FMR LLC cut its holdings in Unilever PLC (NYSE:UL - Free Report) by 0.6% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 5,825,737 shares of the company's stock after selling 35,788 shares during the quarter. FMR LLC owned about 0.23% of Unilever worth $378,440,000 at the end of the most recent quarter.

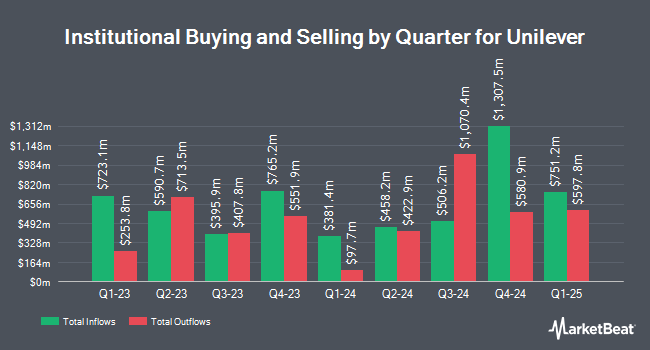

Several other large investors also recently added to or reduced their stakes in the business. Janus Henderson Group PLC grew its holdings in Unilever by 3.8% during the first quarter. Janus Henderson Group PLC now owns 25,033 shares of the company's stock valued at $1,256,000 after purchasing an additional 915 shares during the last quarter. Tidal Investments LLC raised its holdings in Unilever by 2.4% in the 1st quarter. Tidal Investments LLC now owns 14,871 shares of the company's stock worth $746,000 after acquiring an additional 347 shares during the period. Cetera Investment Advisers lifted its position in Unilever by 213.6% during the 1st quarter. Cetera Investment Advisers now owns 277,679 shares of the company's stock worth $13,937,000 after acquiring an additional 189,121 shares during the last quarter. Cetera Advisors LLC boosted its holdings in Unilever by 199.4% during the first quarter. Cetera Advisors LLC now owns 80,556 shares of the company's stock valued at $4,043,000 after acquiring an additional 53,651 shares during the period. Finally, Transcend Capital Advisors LLC grew its position in shares of Unilever by 59.0% in the second quarter. Transcend Capital Advisors LLC now owns 14,040 shares of the company's stock valued at $772,000 after purchasing an additional 5,208 shares during the last quarter. 9.67% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on UL shares. Erste Group Bank reissued a "hold" rating on shares of Unilever in a research report on Tuesday, November 19th. Bank of America upgraded Unilever from an "underperform" rating to a "buy" rating and upped their price target for the stock from $47.00 to $72.00 in a report on Thursday, August 22nd. Finally, StockNews.com downgraded shares of Unilever from a "buy" rating to a "hold" rating in a research note on Tuesday, November 12th. Three investment analysts have rated the stock with a sell rating, three have issued a hold rating and five have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $61.75.

Read Our Latest Stock Report on UL

Unilever Price Performance

Shares of NYSE:UL traded up $0.10 during trading on Friday, hitting $59.84. 1,233,415 shares of the stock were exchanged, compared to its average volume of 2,223,253. Unilever PLC has a 1-year low of $46.46 and a 1-year high of $65.87. The company's fifty day simple moving average is $61.34 and its 200-day simple moving average is $59.84.

Unilever Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 8th will be issued a $0.4755 dividend. This represents a $1.90 annualized dividend and a yield of 3.18%. The ex-dividend date of this dividend is Friday, November 8th. This is a positive change from Unilever's previous quarterly dividend of $0.35.

Unilever Profile

(

Free Report)

Unilever PLC operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe. It operates through five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products consist of the vitamins, minerals, and supplements.

Read More

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.