HighTower Advisors LLC trimmed its stake in shares of Unilever PLC (NYSE:UL - Free Report) by 6.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 407,776 shares of the company's stock after selling 28,764 shares during the quarter. HighTower Advisors LLC's holdings in Unilever were worth $26,420,000 at the end of the most recent quarter.

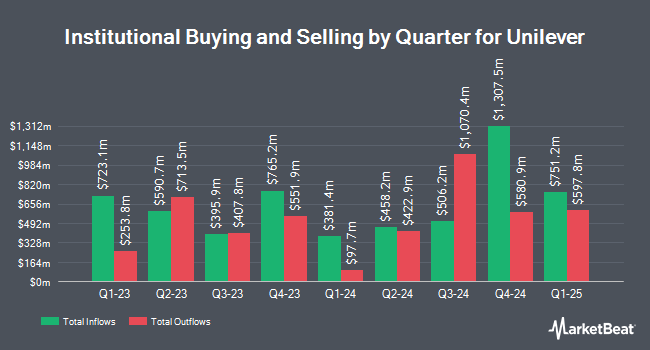

Several other large investors also recently bought and sold shares of UL. Fiera Capital Corp grew its stake in shares of Unilever by 1,866.0% during the second quarter. Fiera Capital Corp now owns 2,135,859 shares of the company's stock worth $117,451,000 after purchasing an additional 2,027,221 shares in the last quarter. Jennison Associates LLC lifted its holdings in Unilever by 981.6% during the 3rd quarter. Jennison Associates LLC now owns 2,076,169 shares of the company's stock worth $134,868,000 after buying an additional 1,884,216 shares during the last quarter. Bank of Montreal Can boosted its position in shares of Unilever by 249.5% during the 2nd quarter. Bank of Montreal Can now owns 1,748,329 shares of the company's stock worth $98,204,000 after acquiring an additional 1,248,136 shares in the last quarter. Clearbridge Investments LLC increased its holdings in shares of Unilever by 598.7% in the 2nd quarter. Clearbridge Investments LLC now owns 1,301,239 shares of the company's stock valued at $71,555,000 after acquiring an additional 1,114,992 shares during the last quarter. Finally, Fisher Asset Management LLC raised its position in shares of Unilever by 7.1% during the 3rd quarter. Fisher Asset Management LLC now owns 16,726,400 shares of the company's stock worth $1,086,547,000 after acquiring an additional 1,114,177 shares in the last quarter. Hedge funds and other institutional investors own 9.67% of the company's stock.

Unilever Price Performance

Shares of NYSE:UL traded down $0.53 on Friday, reaching $59.02. The company's stock had a trading volume of 1,757,790 shares, compared to its average volume of 2,565,271. Unilever PLC has a 52-week low of $46.46 and a 52-week high of $65.87. The stock's 50-day moving average is $60.90 and its two-hundred day moving average is $59.91.

Unilever Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 8th will be given a dividend of $0.4755 per share. This represents a $1.90 dividend on an annualized basis and a yield of 3.22%. This is a boost from Unilever's previous quarterly dividend of $0.35. The ex-dividend date of this dividend is Friday, November 8th.

Analysts Set New Price Targets

Several brokerages have commented on UL. Bank of America upgraded shares of Unilever from an "underperform" rating to a "buy" rating and increased their price target for the company from $47.00 to $72.00 in a research note on Thursday, August 22nd. StockNews.com cut shares of Unilever from a "buy" rating to a "hold" rating in a research report on Tuesday, November 12th. Finally, Erste Group Bank restated a "hold" rating on shares of Unilever in a research note on Tuesday, November 19th. Three investment analysts have rated the stock with a sell rating, three have given a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, Unilever presently has an average rating of "Hold" and an average price target of $61.75.

View Our Latest Report on UL

Unilever Company Profile

(

Free Report)

Unilever PLC operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe. It operates through five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products consist of the vitamins, minerals, and supplements.

See Also

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.