United Parcel Service (NYSE:UPS - Get Free Report) was upgraded by equities research analysts at BMO Capital Markets from a "market perform" rating to an "outperform" rating in a research report issued to clients and investors on Tuesday, MarketBeat reports. The firm currently has a $150.00 target price on the transportation company's stock, down from their prior target price of $155.00. BMO Capital Markets' price target would suggest a potential upside of 15.19% from the company's current price.

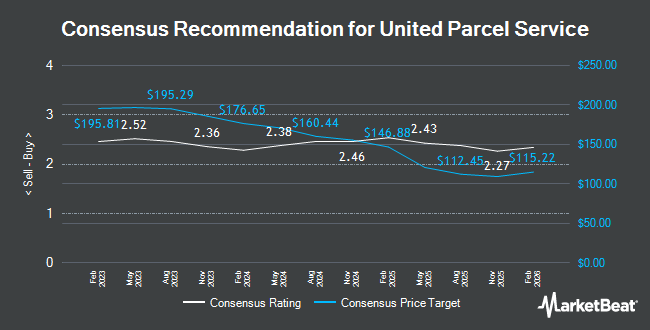

Several other equities analysts also recently weighed in on UPS. TD Cowen initiated coverage on United Parcel Service in a research report on Thursday, August 22nd. They issued a "hold" rating and a $144.00 target price on the stock. Wells Fargo & Company upped their target price on shares of United Parcel Service from $134.00 to $142.00 and gave the stock an "overweight" rating in a report on Thursday, October 10th. Evercore ISI boosted their price target on shares of United Parcel Service from $138.00 to $141.00 and gave the stock an "in-line" rating in a research report on Tuesday, October 22nd. Stifel Nicolaus increased their price objective on shares of United Parcel Service from $151.00 to $156.00 and gave the company a "buy" rating in a report on Friday, October 25th. Finally, Citigroup lowered their target price on United Parcel Service from $163.00 to $158.00 and set a "buy" rating on the stock in a report on Tuesday, November 12th. Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating, thirteen have assigned a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $151.29.

Read Our Latest Stock Report on United Parcel Service

United Parcel Service Stock Performance

NYSE:UPS traded up $1.69 during trading hours on Tuesday, reaching $130.22. The company had a trading volume of 6,282,820 shares, compared to its average volume of 4,162,226. The firm has a market cap of $111.13 billion, a PE ratio of 19.56, a price-to-earnings-growth ratio of 2.06 and a beta of 0.98. United Parcel Service has a 1-year low of $123.12 and a 1-year high of $163.82. The business's 50 day moving average price is $133.16 and its 200-day moving average price is $132.96. The company has a debt-to-equity ratio of 1.20, a current ratio of 1.14 and a quick ratio of 1.14.

United Parcel Service (NYSE:UPS - Get Free Report) last posted its earnings results on Thursday, October 24th. The transportation company reported $1.76 EPS for the quarter, beating analysts' consensus estimates of $1.63 by $0.13. The firm had revenue of $22.20 billion for the quarter, compared to analysts' expectations of $22.10 billion. United Parcel Service had a return on equity of 37.38% and a net margin of 6.25%. The company's quarterly revenue was up 5.4% on a year-over-year basis. During the same period last year, the firm earned $1.57 EPS. Research analysts forecast that United Parcel Service will post 7.48 EPS for the current year.

Insider Transactions at United Parcel Service

In other United Parcel Service news, insider Norman M. Brothers, Jr. sold 7,325 shares of the stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $138.57, for a total transaction of $1,015,025.25. Following the sale, the insider now directly owns 45,098 shares in the company, valued at $6,249,229.86. This represents a 13.97 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Company insiders own 0.13% of the company's stock.

Institutional Trading of United Parcel Service

Large investors have recently modified their holdings of the stock. TruNorth Capital Management LLC purchased a new stake in United Parcel Service during the 2nd quarter worth about $28,000. True Wealth Design LLC increased its stake in shares of United Parcel Service by 397.7% during the third quarter. True Wealth Design LLC now owns 214 shares of the transportation company's stock worth $29,000 after buying an additional 171 shares during the period. Centerpoint Advisors LLC raised its holdings in United Parcel Service by 291.7% in the second quarter. Centerpoint Advisors LLC now owns 235 shares of the transportation company's stock valued at $32,000 after acquiring an additional 175 shares in the last quarter. Princeton Global Asset Management LLC lifted its stake in United Parcel Service by 720.0% in the third quarter. Princeton Global Asset Management LLC now owns 246 shares of the transportation company's stock worth $34,000 after acquiring an additional 216 shares during the last quarter. Finally, Tortoise Investment Management LLC grew its holdings in United Parcel Service by 168.5% during the 2nd quarter. Tortoise Investment Management LLC now owns 247 shares of the transportation company's stock worth $34,000 after acquiring an additional 155 shares in the last quarter. Hedge funds and other institutional investors own 60.26% of the company's stock.

About United Parcel Service

(

Get Free Report)

United Parcel Service, Inc, a package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of express letters, documents, small packages, and palletized freight through air and ground services in the United States.

Featured Articles

Before you consider United Parcel Service, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parcel Service wasn't on the list.

While United Parcel Service currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.