United Rentals (NYSE:URI - Get Free Report) had its price objective lifted by equities researchers at JPMorgan Chase & Co. from $940.00 to $1,000.00 in a report issued on Friday,Benzinga reports. The firm presently has an "overweight" rating on the construction company's stock. JPMorgan Chase & Co.'s price objective would suggest a potential upside of 32.34% from the company's current price.

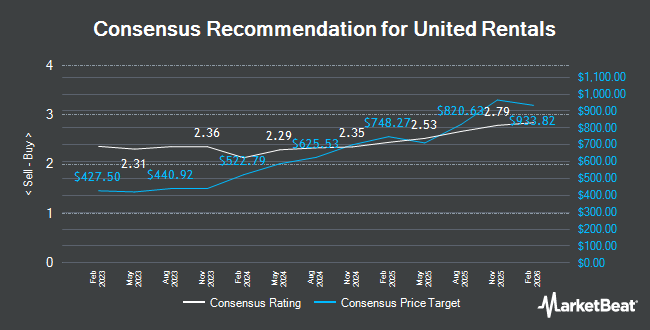

URI has been the topic of a number of other research reports. Argus lifted their target price on shares of United Rentals from $840.00 to $880.00 and gave the company a "buy" rating in a research note on Wednesday, November 20th. Bank of America boosted their price objective on United Rentals from $800.00 to $910.00 and gave the company a "buy" rating in a research report on Thursday, October 24th. Barclays increased their target price on United Rentals from $400.00 to $565.00 and gave the stock an "underweight" rating in a research report on Friday, October 25th. Truist Financial reissued a "buy" rating and issued a $956.00 price target (down from $963.00) on shares of United Rentals in a report on Friday. Finally, Robert W. Baird raised shares of United Rentals from an "underperform" rating to a "neutral" rating and set a $658.00 price objective for the company in a report on Tuesday, January 14th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and nine have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $818.55.

Check Out Our Latest Research Report on URI

United Rentals Stock Performance

Shares of URI traded down $18.44 during trading hours on Friday, hitting $755.64. The stock had a trading volume of 314,028 shares, compared to its average volume of 695,542. The firm has a market capitalization of $49.59 billion, a PE ratio of 19.50, a PEG ratio of 1.68 and a beta of 1.69. The company has a debt-to-equity ratio of 1.38, a current ratio of 0.82 and a quick ratio of 0.77. United Rentals has a 12 month low of $596.48 and a 12 month high of $896.98. The stock has a fifty day moving average price of $766.58 and a 200 day moving average price of $768.75.

United Rentals (NYSE:URI - Get Free Report) last announced its earnings results on Wednesday, January 29th. The construction company reported $11.59 earnings per share (EPS) for the quarter, missing the consensus estimate of $11.65 by ($0.06). United Rentals had a net margin of 16.78% and a return on equity of 34.51%. Analysts anticipate that United Rentals will post 46.06 EPS for the current year.

Institutional Trading of United Rentals

Several hedge funds have recently modified their holdings of URI. FMR LLC increased its position in United Rentals by 3.7% during the 3rd quarter. FMR LLC now owns 2,416,568 shares of the construction company's stock valued at $1,956,768,000 after buying an additional 85,325 shares in the last quarter. International Assets Investment Management LLC grew its stake in shares of United Rentals by 82,462.2% during the third quarter. International Assets Investment Management LLC now owns 1,606,661 shares of the construction company's stock worth $1,300,962,000 after acquiring an additional 1,604,715 shares during the last quarter. Geode Capital Management LLC increased its holdings in shares of United Rentals by 0.6% during the third quarter. Geode Capital Management LLC now owns 1,566,802 shares of the construction company's stock valued at $1,264,326,000 after acquiring an additional 9,256 shares in the last quarter. Franklin Resources Inc. increased its holdings in shares of United Rentals by 6.1% during the third quarter. Franklin Resources Inc. now owns 996,014 shares of the construction company's stock valued at $862,110,000 after acquiring an additional 57,002 shares in the last quarter. Finally, JPMorgan Chase & Co. raised its position in shares of United Rentals by 15.4% in the 3rd quarter. JPMorgan Chase & Co. now owns 787,877 shares of the construction company's stock valued at $637,968,000 after purchasing an additional 105,287 shares during the last quarter. 96.26% of the stock is owned by hedge funds and other institutional investors.

About United Rentals

(

Get Free Report)

United Rentals, Inc, through its subsidiaries, operates as an equipment rental company. It operates in two segments, General Rentals and Specialty. The General Rentals segment rents general construction and industrial equipment includes backhoes, skid-steer loaders, forklifts, earthmoving equipment, and material handling equipment; aerial work platforms, such as boom and scissor lifts; and general tools and light equipment comprising pressure washers, water pumps, and power tools for construction and industrial companies, manufacturers, utilities, municipalities, homeowners, and government entities.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United Rentals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Rentals wasn't on the list.

While United Rentals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.