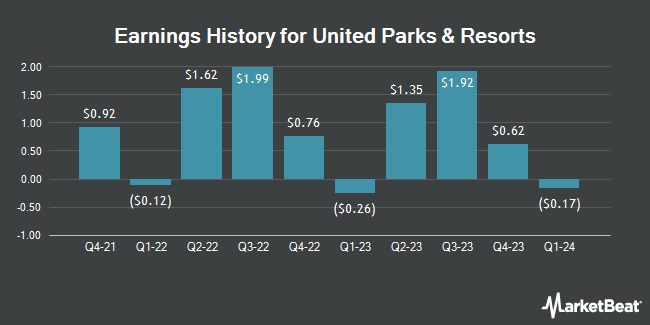

United Parks & Resorts (NYSE:PRKS - Get Free Report) announced its earnings results on Thursday. The company reported $2.08 EPS for the quarter, missing the consensus estimate of $2.23 by ($0.15), Briefing.com reports. The business had revenue of $545.90 million for the quarter, compared to the consensus estimate of $550.47 million. United Parks & Resorts had a negative return on equity of 92.07% and a net margin of 14.06%. United Parks & Resorts's revenue for the quarter was down .4% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.92 EPS.

United Parks & Resorts Stock Performance

NYSE:PRKS traded up $1.75 during mid-day trading on Friday, hitting $56.77. 855,721 shares of the stock were exchanged, compared to its average volume of 895,519. The stock has a market capitalization of $3.29 billion, a price-to-earnings ratio of 14.75 and a beta of 2.00. The firm's 50-day simple moving average is $51.63 and its 200 day simple moving average is $51.70. United Parks & Resorts has a fifty-two week low of $44.72 and a fifty-two week high of $60.36.

Analyst Ratings Changes

Several brokerages have recently issued reports on PRKS. B. Riley reaffirmed a "buy" rating and set a $71.00 price target on shares of United Parks & Resorts in a research note on Monday, October 7th. Stifel Nicolaus dropped their price target on United Parks & Resorts from $76.00 to $70.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. Mizuho reiterated an "underperform" rating and set a $43.00 price objective (down from $45.00) on shares of United Parks & Resorts in a report on Friday. Macquarie decreased their price target on United Parks & Resorts from $75.00 to $70.00 and set an "outperform" rating for the company in a research note on Friday, October 18th. Finally, The Goldman Sachs Group downgraded United Parks & Resorts from a "buy" rating to a "neutral" rating and decreased their price target for the company from $63.00 to $53.00 in a research note on Thursday, August 8th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and six have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $62.90.

Read Our Latest Stock Analysis on United Parks & Resorts

Insider Buying and Selling

In related news, Director Yoshikazu Maruyama sold 12,984 shares of United Parks & Resorts stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $50.07, for a total transaction of $650,108.88. Following the completion of the sale, the director now directly owns 41,766 shares of the company's stock, valued at approximately $2,091,223.62. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. In other news, insider George Anthony Taylor sold 23,837 shares of United Parks & Resorts stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $52.94, for a total value of $1,261,930.78. Following the transaction, the insider now owns 85,463 shares in the company, valued at approximately $4,524,411.22. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Yoshikazu Maruyama sold 12,984 shares of the business's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $50.07, for a total value of $650,108.88. Following the sale, the director now owns 41,766 shares in the company, valued at $2,091,223.62. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 37,366 shares of company stock valued at $1,938,984. Insiders own 1.10% of the company's stock.

About United Parks & Resorts

(

Get Free Report)

United Parks & Resorts Inc, together with its subsidiaries, operates as a theme park and entertainment company in the United States. It operates and licenses SeaWorld theme parks in Orlando, Florida; San Antonio, Texas; Abu Dhabi, United Arab Emirates; and San Diego, California, as well as Busch Gardens theme parks in Tampa, Florida, and Williamsburg, Virginia.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United Parks & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parks & Resorts wasn't on the list.

While United Parks & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.