Minerva Advisors LLC boosted its stake in United States Lime & Minerals, Inc. (NASDAQ:USLM - Free Report) by 400.0% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 6,250 shares of the construction company's stock after purchasing an additional 5,000 shares during the period. Minerva Advisors LLC's holdings in United States Lime & Minerals were worth $608,000 at the end of the most recent reporting period.

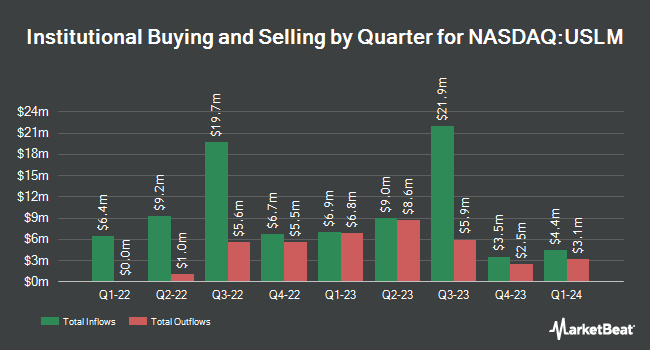

Other hedge funds also recently made changes to their positions in the company. Farther Finance Advisors LLC boosted its holdings in United States Lime & Minerals by 900.0% in the third quarter. Farther Finance Advisors LLC now owns 310 shares of the construction company's stock worth $30,000 after acquiring an additional 279 shares in the last quarter. Amalgamated Bank increased its position in United States Lime & Minerals by 400.0% during the third quarter. Amalgamated Bank now owns 360 shares of the construction company's stock valued at $35,000 after acquiring an additional 288 shares during the last quarter. nVerses Capital LLC purchased a new stake in United States Lime & Minerals during the third quarter valued at $49,000. CWM LLC increased its position in United States Lime & Minerals by 1,104.8% in the second quarter. CWM LLC now owns 253 shares of the construction company's stock worth $92,000 after buying an additional 232 shares in the last quarter. Finally, Quest Partners LLC purchased a new stake in United States Lime & Minerals in the second quarter worth about $125,000. 27.12% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded United States Lime & Minerals from a "hold" rating to a "buy" rating in a research report on Tuesday, October 22nd.

Check Out Our Latest Research Report on United States Lime & Minerals

Insider Activity

In other news, Director Richard W. Cardin sold 12,000 shares of United States Lime & Minerals stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $77.88, for a total value of $934,560.00. Following the transaction, the director now directly owns 14,300 shares in the company, valued at approximately $1,113,684. This trade represents a 45.63 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, VP Nathan O'neill sold 1,750 shares of United States Lime & Minerals stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $139.73, for a total value of $244,527.50. Following the sale, the vice president now directly owns 7,880 shares of the company's stock, valued at approximately $1,101,072.40. This represents a 18.17 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.62% of the company's stock.

United States Lime & Minerals Stock Down 1.1 %

United States Lime & Minerals stock traded down $1.55 during midday trading on Tuesday, reaching $141.59. 93,853 shares of the stock traded hands, compared to its average volume of 98,481. The stock's fifty day moving average is $105.50 and its 200-day moving average is $85.29. United States Lime & Minerals, Inc. has a 12 month low of $41.21 and a 12 month high of $146.70. The stock has a market cap of $4.05 billion, a P/E ratio of 41.49 and a beta of 0.82.

United States Lime & Minerals Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 22nd will be paid a $0.05 dividend. This represents a $0.20 annualized dividend and a dividend yield of 0.14%. The ex-dividend date of this dividend is Friday, November 22nd. United States Lime & Minerals's payout ratio is 5.80%.

United States Lime & Minerals Company Profile

(

Free Report)

United States Lime & Minerals, Inc manufactures and supplies lime and limestone products in the United States. It extracts limestone from open-pit quarries and an underground mine, and processes it as pulverized limestone, quicklime, hydrated lime, and lime slurry. The company supplies its products primarily to the construction customers, including highway, road, and building contractors; industrial customers, such as paper and glass manufacturers; environmental customers comprising municipal sanitation and water treatment facilities, and flue gas treatment processes; oil and gas services companies; roof shingle manufacturers; and poultry producers.

Recommended Stories

Before you consider United States Lime & Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Lime & Minerals wasn't on the list.

While United States Lime & Minerals currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.