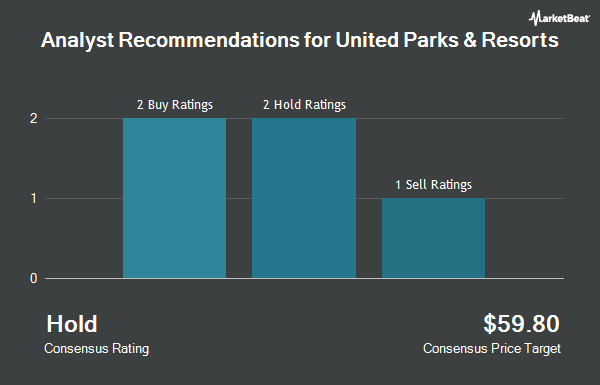

United Parks & Resorts Inc. (NYSE:PRKS - Get Free Report) has earned an average rating of "Moderate Buy" from the ten brokerages that are presently covering the firm, Marketbeat Ratings reports. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and six have given a buy rating to the company. The average 1 year target price among brokers that have issued ratings on the stock in the last year is $62.60.

Several analysts recently commented on the stock. B. Riley reissued a "buy" rating and set a $71.00 price objective on shares of United Parks & Resorts in a research report on Monday, October 7th. Macquarie cut their price objective on shares of United Parks & Resorts from $75.00 to $70.00 and set an "outperform" rating on the stock in a research report on Friday, October 18th. The Goldman Sachs Group downgraded shares of United Parks & Resorts from a "buy" rating to a "neutral" rating and cut their price objective for the company from $63.00 to $53.00 in a research report on Thursday, August 8th. Mizuho reissued an "underperform" rating and set a $43.00 price objective (down from $45.00) on shares of United Parks & Resorts in a research report on Friday, November 8th. Finally, JPMorgan Chase & Co. cut their price objective on shares of United Parks & Resorts from $57.00 to $56.00 and set a "neutral" rating on the stock in a research report on Monday, September 16th.

View Our Latest Report on PRKS

United Parks & Resorts Trading Up 1.5 %

NYSE PRKS traded up $0.84 during trading on Thursday, hitting $58.07. The company had a trading volume of 598,934 shares, compared to its average volume of 889,277. United Parks & Resorts has a one year low of $44.72 and a one year high of $60.36. The company has a market cap of $3.19 billion, a price-to-earnings ratio of 14.55 and a beta of 2.00. The company's fifty day moving average is $53.38 and its 200-day moving average is $52.28.

United Parks & Resorts (NYSE:PRKS - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $2.08 EPS for the quarter, missing the consensus estimate of $2.23 by ($0.15). United Parks & Resorts had a negative return on equity of 76.13% and a net margin of 13.85%. The company had revenue of $545.90 million during the quarter, compared to the consensus estimate of $550.47 million. During the same quarter last year, the company posted $1.92 earnings per share. The firm's revenue for the quarter was down .4% compared to the same quarter last year. As a group, equities analysts anticipate that United Parks & Resorts will post 3.97 EPS for the current year.

Insider Activity

In other United Parks & Resorts news, insider James Mikolaichik bought 34,000 shares of the business's stock in a transaction that occurred on Monday, November 18th. The stock was purchased at an average cost of $57.29 per share, with a total value of $1,947,860.00. Following the completion of the acquisition, the insider now owns 76,267 shares in the company, valued at $4,369,336.43. This trade represents a 80.44 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider George Anthony Taylor sold 23,837 shares of the firm's stock in a transaction on Thursday, September 5th. The shares were sold at an average price of $52.94, for a total transaction of $1,261,930.78. Following the completion of the transaction, the insider now directly owns 85,463 shares of the company's stock, valued at approximately $4,524,411.22. This trade represents a 21.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.10% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of PRKS. SG Americas Securities LLC purchased a new stake in shares of United Parks & Resorts during the third quarter valued at $739,000. Handelsbanken Fonder AB purchased a new stake in shares of United Parks & Resorts during the third quarter valued at $390,000. Hexagon Capital Partners LLC purchased a new stake in shares of United Parks & Resorts during the third quarter valued at $25,000. Perpetual Ltd purchased a new stake in shares of United Parks & Resorts during the third quarter valued at $16,862,000. Finally, Inspire Investing LLC purchased a new stake in shares of United Parks & Resorts during the third quarter valued at $411,000.

United Parks & Resorts Company Profile

(

Get Free ReportUnited Parks & Resorts Inc, together with its subsidiaries, operates as a theme park and entertainment company in the United States. It operates and licenses SeaWorld theme parks in Orlando, Florida; San Antonio, Texas; Abu Dhabi, United Arab Emirates; and San Diego, California, as well as Busch Gardens theme parks in Tampa, Florida, and Williamsburg, Virginia.

Featured Articles

Before you consider United Parks & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parks & Resorts wasn't on the list.

While United Parks & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.