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.